Articles

- BLOG / Articles / View

- Articles

NOV's Perspective in Q3 2025: KEY Takeaways

By Avik on November 24, 2025 in Articles

Shale industry outlook

North American shale has been the big winner since 2012, driving over 80% of global supply growth by slashing production costs. It pulled in the most capital and technology, beating offshore and other sources on efficiency. But Tier 1 shale spots are running out, and production growth is flattening as costs rise in lower-quality Tier 2 zones. NOV’s management finds an advantage for the international shale basin operators because the same shale tech that powered the U.S. boom is going global as international players chase cheaper barrels abroad.

Deepwater and International Market Outlook

NOV also observes that deepwater drilling is making a comeback after years of lagging behind shale. Efficiency gains, standardized subsea systems, and improved rig capabilities have pushed deepwater costs below U.S. shale, making it the new low-cost growth engine. Investments are flowing back into offshore projects, with major discoveries in places like Guyana, Namibia, and the Eastern Mediterranean.

Industry forecasts see offshore oil output climbing to about 13 million barrels per day by 2026, making deepwater the top source of new supply. Floating LNG projects are also boosting offshore gas development economics. Globally, rig demand in the Middle East is steady, and exploration drilling is expected to ramp up from late 2026 as offshore FIDs accelerate.

Q4 Outlook

NOV expects near-term conditions to stay soft, with tariffs, inflation, and weaker global drilling activity weighing on margins. However, management anticipates demand to strengthen from late 2026 as offshore and international land markets expand, positioning NOV to capture growth through its technology edge and global footprint.

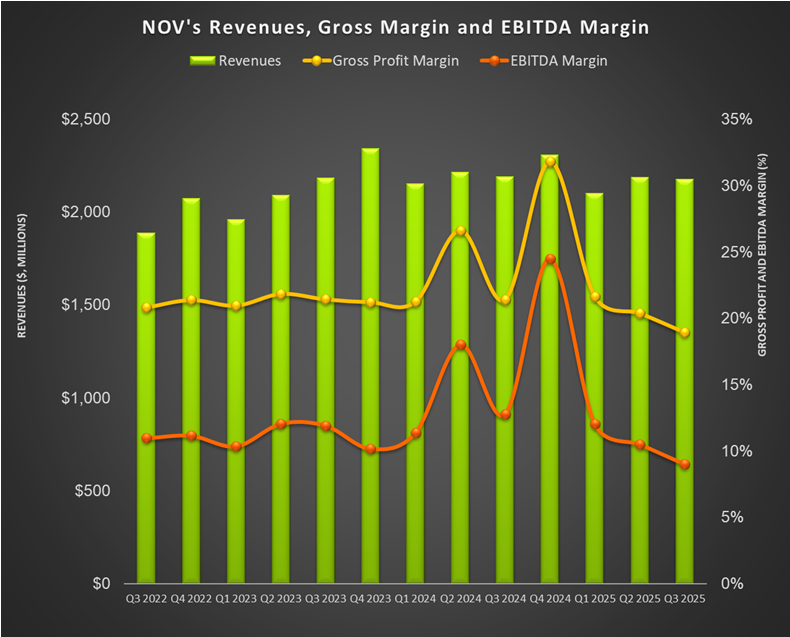

By Q3, NOV’s bookings have risen for three straight quarters, showing steady improvement despite weaker near-term capital equipment demand. Offshore rig activity is set to pick up in 2H 2026, supporting orders for high-spec gear like MPD and BOP systems. Automation and robotics demand is gaining momentum, with ATOM RTX systems driving safety and efficiency gains. Drilling aftermarket revenues are still soft but improving sequentially as spare parts bookings rise. For Q4, NOV expects a mild seasonal uptick, with Energy Equipment revenue down 2–4% year-over-year and EBITDA between $160–$180 million.

Assessing The Tariff Impact

NOV expects about $25 million in tariff expenses in Q4 but is working to offset the impact through supply chain realignment and strategic sourcing. The company’s cost-reduction initiatives, including facility consolidation and product line rationalization, are targeting over $100 million in annual savings by 2026. NOV’s management believes these actions will strengthen margins and improve long-term returns.

Relative Valuation

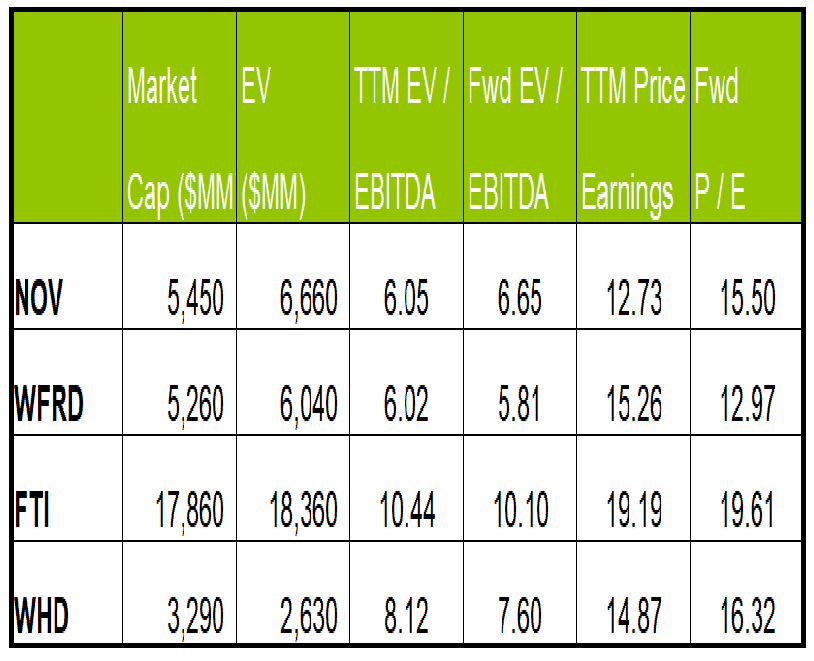

NOV is currently trading at an EV/EBITDA multiple of 6.1x. Based on sell-side analysts' EBITDA estimates, the forward EV/EBITDA multiple is 6.7x. The current multiple is lower than its five-year average EV/EBITDA multiple of 14.1x.

NOV's forward EV/EBITDA multiple expansion versus the current EV/EBITDA contrasts with its peers because its EBITDA is expected to decrease compared to a rise in EBITDA for its peers in the next year. This typically results in a much lower EV/EBITDA multiple than its peers. The stock's EV/EBITDA multiple is lower than its peers' (CHX, FTI, and WHD) average. So, the stock is reasonably valued, with a negative bias, compared to its peers.

Final Commentary

North American shale is losing its edge as Tier 1 inventory declines and production costs rise, shifting focus toward international shale basins where the same technologies promise cheaper development. NOV sees deepwater regaining dominance, with improved efficiency and standardization pushing costs below U.S. shale. Offshore investment is ramping up globally, led by new discoveries and rising floating LNG activity.

NOV expects market softness through the next few quarters, but a recovery from late 2026 as offshore and international drilling accelerate. Bookings have grown for three straight quarters, supported by demand for automation and robotics, while drilling aftermarket activity is starting to rebound. The stock is reasonably valued, with a negative bias, versus its peers.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform