Articles

- BLOG / Articles / View

- Articles

Baker Hughes's Perspective in Q3: KEY Takeaways

By Avik on November 21, 2025 in Articles

Booking and End Market Outlook

We have already discussed Baker Hughes's (BKR) Q3 2025 financial performance in our recent article. Here is an outline of its strategies and outlook. Baker Hughes’s management sees 2026 as another year of subdued activity, though long-term prospects appear stronger, particularly in offshore and international markets. Oil-related upstream investment is expected to stay weak through 2025 as markets absorb excess OPEC+ supply.

Sustaining production growth will require continued investment, especially in extending the life of existing fields. Natural gas fundamentals remain more favorable, with rising policy support and demand expected to grow sharply through 2040.

Tech Upgrade and LNG

Baker Hughes continues to strengthen its technology portfolio, with advanced compression and liquefaction solutions that enhance LNG efficiency and project economics. Its LM9000 turbine sets new performance and reliability standards for large-scale energy infrastructure.

At the same time, the potential integration of Chart Industries is expected to improve optimization across the LNG value chain and boost lifecycle value for customers.

With a growing installed base and long-term service agreements, Baker Hughes sees durable LNG-driven growth and earnings expansion well beyond 2030. It reported strong IET order momentum, led by major LNG and power generation projects. The company secured over $800 million in LNG equipment orders, including work on Sempra’s Port Arthur and NextDecade’s Rio Grande projects.

Management expects this momentum to continue into 2026, supported by rising demand for distributed power, geothermal, and mobile generation solutions.

IET Order Outlook

Baker Hughes’ IET division posted strong order momentum in Q3, reaching $4.1 billion, driven by LNG equipment, Cordant Solutions, and gas infrastructure projects. The backlog hit a record $32.1 billion, underscoring long-term revenue visibility and growth durability.

Management expects full-year IET orders to surpass prior guidance and targets at least $40 billion over the next three years. Future growth will be led by gas infrastructure, power generation, and new energy markets, with LNG demand remaining steady.

Oilfield Margin Headwinds and Outlook

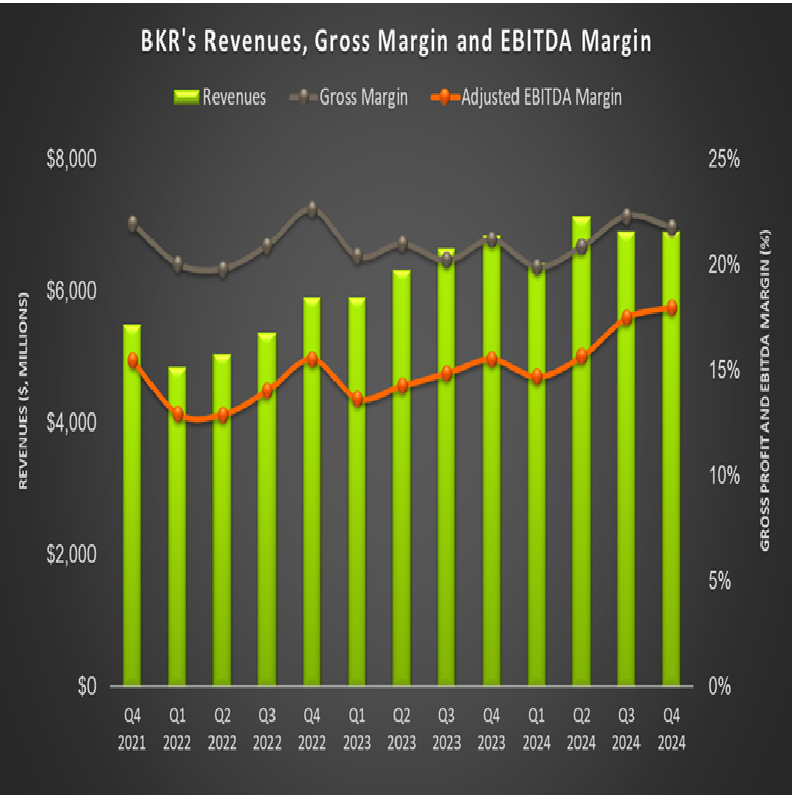

As we discussed in the Q3 earnings report, BKR’s Oilfield Services and Equipment segment margins declined due to macro headwinds, but stronger Industrial and Energy Technology results offset the impact. However, its consolidated EBITDA margin still rose to 17.7%, reflecting disciplined execution and portfolio resilience. The management now expects FY2025 adjusted EBITDA to surpass $4.7 billion.

Relative Valuation

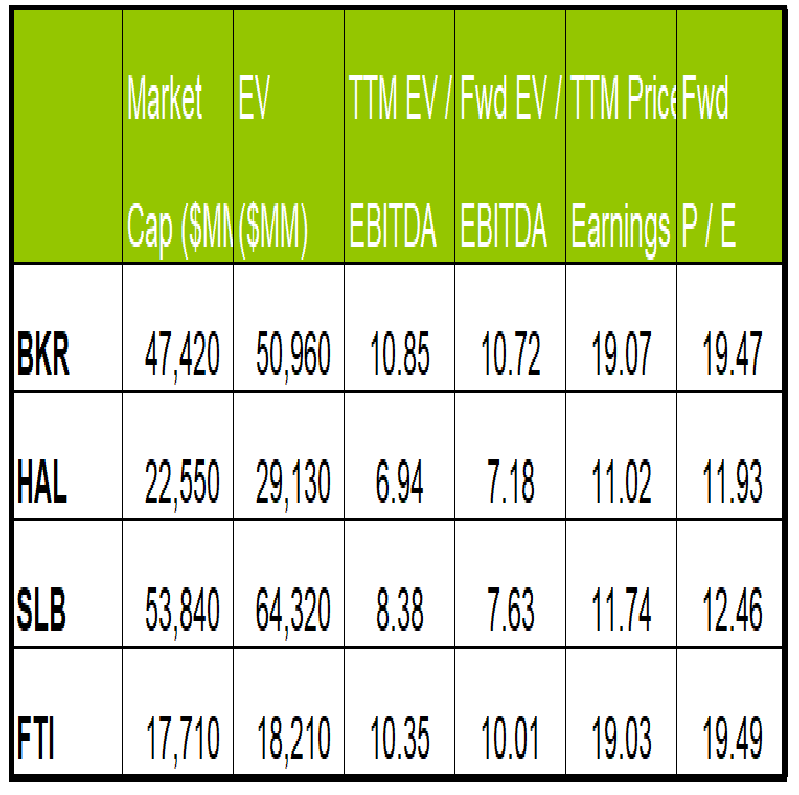

Baker Hughes is currently trading at an EV/EBITDA multiple of 10.9x. Based on sell-side analysts' EBITDA estimates, the forward EV/EBITDA multiple is 10.7x. The current multiple is slightly higher than its five-year average EV/EBITDA multiple of 10.1x.

BKR's forward EV/EBITDA multiple contraction versus the current EV/EBITDA is less steep than its peers because the company's EBITDA is expected to increase less sharply in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock's EV/EBITDA multiple is higher than its peers' (HAL, SLB, and FTI) average. So, the stock is overvalued compared to its peers.

Final Commentary

BKR remains cautious on short-term oil investment but sees stronger long-term growth, led by offshore, international, and natural gas markets. The company is deepening its LNG leadership through advanced liquefaction technology, the LM9000 turbine, and the planned integration of Chart Industries, which should enhance lifecycle economics.

Strong order momentum in the IET division and a record backlog signal durable multi-year growth supported by gas infrastructure, power generation, and new energy demand. Despite margin pressure in oilfield services, disciplined execution and rising high-margin IET contributions position Baker Hughes for steady earnings expansion beyond 2025. The stock appears overvalued compared to its peers.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform