Articles

NINE Energy's Perspective in Q3 2025: KEY Takeaways

By Avik on December 12, 2025 in Articles

Tags:

By Avik on December 12, 2025 in Articles

Industry Outlook

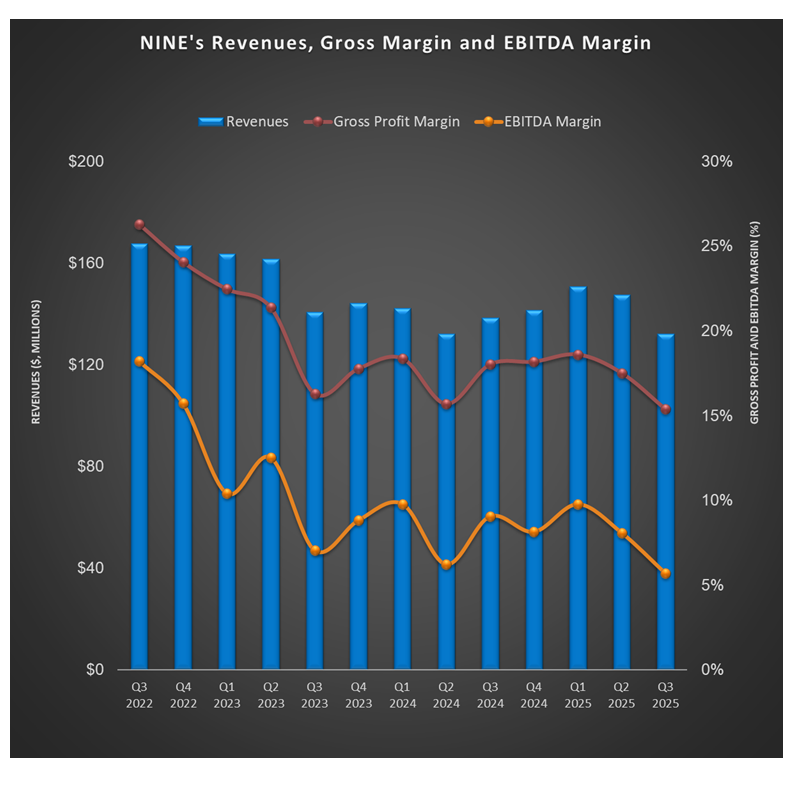

We discussed our initial thoughts about Nine Energy Service's (NINE) Q3 2025 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. The company’s management observes that the market’s been tough lately, with activity slipping and pricing under pressure. Most operators are still figuring out their 2026 spending plans as oil price swings keep everyone cautious. Still, steady gas prices are giving a lift — operations in the Northeast and Haynesville are running smoother, and sentiment’s starting to turn a bit more positive.

US Challenges and International Growth

The U.S. market’s been rough, with activity falling and pricing pressure intensifying — especially in the Permian, where rig counts dropped around 15% since Q1. Competition is fierce, with operators undercutting each other and customers forcing bids outside normal cycles to push prices lower. That’s hit Nine’s revenues and earnings across all service lines.

The completion tools division also lost some domestic share due to customer consolidation and changes in completion designs, but R&D is already redesigning tools to fit new casing sizes. On the brighter side, international business is still expected to grow this year. Natural gas prices held steady through Q3, keeping some support in the system. Given the challenging background, Nine generated no excess cash flow in the past two quarters. So, it has been decided that no payout will be made to noteholders.

Q4 Outlook and Achievements

To NINE’s management, the Q4 looks slow, with no major activity changes expected. However, typical seasonal dips from weather, holidays, and budget exhaustion can keep it weak. Low pricing will likely persist in Q4, and management expects both revenue and EBITDA to fall from Q3. The company projects Q4 revenue at $120 million-$130 million, or 5% lower than Q3. Still, the company plans to stay aggressive on market share growth while cutting costs. On the bright side, the cementing team pulled off a standout job in the tough Haynesville basin. It benefited from the technical edge, even working under extreme temperature and pressure conditions.

Relative Valuation

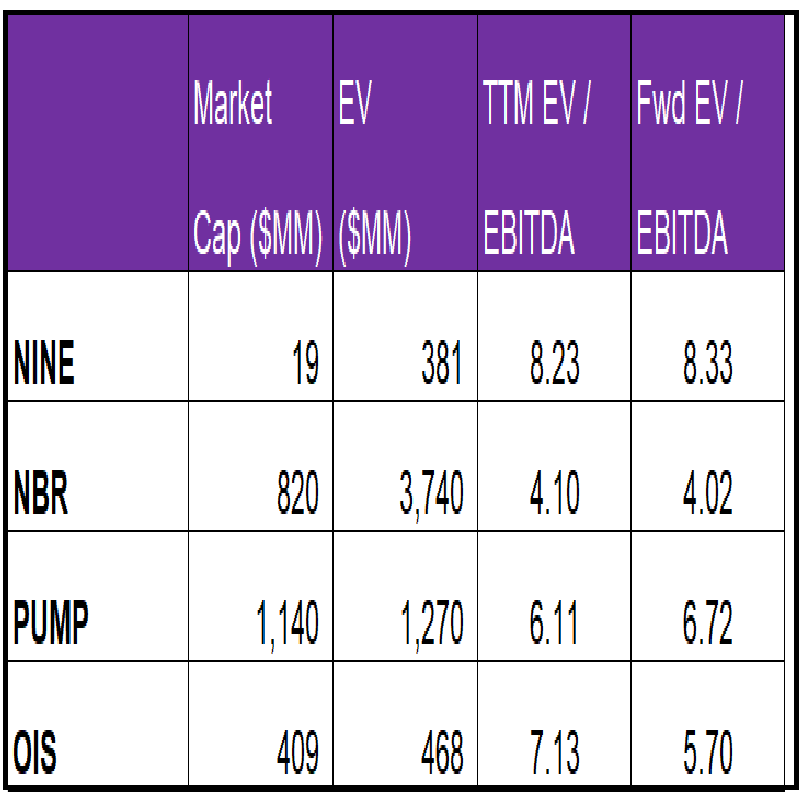

NINE is currently trading at an EV/EBITDA multiple of 8.2x. Based on sell-side analysts' EBITDA estimates, the forward EV/EBITDA multiple is higher.

NINE's forward EV/EBITDA multiple compared to the current EV/EBITDA is expected to expand compared to a contracted multiple for its peers. This implies that its EBITDA is expected to decrease compared to a rise in EBITDA for its peers in the next year. This typically results in a much lower EV/EBITDA multiple. The stock's EV/EBITDA multiple is higher than the peers' (NBR, PUMP, and OIS) average. So, the stock is relatively overvalued compared to its peers.

Final Commentary

Nine’s management sees a difficult market ahead, with pricing pressure, lower activity, and oil volatility keeping operators cautious into 2026. However, stable gas prices are helping sentiment improve in key basins like the Northeast and Haynesville. The Permian remains oversupplied, squeezing revenues and margins, though international work continues to show growth potential.

The company’s Q4 performance is expected to be soft, with seasonality and weak pricing dragging results lower, but Nine aims to protect share and manage costs tightly. Owing to the challenges, it has decided not to make any payouts to noteholders. The stock is relatively overvalued compared to its peers.

Tags:

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform