Outlook Signals Recovery: ProFrac’s (ACDC) management observes that the completion activity appears to be improving in Q4 after a dip in late-Q3. Energy prices look to “strengthen” and the “pressure pumping market continues to tighten via natural equipment attrition.” It plans to focus on through-cycle resilience and structural cost savings, which can bring $85-$115 million in annualized cash savings by Q2 2026.

Management sees Q4 frac activity to edge higher with steady frac spread deployment, even as pricing softens slightly. The company sees stronger results ahead, driven by better efficiency, higher throughput, and improved proppant volumes.

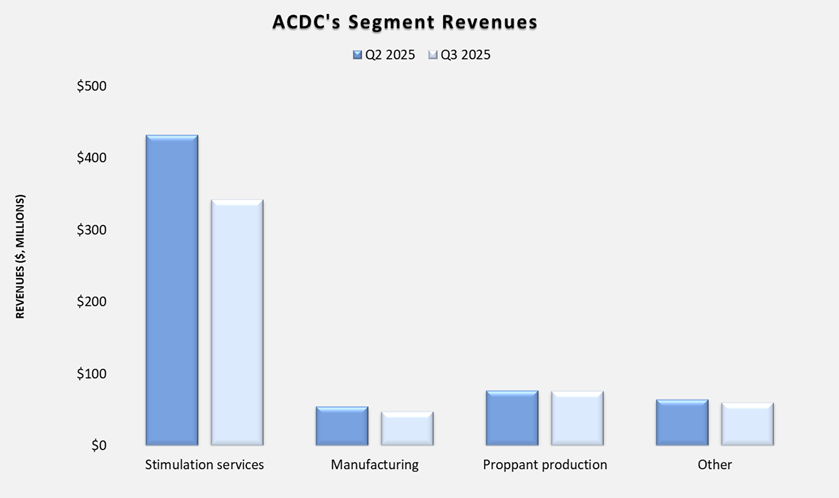

Segment Performance in Q3

From Q2 to Q3, ACDC's revenues from Stimulation Services and Manufacturing fell sharply (20.6% and 14%, respectively), while its revenues from Proppant production remained resilient (1.4% down). Quarter-over-quarter, the company's adjusted EBITDA margin contracted by 551 basis points in Q3. Challenging market conditions, including an “unexpected decline in conditions,” led to topline and margin deterioration in Q3.

FCF Dried Up In 9M 2025: In 9M 2025, the company's free cash flow was barely positive but was significantly lower than a year ago due to a substantial decline in cash flow from operations. In 9M 2025, its capex fell. Its projected capex for FY2025 is expected to range from $160 million to $190 million—a $25 million reduction from previous guidance —reflecting the company’s commitment to maintaining financial discipline.

Thanks for reading the ACDC Take Three, designed to give you three critical takeaways from ACDC's earnings report. Soon, we will present a second update on ACDC earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.