Completion To Face Challenges In Q4: Nine Energy (NINE) expects the “US land market continues to be challenging” because of the pricing pressure in oilfield services, seasonality, and budget exhaustion. Natural gas prices declined marginally in Q3 compared to Q2. Drought-related delays in the Northeast hurt wireline and completion tool activity. On a positive note, the cementing team achieved a key technical milestone with a slurry job in the challenging Haynesville basin.

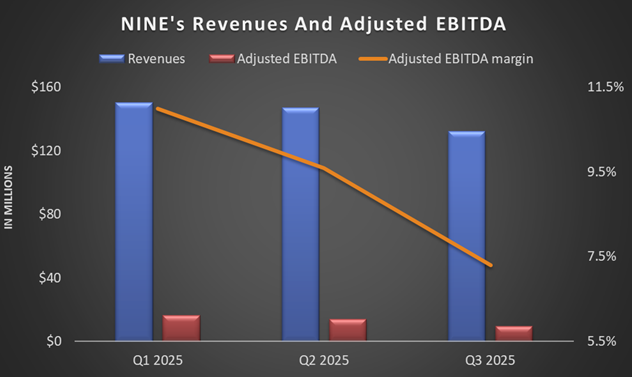

Revenue and EBITDA Margin Deteriorated in Q3

Quarter-over-quarter, NINE's revenues decreased by 10.3% in Q3, while its adjusted EBITDA margin contracted by 230 basis points. U.S. rig count fell in Q3, driving steep pricing pressure, especially in the crowded Permian Basin. The slowdown hit revenues and earnings across all service lines. Completion Tools also lost market share due to customer consolidation and shifting completion designs.

Cash Flows And Liquidity: NINE's cash flow from operations turned negative in Q3 2025 compared to a positive cash flow a quarter ago. As a result, free cash flow also turned negative in Q3. Due to negative shareholders' equity, its debt-to-equity ratio remained negative and deteriorated further as of September 30, 2025. It now has $40.3 million in liquidity. Due to lower inventory valuations tied to weak commodity prices, its borrowing base and liquidity will shrink by about $2.2 million each month through January 2026.

Thanks for reading the NINE Take Three, designed to give you three critical takeaways from NINE's earnings report. Soon, we will present a second update on NINE earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.