Articles

- BLOG / Articles / View

- Articles

ProFrac Holding's Perspective in Q3 2025: KEY Takeaways

By Avik on December 19, 2025 in Articles

Industry And Fracking Outlook

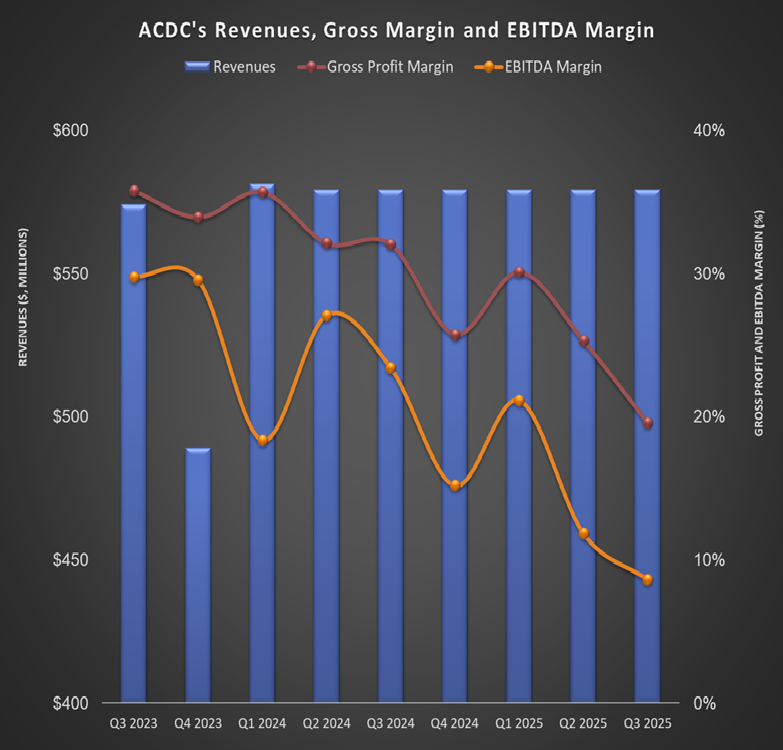

Our short article discussed our initial thoughts about ProFrac Holding's (ACDC) Q3 2025 performance a couple of weeks ago. This article will dive deeper into the industry and its current outlook. ACDC’s Q3 started with improving conditions and stronger pump hours, but activity dropped sharply in September as customers delayed programs. The U.S. completions market remains volatile, with operators cautious on spending.

Activity improved in October as deferred programs returned and new contracts began. Q4 will face normal seasonal softness, but the company is taking steps to cushion the impact. Management expects shale activity to rise in 2026 as production declines force more completions. The outlook for gas remains strong, with LNG growth and power demand likely to tighten frac market dynamics next year.

Recent Drivers and Strategy

Activity picked up in August as customer programs gained momentum, but dropped sharply in September as deferrals increased white space. The volatility shows how cautious operators remain in spending across the U.S. completions market. To adapt, management is shifting toward a more resilient model focused on dedicated, stable fleets. The company is also tightening costs and improving efficiency to stay competitive through the cycle.

ProFrac’s integrated model combines asset management and in-house manufacturing, giving it cost and flexibility advantages. This setup helps it stay strong in high-demand dual-fuel and electric fracturing markets. Its ProPilot 2.0 system is cutting fuel use by up to 26%, boosting cost efficiency. The Seismos partnership adds closed-loop fracturing, marking the next step in advanced completion technology.

Update on Flotek Partnership

In April, Flotek acquired mobile power generation assets from ProFrac for $105 million, entering the high-growth mobile power generation sector. ProFrac’s partnership with Flotek converted a former cost center into a scalable third-party business. Through the partnership, ACDC received $105 million through a sale-leaseback of its mobile power units. The deal boosted liquidity while giving ProFrac long-term upside. With a 60% equity stake in Flotek, ProFrac is positioned to tap into a multibillion-dollar gas conditioning market across several industries..

Cost and Capital Market Strategy

ProFrac is tightening its cost structure. In October, it cut headcount, targeting $35–$45 million in annual savings. The company also aims to trim another $30–$40 million from non-labor costs by tightening operating expenses and centralizing equipment control.

Its fleet mix is being optimized to reduce downtime and boost efficiency, saving another $20–$30 million in maintenance capital. These steps should strengthen cash flow and improve operating leverage. In August, ProFrac raised about $80 million through an equity offering, using part of the proceeds to pay down debt and fund working capital.

Relative Valuation

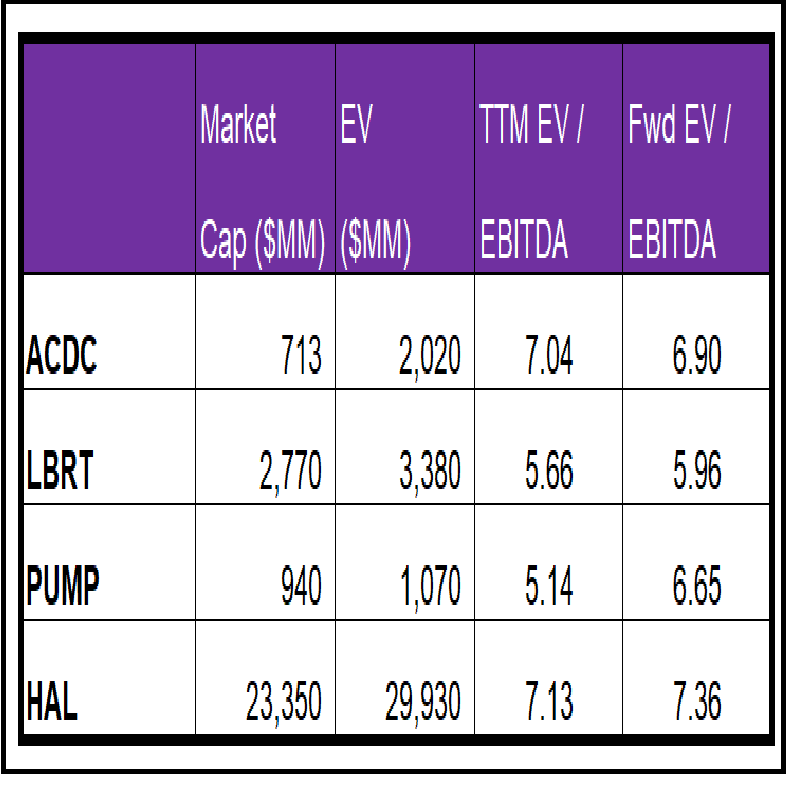

ACDC is currently trading at an EV/EBITDA multiple of 7x. Based on sell-side analysts' EBITDA estimates, the forward EV/EBITDA multiple is 6.9x.

ACDC's forward EV/EBITDA multiple contraction versus the current EV/EBITDA contrasts with its peers because its EBITDA is expected to increase, while its peers’ EBITDA is expected to decrease in the next year. This typically results in a a much lower EV/EBITDA multiple than its peers. The stock's EV/EBITDA multiple is higher than its peers' (LBRT, PUMP, and HAL) average (6x). So, the stock is overvalued compared to its peers.

Final Commentary

ProFrac faced a choppy Q3 as early momentum faded with September deferrals, but activity rebounded in October on returning programs and new contracts. The market remains volatile, yet management expects shale completions to recover in 2026 as production declines drive demand. The company is focusing on dedicated fleets, cost efficiency, and long-term resilience to weather near-term softness. Its integrated platform and in-house manufacturing continue to provide a cost edge, while dual-fuel and electric fleets keep it competitive in premium markets.

The Flotek partnership added $105 million in liquidity and positioned ProFrac to benefit from future gas conditioning growth. Recent cost cuts and streamlined operations should lift margins and strengthen free cash flow heading into 2026. The stock is overvalued compared to its peers.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform