Q4 Outlook: KLX Energy Services’ (KLXE) management expects activity to ease slightly in Q4 due to seasonality and budget exhaustion. Revenue may dip by “mid-single digits”, which is less than the typical Q4 decline. Margins should stay stable, backed by new projects, regional mix, and cost control.

Revenue and EBITDA Margin in Q3

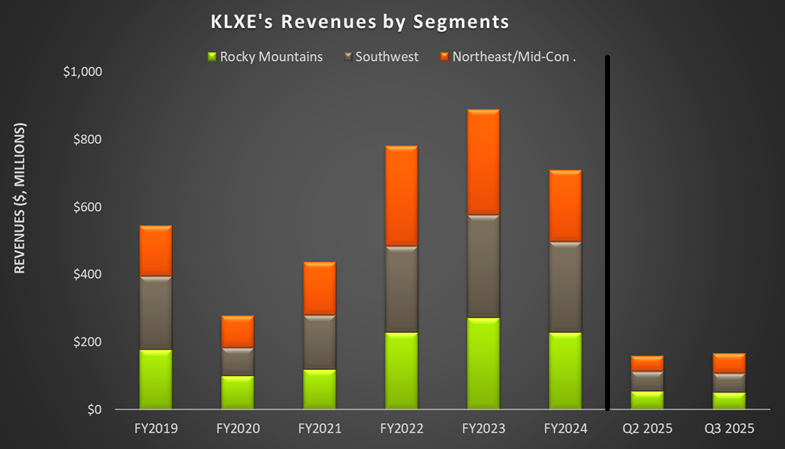

Quarter-over-quarter, KLXE's revenues in the Rocky Mountains decreased by 6% in Q3, driven by lower asset utilization, while the segment's operating income declined by 45%. Northeast/Mid-Con saw a 29% revenue rise, while its operating loss turned significantly positive in Q3. Improved completions utilization and increased regional natural gas-focused activity benefited the results in Q3. Its revenues from the Southwest segment decreased by 4% in Q3 due to lower pricing and an increased share of lower-profit-earning products in the sales mix.

Overall, KLXE's adjusted EBITDA margin expanded (up by 102 basis points) from Q2 to Q3 due to sequential improvement in completion-oriented activities in the Mid-Con/Northeast region and improved frac spread utilization in Q3. It also cut its net loss to $14.3 million in Q3.

Cash Flows Decreased: KLXE's cash flow from operations decreased by 29% in Q3 compared to Q2. Its free cash flow also decreased substantially in Q3. Its cash balance, however, has significantly reduced since the start of the year. Due to a large accumulated deficit, its shareholders' equity was negative as of September 30, 2025.

Thanks for reading the KLXE Take Three, designed to give you three critical takeaways from KLXE's earnings report. Soon, we will present a second update on KLXE's earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.