Articles

- BLOG / Articles / View

- Articles

Liberty Energy's Perspective in Q2 2025: KEY Takeaways

By Avik on August 29, 2025 in Market Sentiment

Industry and Completion Outlook

We have already discussed Liberty Energy's (LBRT) Q2 2025 financial performance in our recent article. Here is an outline of its industry outlook. North American production has remained steady despite geopolitical and economic volatility, thanks to strong operators with efficient operations and healthy well economics. Producers are maintaining flat output, using just enough completions to counter natural decline.

Completion activity is expected to slow in the second half due to tighter capital discipline. This will likely lead to higher equipment attrition, improving long-term service sector balance. Larger operators now demand high-efficiency, technically advanced service offerings. Liberty’s integrated capabilities and strategic investments position it well to outperform in this evolving environment.

Frac Outlook

Liberty plans to slightly reduce its deployed frac fleet in 2H 2025 due to near-term activity pullbacks, reallocating capacity toward high-efficiency simul-frac demand from long-term partners. Despite the cutback, Liberty is leveraging its integrated service offerings—frac, wireline, sand, logistics, diagnostics—to strengthen customer relationships and preserve market share.

The company’s digiPrime platform is advancing quickly, with two variable-speed natural gas engines now pumping in West Texas and delivering operational efficiency gains. Meanwhile, the digiFleet platform, three years post-deployment, is demonstrating significantly enhanced engine durability and lower component stress compared to diesel systems. This durability translates to longer equipment life and reduced maintenance, reinforcing Liberty’s leadership in efficient, lower-emission fracturing technologies.

Power Solutions Business Opportunity

Liberty is expanding its power solutions business to meet rising energy demands from data centers and industrial users through strategic partnerships. New alliances in Pennsylvania and Colorado will deliver integrated on-site generation and power infrastructure tied to local natural gas resources and Liberty Microgrids. These turnkey projects help overcome challenges in land access, fuel supply, and power integration for high-load developments. A recent collaboration with Oklo adds a long-term vision by combining Liberty’s fast-deploying natural gas systems with small modular nuclear reactors to ensure scalable, low-carbon, and reliable power solutions.

Q2 Performance And Liquidity

x

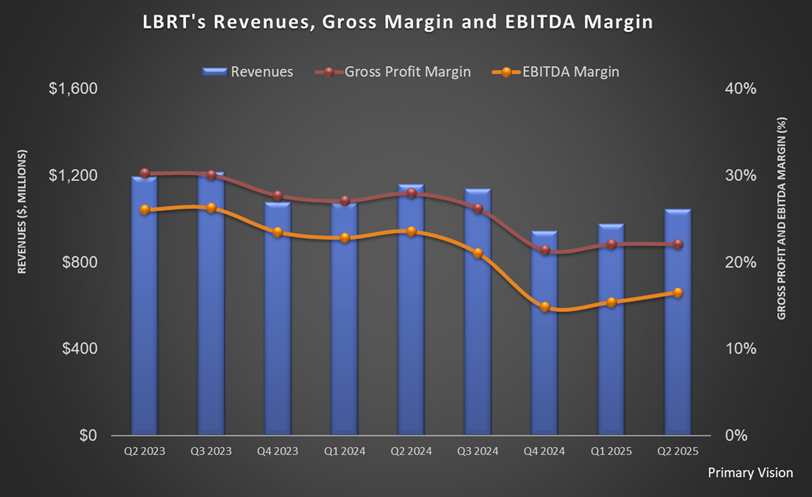

LBRT's revenues increased by 6.7% quarter-over-quarter in Q2, while its adjusted EBITDA went up by 7.5%. Its net income surged sharply, by 2.5x, in Q2 compared to Q1. In 1H 2025, its free cash flow decreased by 28% compared to 1H 2024. In July, it increased liquidity by expanding its credit facility to provide for a $225 million increase in aggregate commitment. Read more about LBRT's performance in our short article.

Given recent macroeconomic shifts, the company has withdrawn its full-year EBITDA target but remains optimistic about long-term opportunities, particularly in its Power business.

Relative Valuation

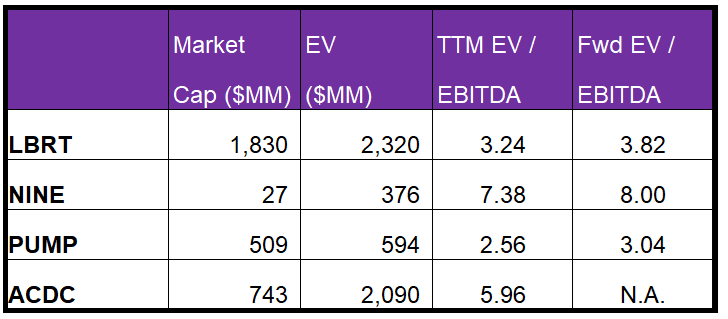

Liberty is currently trading at an EV/EBITDA multiple of 3.2x. Based on sell-side analysts' EBITDA estimates, the forward EV/EBITDA multiple is higher. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 15.5x.

LBRT's forward EV/EBITDA multiple expansion versus the current EV/EBITDA is higher than its peers because the company's EBITDA is expected to decline more sharply than its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock's EV/EBITDA multiple is lower than its peers' (NINE, PUMP, and ACDC) average of 5.3x. So, the stock is reasonably valued compared to its peers.

Final Commentary

North American production remains stable as efficient operators maintain flat output and offset declines with steady completions. However, LBRT’s completion activity is expected to slow in 2H 2025, potentially leading to equipment attrition that could tighten the service supply over time. It plans a modest reduction in its deployed frac fleet but will redirect capacity toward high-efficiency simul-frac work. Its digiPrime and digiFleet platforms continue to deliver operational gains and durability benefits, reinforcing its edge in clean, efficient technology.

The power solutions business is expanding through partnerships that aim to deliver integrated, scalable energy infrastructure to industrial users. Despite macro uncertainty and the withdrawal of full-year EBITDA guidance, Liberty remains well-positioned for long-term growth. Compared to its peers, the stock is reasonably valued.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform