Articles

Halliburton: Q3 2025 TAKE THREE

By Avik on October 21, 2025 in Articles

Tags:

By Avik on October 21, 2025 in Articles

Key Innovations and Operating Highlights: Halliburton’s (HAL) management expects the cost-saving measures, including equipment idling, to deliver estimated savings of $100 million per quarter. Its management sees continued strength in completion services, supported by demand for digital fracturing technologies like Octiv and advanced well construction tools. However, reduced activity in Saudi Arabia across multiple product service lines following lower rig count can present a challenge.

Among the key projects in Q3, Halliburton secured a major contract with the Northern Endurance Partnership for completions and monitoring in the U.K.’s East Coast carbon capture project. It won a five-year deal with ConocoPhillips Skandinavia to deliver offshore stimulation services in the North Sea using Octiv digital fracturing. The company also advanced new technologies such as the LOGIX geosteering system and Turing SmartWell system to enhance drilling precision and production efficiency.

North America Sales Gain; Impairment Charges Debunked

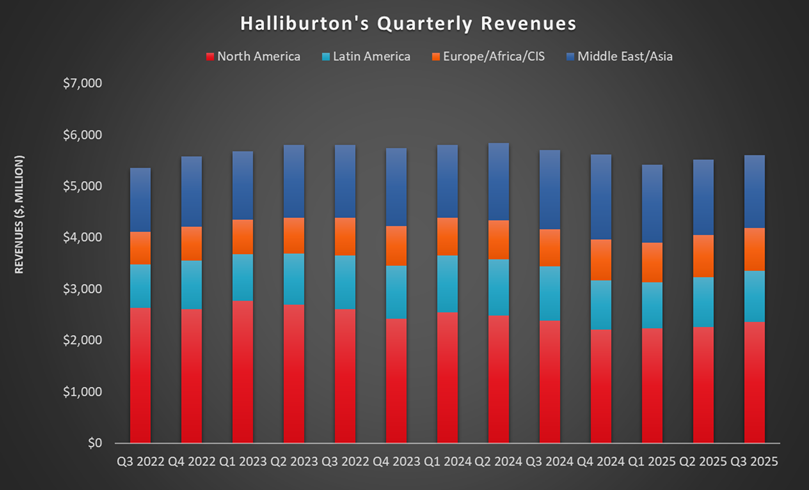

Quarter-over-quarter, the revenue growth in the company's Completion and Production operating segments was nearly equal (1.6%) in Q3. Geographically, North America witnessed the sharpest rise (4.6% up), followed by Latin America and Europe/Africa/CIS. The top line in the Middle East/Asia, in comparison, was relatively weak from Q2 to Q3 (3% down).

Stronger stimulation activity in the U.S. land and Canada, along with higher completion tool sales and wireline work in the Gulf of Mexico, primarily drove the Q3 sales in North America. Increased completion tool sales, well construction activity, and project execution in Mexico and Brazil pushed sales in Latin America. However, lower stimulation activity and reduced well construction services, project delays, and pricing pressure in certain markets kept its Middle East/Asia performance down. Quarter-over-quarter, the company’s net income was slashed to a meager $20 million after a total charge of $540 million related to impairments and other charges.

Share Repurchase Amidst Cash Flow Weakness: HAL's cash flow from operations kept on weakening (27% down) in 9M 2025 compared to a year ago. As a result, its FCF decreased by ~39%. Debt-to-equity (0.74x) deteriorated compared to the start of the year. Halliburton repurchased $250 million of common stock during Q3 2025. Year-to-date, total share repurchases reached $750 million.

Thanks for reading the HAL take three, designed to give you three critical takeaways from HAL's earnings report. Soon, we will present a second update on HAL earnings highlighting its current strategy, news, and notes we extracted from our deeper dive.

Tags:

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform