Articles

- BLOG / Articles / View

- Articles

OFS Ranking Index: Structure Still Leads

By Avik on December 24, 2025 in Articles

Summary

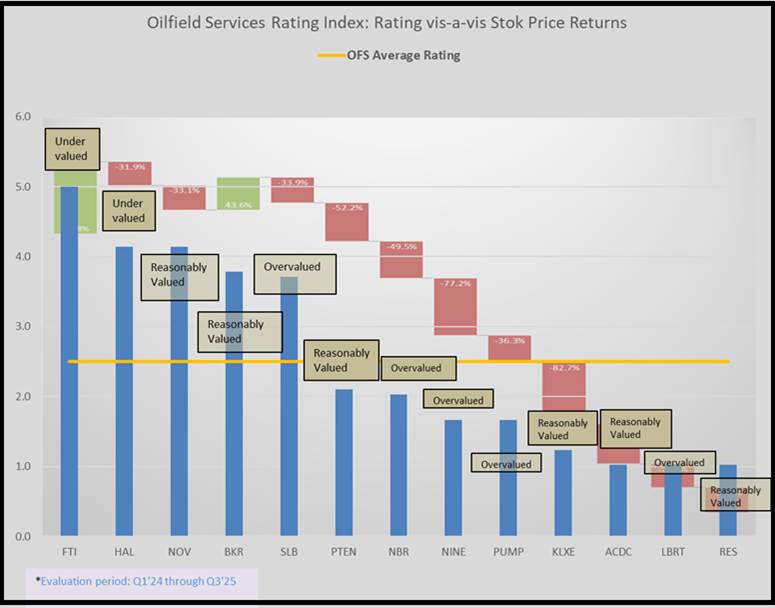

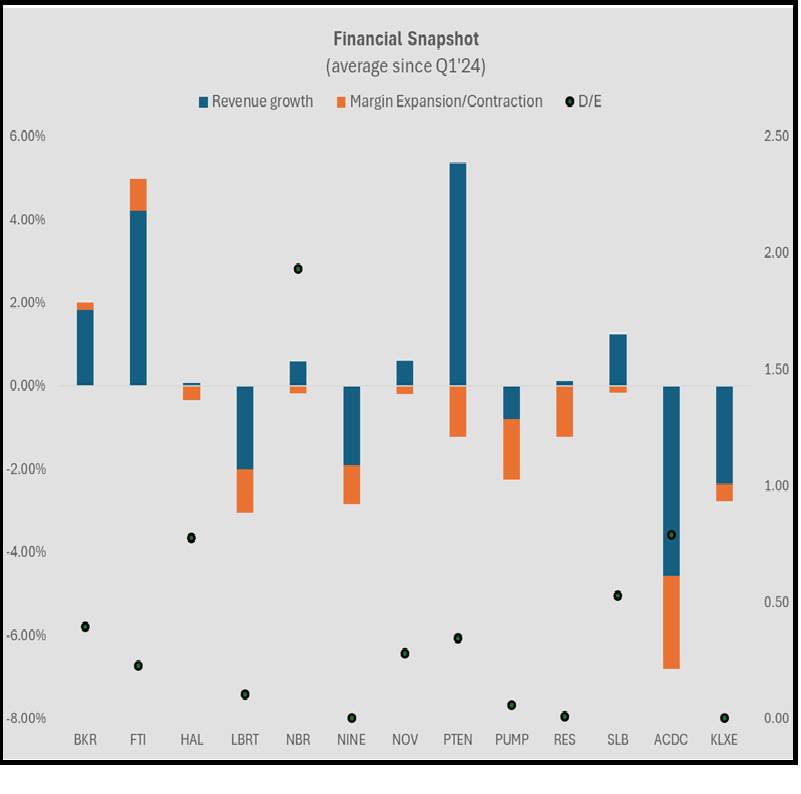

We started off the ranking journey by creating an index for pure-play pressure pumpers. This analysis compares leading oilfield services companies using our OFS Index, a scorecard built to highlight which business models are best positioned in the current cycle. On a 10-point indexed scale, the sector is sitting in the low-to-mid 2s, reflecting a muted activity backdrop and uneven short-cycle demand. Within that environment, differentiation comes from structure, backlog visibility, and credible execution, not just near-term utilization.

TechnipFMC stands out clearly at the top of the rankings, scoring in the mid-4s, well ahead of peers. Halliburton and NOV follow in the low-4s, supported by steady execution and improving durability. Baker Hughes and Schlumberger form a diversified upper tier in the high-3s, while hybrid and pressure-focused names cluster closer to 2 or below. The dispersion in scores underscores a market where long-cycle exposure is increasingly driving relative advantage.

Method, in brief

Rather than ranking companies on a single metric, the index blends multiple dimensions of performance and positioning into a composite score. Financial execution anchors the framework, ensuring that revenue trends, margins, cash flows, and balance sheets still matter. But in this phase of the cycle, numbers alone are not enough. Management outlook, backlog confidence, and capital discipline increasingly separate leaders from laggards, which is why qualitative signals carry equal weight.

The model also places its heaviest emphasis on diversification — rewarding companies with exposure to offshore, subsea, LNG, international, and equipment markets that provide longer-duration earnings streams. A smaller allocation captures optional upside from power and infrastructure adjacency. Scores are averaged across quarters to smooth volatility and reflect cycle-level positioning. For presentation, results are indexed to a 10-point scale, so relative gaps between companies are easier to interpret.

In short, ranking is designed to answer one question: which OFS companies are best positioned to compound earnings power across cycles, not just through the next turn in activity?

What the index is telling us

With the composite index hovering around 2–3, the message is consistent. Short-cycle activity is uneven. Long-cycle demand in offshore, subsea, LNG, and international markets is holding. In this environment, durability matters more than intensity. Companies with diversified earnings streams and credible forward tone continue to separate. Admittedly, credible execution plus improving durability can rival pure structural breadth.

TechnipFMC: Clear structural leader

TechnipFMC sits decisively at the top of OSAI, scoring in the mid-4s. Its advantage is structural. A deep iEPCI backlog, subsea strength, and multi-year project visibility provide durability few peers can match. Management tone reinforces confidence in execution and returns. In this framework, TechnipFMC is the clearest example of backlog translating into sustained earnings power.

Halliburton and NOV: Execution-driven leaders

Halliburton benefits from international growth and disciplined contracting that smooths its North American exposure. Qualitative signals on pricing and execution remain constructive, which the higher outlook weight now captures.

NOV’s mix of rig equipment and offshore exposure supports backlog visibility. While project timing still affects earnings, diversification and steady tone keep NOV close to Halliburton.

Baker Hughes and Schlumberger: Diversified upper tier

Schlumberger continues to score well near the high-3s, reflecting unmatched global scale and technology depth. The profile is steady and resilient, though recent outlook signals point more toward consistency than acceleration.

Baker Hughes, in the mid-3s, benefits from exposure to LNG, gas infrastructure, and industrial energy technology. Greater weight on qualitative direction lifts its standing as management emphasizes long-cycle visibility and backlog growth. Near-term execution remains mixed, but strategic optionality is clear.

Hybrids: Patterson-UTI and Nabors

Patterson-UTI and Nabors cluster around 2. Integration and international exposure improve visibility, but both remain more tied to cyclical drilling and completions than the diversified leaders. Outlook signals are stable, not decisive. The model credits improving balance, but structural upside remains limited.

Pressure-focused names: Narrow structure caps upside

Pure pressure-focused names — Nine, ProPetro, KLX Energy, RPC, ACDC, and Liberty — remain clustered between 1 and 2. Execution can improve quarter to quarter, but a narrower business mix and limited backlog duration keep structural scores low. Power adjacency helps at the margin, but it does not close the gap.

In the context of fracking, we have explained the break-even prices here. We discussed the significance of the BE prices for some major US energy producers. We even did scenario analysis, assuming a fall in oil price or a move towards lower-tier acreages.

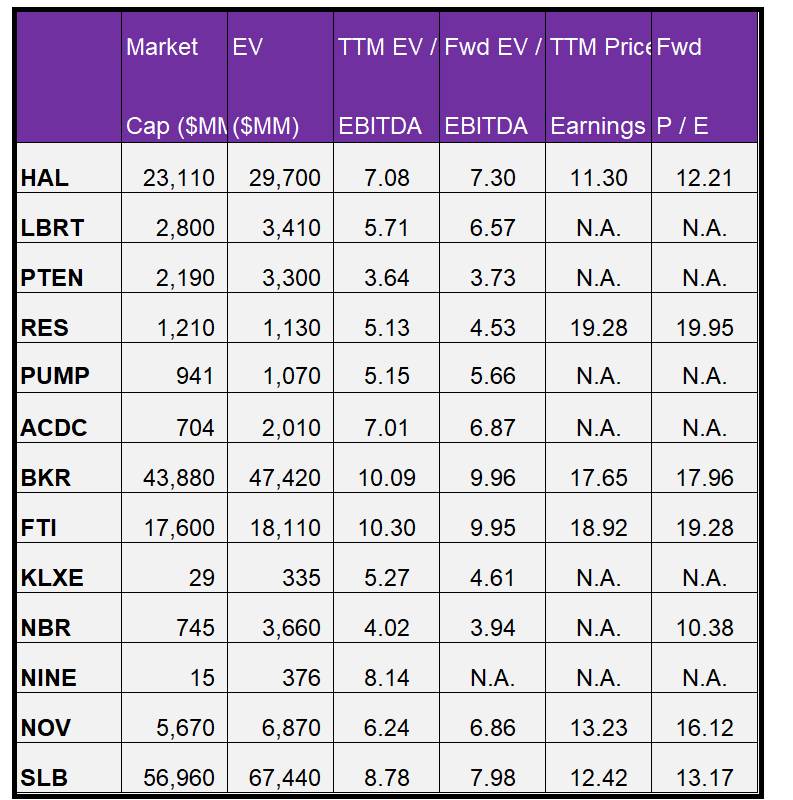

Relative Valuation

Based on changes in relative valuation multiples (EV/EBITDA), PTEN and RES appear attractively priced, with low trading multiples. ACDC, BKR, FTI, NINE, and SLB, based on the relative valuation multiples, are the least attractively placed. The rest are reasonably spread across the pricing spectrum.

Takeaway

The index scores point to a clear conclusion. In a sector operating around 2–3 on a 10-point structural scale, leadership is no longer about who can squeeze the most out of short-cycle activity. It is about who brings a durable backlog, diversified exposure, and credible execution into a flatter environment.

TechnipFMC, with a score in the mid-4s, stands out as the clearest structural winner in this cycle. Halliburton and NOV, in the low-4s, show that disciplined execution and improving durability can narrow the gap with more diversified peers. Baker Hughes and Schlumberger remain strong platforms in the high-3s, offering resilience rather than acceleration. By contrast, hybrids and pressure-focused operators, clustered near or below 2, continue to face structural limits despite pockets of operational improvement.

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform