ARC’s Bid and Company Outlook: In September, STEP Energy (SNVVF) received a non-binding offer from ARC Financial to acquire all remaining shares at $5.50 per share in cash. ARC already controls over 55% of STEP’s shares. In recent weeks, STEP’s board approved an arrangement with ARC, but the deal remains subject to shareholder approval.

STEP’s management expects robust activity early in Q4 before a gradual seasonal slowdown as clients wrap up spending. Fracturing demand should stay steady, while coiled tubing will dip due to slower fracturing and permit delays from labor actions in British Columbia. Its fracturing schedule in Q1 2026 is almost booked. The management’s long-term outlook for oilfield services is “very constructive” as the North American natural gas market is set to expand.

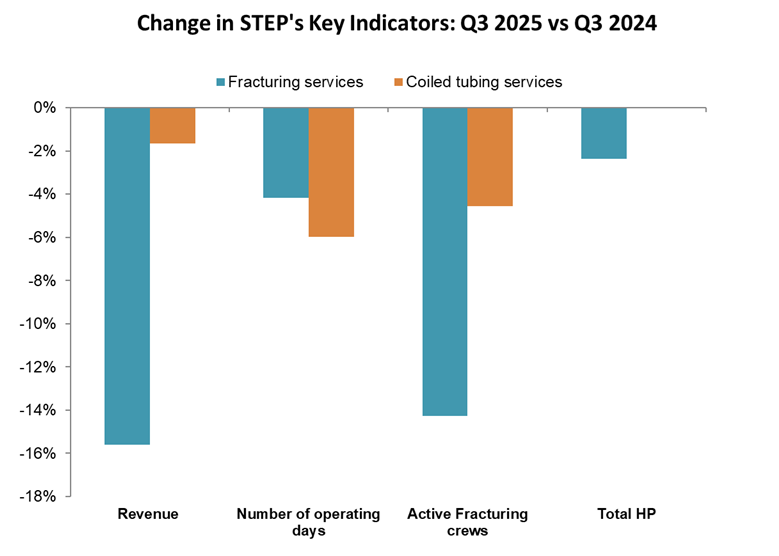

Operating Metrics Deteriorated in Q3

In Q3 2025, STEP’s year-over-year revenues from Fracturing services decreased by 15.6% as operating days declined by 4%. Its frac spreads also decreased by one in Canada to six. Its dual-fuel horsepower, however, remained resilient (up by 1%) during this period, while total HP deployed fell by 2%. Nearly 77% of its total HHP is dual-fuel capable, up from 75% a year ago.

The company’s revenues from Coiled Tubing services decreased by 2% in Q3 2025 compared to a year ago, due primarily to lower operating days and coiled tubing units. Despite the pressure, the company’s adjusted EBITDA margin expanded by nearly 100 basis points, as utilization in the fracturing service line improved.

Free Cash Flow Fell: STEP's cash flow declined (40% down) in 9M 2025 compared to a year ago, while its free cash flow decreased by 50% during this period. Its debt-to-equity improved to 0.10x as of September 30, 2025, from 0.15x at the beginning of the year.

Thanks for reading the STEP Take Three, designed to give you three critical takeaways from STEP's earnings report. Soon, we will present a second update on STEP earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.