Articles

- BLOG / Articles / View

- Articles

Monday Macro View: African oil supply, U.S. shale activity and other important news

By Osama on January 4, 2026 in Market Sentiment

This week’s Monday Macro View opens with the first Primary Vision activity data of 2026, and it sets a measured tone for the year ahead. The Frac Spread Count declined by one on a week over week basis to 153, while the Frac Job Count fell by two to 190. These are modest sequential moves, but they extend a pattern that has been in place since late 2025: completion activity is being maintained and these last two weeks only represent a seasonal decline. We should see frac activity picking up again as we enter 2nd week of January 2026.

The structure of the data matters as much as the headline figures. Spreads and jobs continue to track closely, which indicates operators are maintaining execution efficiency while moderating overall volume. With the U.S. rig count at 546, up one week but still well below year-ago levels, the upstream system is balanced toward sustaining output rather than growing it. The current activity mix points to flat production with limited upside absent a meaningful shift in pricing or policy.

That restraint is consistent with the broader price environment. Oil prices ended 2025 with their steepest annual decline since 2020, with both Brent and WTI down nearly 20% for the year. Brent closed December around $61 per barrel and WTI near $57. This price level sits uncomfortably close to the threshold where operators prioritize cash flow durability over incremental growth. The ability of U.S. shale producers to hedge volumes earlier in the cycle has reduced immediate downside pressure, but it may serve as a lack of an incentive to expand completions. The latest FSC and FJC prints reflect that balance between protection and caution. But as we said last year, our EFRACS platform doesn't show any drastic fall in completions. In fact, we see producers in the U.S. maintaining last year's job number while aiming for further increase in oil recovery.

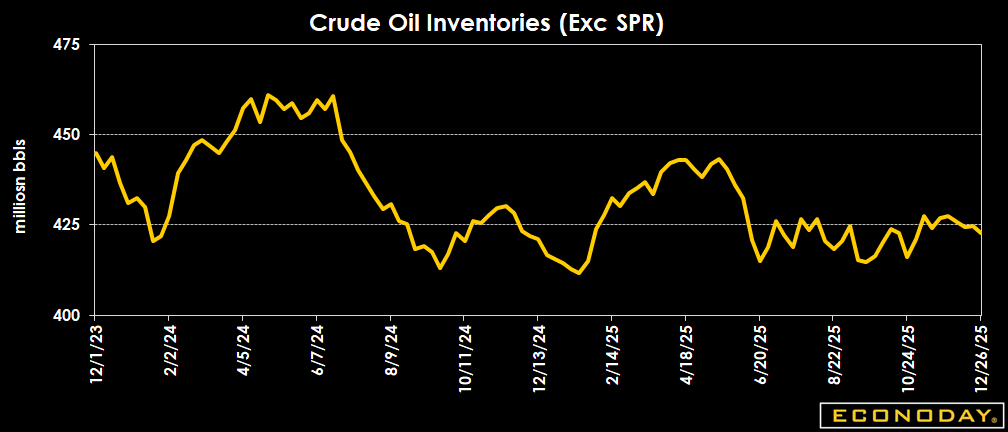

This is against expectations of a softer demand scenario. Inventory data shows crude inventories fell by roughly 1.9 million barrels in the final week of December, gasoline stocks rose by nearly 6 million barrels and distillates by approximately 5 million barrels, both well above expectations. These builds point to soft post-holiday demand and underscore why refiners and upstream operators are approaching the first quarter conservatively. Product oversupply, rather than crude scarcity, remains the dominant feature of the market. There are futher nuances to this that I have discussed in my previous free reads.

Outside the U.S., supply disruptions and policy shifts continue to reshape global flows. Venezuela has emerged as a near-term supply wildcard, with output from the Orinoco Belt falling roughly 25% in late December to just under 500,000 barrels per day. Export constraints, storage saturation, and escalating U.S. enforcement actions forced PDVSA to shut in wells, removing barrels that had quietly re-entered the market earlier in 2025. This was before the recent takeover of U.S. of Venezuela - about which we will discuss in detail. In short, we do not believe that this will have any significant development on the global or U.S. oil markets.

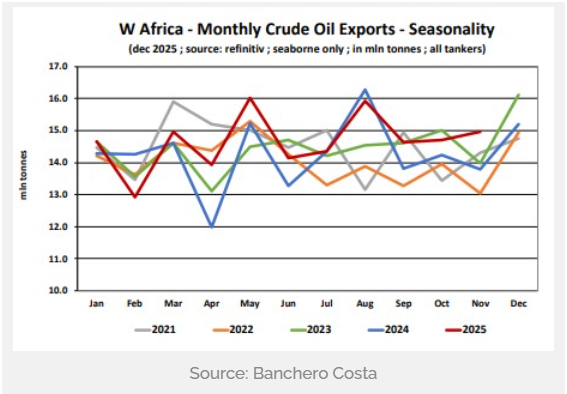

In contrast, Africa is becoming an increasingly important part of the medium-term supply story. Regulatory reforms in Angola, Nigeria, and the Republic of Congo are translating into tangible upstream momentum. Angola continues to sustain production above one million barrels per day while advancing multi-billion-dollar developments such as Kaminho and Agogo. Nigeria’s Petroleum Industry Act has begun to attract renewed licensing interest, with ambitions to move toward 2.5 million barrels per day. Congo is pairing upstream investment with LNG expansion, targeting three million tonnes per annum through phased developments.

Source: Hellenic Shipping News

As 2026 begins, the Primary Vision data point to an industry calibrated for endurance rather than acceleration. Completion activity is being maintained, prices remain constrained, and global supply options are broadening. Unless demand surprises to the upside or inventories tighten meaningfully, U.S. shale activity is likely to remain range-bound, setting a cautious but stable foundation for the year ahead.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform