Articles

- BLOG / Articles / View

- Articles

Liberty Energy's Perspective in Q3 2025: KEY Takeaways

By Avik on November 7, 2025 in Articles

Industry Outlook

We have already discussed Liberty Energy's (LBRT) Q3 2025 financial performance in our recent article. Here is an outline of its industry outlook. LBRT’s management believes current frac activity has fallen below levels needed to sustain North American oil production. It attributes this to producers cutting completions after exceeding output targets and amid economic uncertainty.

They note that weakness in oil markets has outweighed gains in gas-related activity, though LNG demand remains supportive.

However, Liberty now forecasts the slowdown to be temporary, with global oversupply peaking by early 2026 and activity improving thereafter. Management expects fleet attrition and tighter capacity to restore pricing strength as demand rebounds. It also sees strong, sustained demand for its next-generation digiTechnologies fleets, driven by efficiency and lower emissions.

Frac Efficiency is Up

LBRT’s digiPrime fleets delivered record performance in pumping hours, horsepower, and proppant volumes during Q3. Liberty’s uniquely engineered digiPrime pumps achieved over 30% lower maintenance costs than conventional systems. Management credits advanced engineering and simplified design for higher output and reliability between maintenance cycles.

The company’s AI-driven StimCommander software further improved efficiency through automated rate and pressure control. Fleet automation enhanced stage execution speed by 65% and boosted hydraulic efficiency by up to 10%. Liberty says these gains from its acquisition of SLB’s completion technologies.

Top of Form

Bottom of Form

Power Solutions Business Capacity Expansion

Liberty expects strong expansion ahead, targeting over 1 gigawatt of total capacity by 2027 to meet growing demand. Its management sees structural power demand strengthening, driven by AI compute growth, electrification, and industrial reshoring. Rising grid reliability issues are creating opportunities for Liberty’s flexible, on-site power solutions. The company is engaging large customers with high, variable power needs through integrated offerings covering fuel management and grid connectivity.

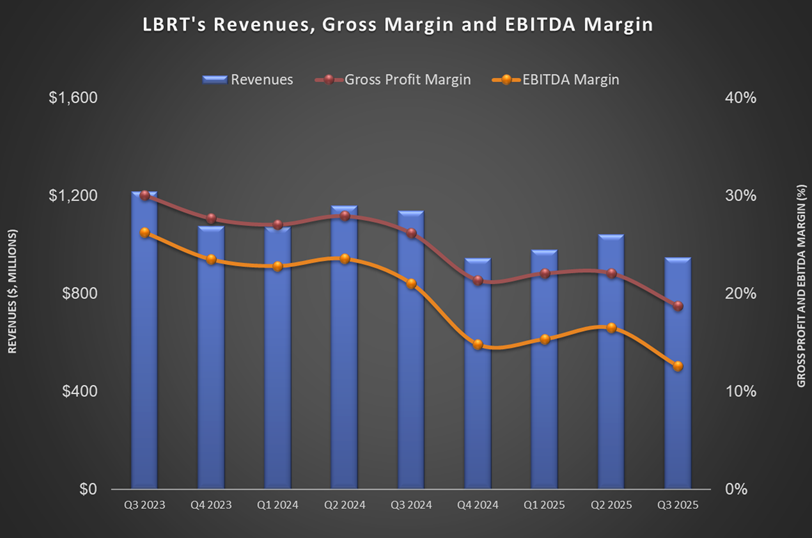

Q3 Performance And Balance Sheet

LBRT's revenues decreased by 9.1% quarter-over-quarter in Q3, while its adjusted EBITDA dipped by 29%. Its net income fell even more sharply, by 39%, in Q3 after surging remarkably in Q1. The company's debt-to-equity ratio deteriorated to 0.12x as of September 30, compared to 0.08x in the previous quarter. Despite the strain in the environment, it has recently increased its quarterly cash dividend by 13%.

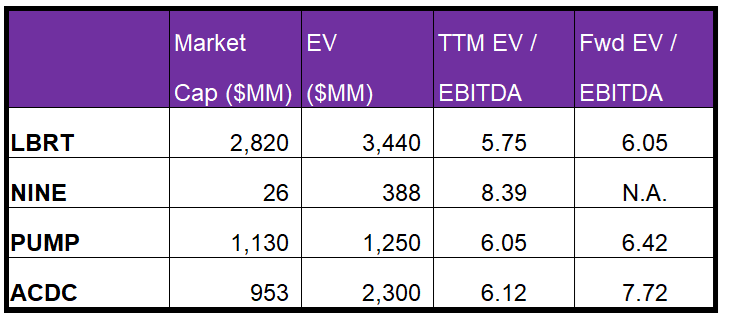

Relative Valuation

Liberty is currently trading at an EV/EBITDA multiple of 5.8x. Based on sell-side analysts' EBITDA estimates, the forward EV/EBITDA multiple is higher. The current multiple is lower than its five-year average EV/EBITDA multiple of 15.3x.

LBRT's forward EV/EBITDA multiple expansion versus the current EV/EBITDA is lower than its peers because the company's EBITDA is expected to decline less sharply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple than peers. The stock's EV/EBITDA multiple is lower than its peers' (NINE, PUMP, and ACDC) average of 6.9x. So, the stock appears to be undervalued compared to its peers.

Final Commentary

Liberty expects near-term softness in completions but anticipates a rebound as global oil balances tighten in 2026. Management believes reduced capacity and equipment retirements will help restore healthier pricing across the market. The company’s technology-driven fleets continue to deliver superior performance and lower maintenance intensity, supporting cost efficiency.

AI-enabled automation tools are enhancing field productivity and reliability across customer operations. Liberty’s power division is scaling rapidly to capture rising demand from the industrial and data center sectors for distributed energy. While quarterly earnings dipped due to weaker activity, Liberty remains focused on long-term growth and steady shareholder returns. Compared to its peers, the stock appears undervalued.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform