Articles

- BLOG / Articles / View

- Articles

Pressure Pumping Ranking: Who’s Actually Winning

By Avik on December 18, 2025 in Articles

Ranking Pressure Pumpers

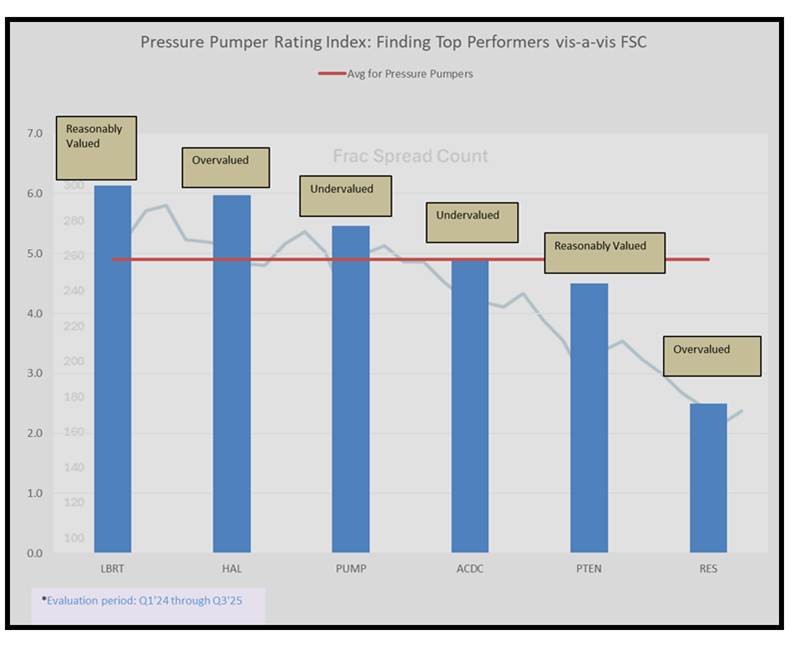

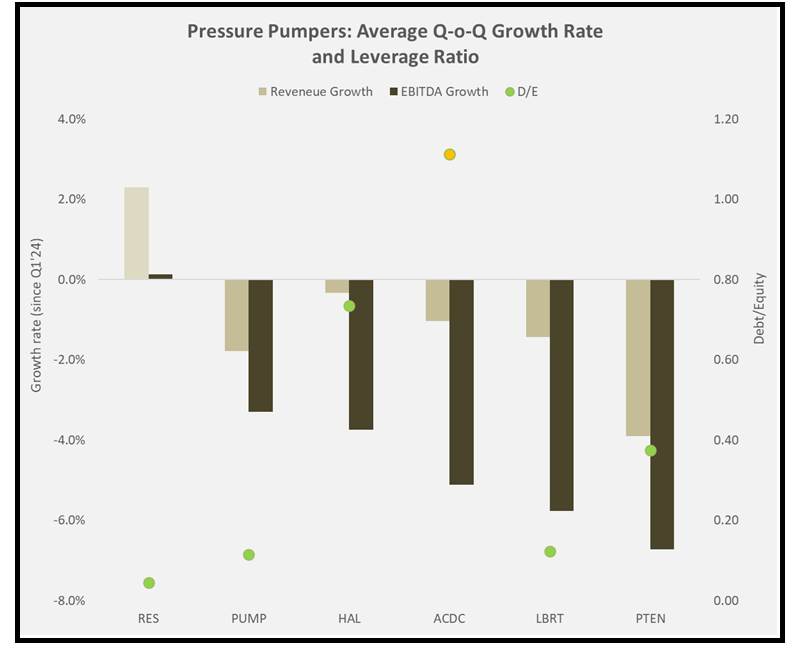

This analysis focuses exclusively on U.S. pressure pumpers—Halliburton, Liberty Energy, Patterson-UTI, RPC, ProPetro, and ProFrac—using a rating framework designed to capture completion intensity, fleet efficiency, and management execution rather than broad OFS exposure. Our Pressure Pumping Rating Index differs from conventional rankings in two important ways.

- First, it quantifies qualitative inputs, converting management outlook, tone, and execution signals into weighted data.

- Second, it embeds frac-spread exposure and utilization, which most models ignore despite their central role in completion-led cycles.

Method, in brief

Each company receives a quarterly score combining financial performance, balance sheet trends, price action, and coded qualitative signals from earnings commentary. Outlook statements are classified and weighted by tone and content, so sentiment becomes measurable. These quarterly scores are averaged across Q1’24–Q3’25 to reduce noise and capture cycle-level execution rather than quarter-to-quarter volatility.

What the Index Is Telling Us

Drilling slowed. Completions did not. Operators leaned on inventory conversion, pad efficiency, and higher stages per day to sustain output. In that environment, frac efficiency matters more than fleet count.

Our model quantifies all three. In the context of frac efficiency, we have explained the break-even prices here. We discussed the significance of the BE prices for some major US energy producers. We even did scenario analysis, assuming a fall in oil price or a move towards lower-tier acreages.

Halliburton: Scale with discipline

Halliburton remains the benchmark. Its strength lies in fleet discipline and contract structure, not aggressive capacity growth. Management consistently emphasized utilization, pricing stability, and execution over share. Those signals show up repeatedly in our outlook scoring.

More recently, Halliburton’s continued rollout of integrated completion workflows and digital well construction tools has helped customers push higher stages per day without adding incremental horsepower. This has reinforced Halliburton’s positioning with large operators focused on efficiency gains rather than volume expansion, supporting steadier margins despite softer North American pricing.

Liberty Energy: Completion intensity leader

Liberty’s advantage is straightforward: completion intensity. Stage counts per day, fleet utilization, and operational uptime remained strong through the last three quarters. Our model captures this both through the frac-spread factor and through repeated positive outlook signals tied to efficiency, fuel strategy, and data integration.

A key support has been Liberty’s expansion of electrified and dual-fuel fleets, particularly in core shale basins, which has reduced downtime and fuel volatility for customers. These deployments have strengthened Liberty’s competitive standing in longer-term completion programs where reliability and cost control matter more than headline activity levels.

ProPetro: Efficiency over volume

ProPetro’s improvement is driven by operational focus in the Permian. Management commentary consistently highlighted customer alignment, uptime, and fleet upgrades, with few negative signals. Frac-spread utilization stayed firm even as activity normalized.

In recent quarters, ProPetro’s targeted fleet modernization and redeployment toward higher-efficiency contracts have supported margin improvement without chasing incremental volume. This shift has helped stabilize performance and improved visibility, even as pricing power across the sector remained uneven.

Patterson-UTI: Stability through integration

Patterson-UTI sits in the middle of the pack, but with improving fundamentals. The combination of drilling and completions provides visibility, while pressure-pumping execution stabilized across 2024 and 2025. A notable development has been the company’s progress in integrating drilling and completion services for key customers, which has improved scheduling efficiency and reduced idle time across fleets. While this has not yet translated into clear outperformance, it has reduced downside risk and improved execution consistency.

The company’s score reflects steady but unspectacular execution. It lacks the utilization edge of Liberty or the margin inflection of ProPetro, but it benefits from scale and integration in a market that increasingly values reliability.

RPC: Smaller fleets, higher volatility

RPC remains more exposed to cycle volatility. Its scores reflect uneven utilization and weaker pricing leverage, particularly outside its core basins. Execution signals have been mixed, reflecting sensitivity to customer pacing.

That said, RPC has recently benefited from select contract wins tied to incremental completion programs, which helped lift activity off cycle lows. These wins improve near-term outlook but have not yet altered the company’s structurally higher volatility profile.

ACDC: Niche exposure with improving traction

ACDC’s recent quarters showed improvement, supported by niche exposure and selective customer wins. Execution consistency remains uneven, but the direction has been more constructive than earlier in the cycle.

In particular, ACDC’s focus on smaller-scale, basin-specific completion projects has helped stabilize utilization in pockets where larger providers are less flexible. This strategy supports upside in tighter completion markets, though execution risk remains elevated relative to larger peers.

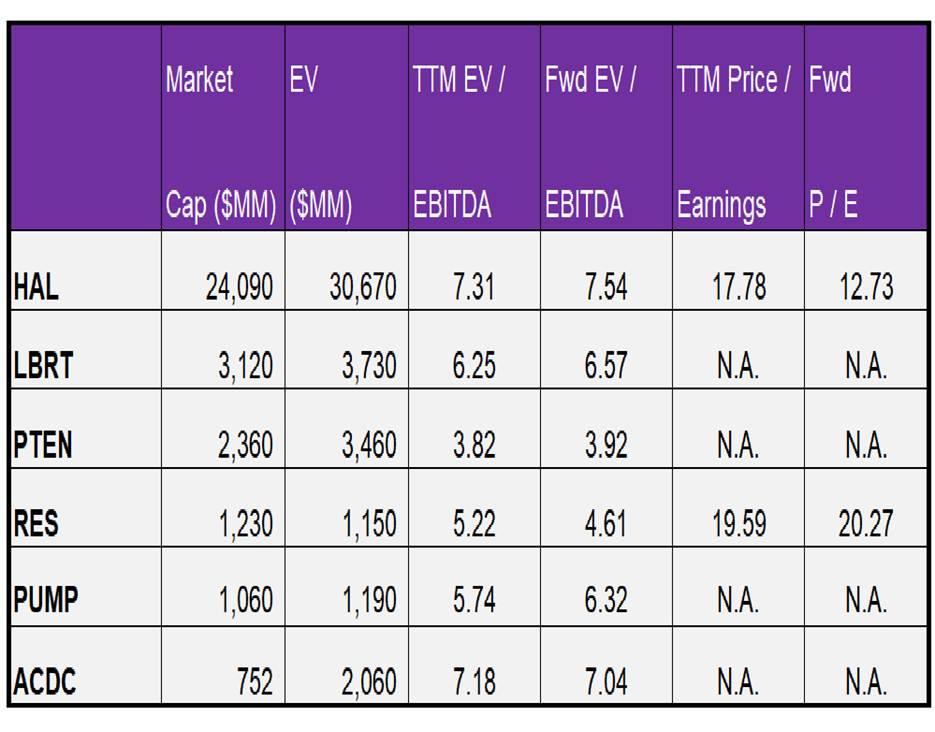

Relative Valuation

Based on changes in relative valuation multiples (EV/EBITDA), PUMP appears attractively priced, with a high-quality index. RES, based on the relative valuation multiple and our rating index, is the least attractively placed. The rest are reasonably spread across the value spectrum.

Takeaway

This is not a size contest. It is a test of completion productivity and proof. In a pressure-pumping-driven cycle, the winners are those converting stable frac activity into margins and cash, not those chasing growth. The index isolates that reality. It shows where execution is strongest today—and where it is not.

Halliburton and Liberty stand out as the only operators consistently outperforming the industry on execution. Their advantage comes from disciplined fleet utilization and better exposure to higher-intensity completions. ProPetro is executing adequately but lacks a clear edge versus peers. Patterson-UTI, RPC, and ACDC continue to trail the industry average, reflecting higher operating volatility. For investors, the gap between leaders and laggards remains wide, and selectivity still matters in this cycle.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform