Articles

Halliburton's Perspective in Q3 2025: KEY Takeaways

By Avik on November 10, 2025 in Articles

Tags:

By Avik on November 10, 2025 in Articles

Industry Outlook

We have already discussed Halliburton's (HAL) Q3 2025 financial performance in our recent article. In the call, the management expressed its observation that most upstream spending now only offsets natural production declines, requiring sustained investment. Volatile energy prices and OPEC+ capacity shifts are keeping North American operators cautious in the near term. International activity, however, is expected to remain stable in 2026.

North America and Frac Outlook

Halliburton expects North America Q4 revenue to “decline by about 12–13%” due to seasonal slowdowns and white space. During Q3, it “stacked uneconomic frac fleets” and may continue to do so in Q4. Despite this, technology demand remains strong as customers focus on capital efficiency. The ZEUS electric fleet continues to lead in completions, with two new fleets added under contract this year.

Nearly 50% of Halliburton’s active North American fleet is now ZEUS, marking a key milestone.

The ZEUS IQ closed-loop fracturing system (fully electric and automated fracturing technology) is gaining traction and expected to see strong growth through 2026. In Drilling Services, the new 7 7/8 iCruise CX system (rotary steerable drilling system) delivered strong results in the Permian and is poised for wider adoption.

International Market Outlook

Halliburton expects international revenue to “rise 3–4%” in Q4, supported by strong software and completion tool sales. Its key growth drivers include production services, artificial lift, unconventionals, and drilling. Read the company’s offshore and international projects in the short article here.

VoltaGrid: The New Growth Machine?

Investors may note that Halliburton holds about 20% of VoltaGrid, which recently secured a 2.3-gigawatt power deal supporting Oracle’s AI data centers. This agreement expands VoltaGrid’s backlog and confirms its leadership in distributed power solutions. Halliburton will also partner with VoltaGrid internationally to deliver data center power projects, creating a long-term growth avenue beyond oilfield services.

Segment Forecast

In Q4 2025, Halliburton expects the Completion and Production revenue to decline 4–6% due to seasonal slowdowns in North America. International strength will partly offset this impact, though margins may compress by up to 75 basis points. In Drilling and Evaluation, revenue should remain stable with margins improving by 50–100 basis points.

Relative Valuation

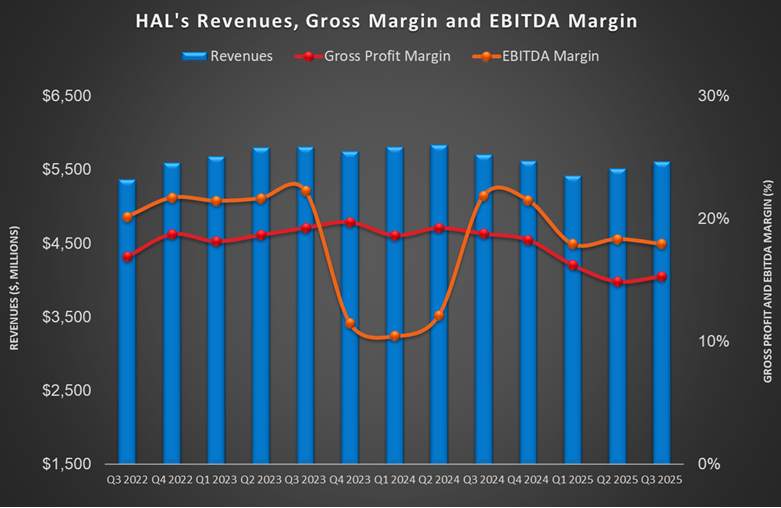

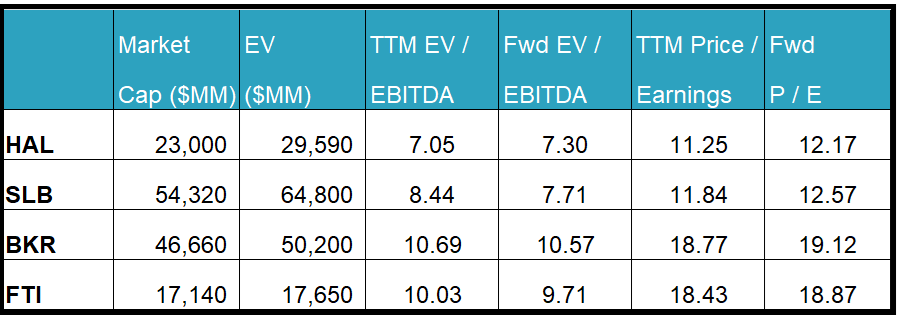

Halliburton is currently trading at an EV/EBITDA multiple of 7.1x. Based on sell-side analysts' EBITDA estimates, the forward EV/EBITDA multiple is higher. The current multiple is lower than its five-year average EV/EBITDA multiple of 10.6x.

HAL's forward EV/EBITDA multiple expansion versus the adjusted current EV/EBITDA contrasts a decline in the multiple for its peers because the company's EBITDA is expected to decline versus a rise in EBITDA for its peers in the next four quarters. This typically results in a much lower EV/EBITDA multiple than peers. The stock's EV/EBITDA multiple is lower than its peers' (SLB, BKR, and FTI) average. So, the stock is reasonably valued, with a negative bias, versus its peers.

Final Commentary

Halliburton’s outlook reflects steady international activity and long-term upstream investment needs despite short-term caution in North America. Seasonal weakness will weigh on Q4 U.S. completions, but the ZEUS electric fleet, the ZEUS IQ closed-loop fracturing system position, and the new iCruise CX rotary steerable system will put the company in a strong position for recovery through 2026.

International markets remain the key earnings driver, supported by contracts in production services, artificial lift, and unconventionals. Additionally, Halliburton’s 20% stake in VoltaGrid opens a high-growth channel in distributed power, diversifying earnings beyond oilfield services. The stock is reasonably valued, with a negative bias, compared to its peers.Bottom of Form

Tags:

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform