Articles

Monday Macro View: FSC and FJC jumps by 5 this week. Here is what to expect next

By Osama on September 15, 2025 in Market Sentiment

Tags:

By Osama on September 15, 2025 in Market Sentiment

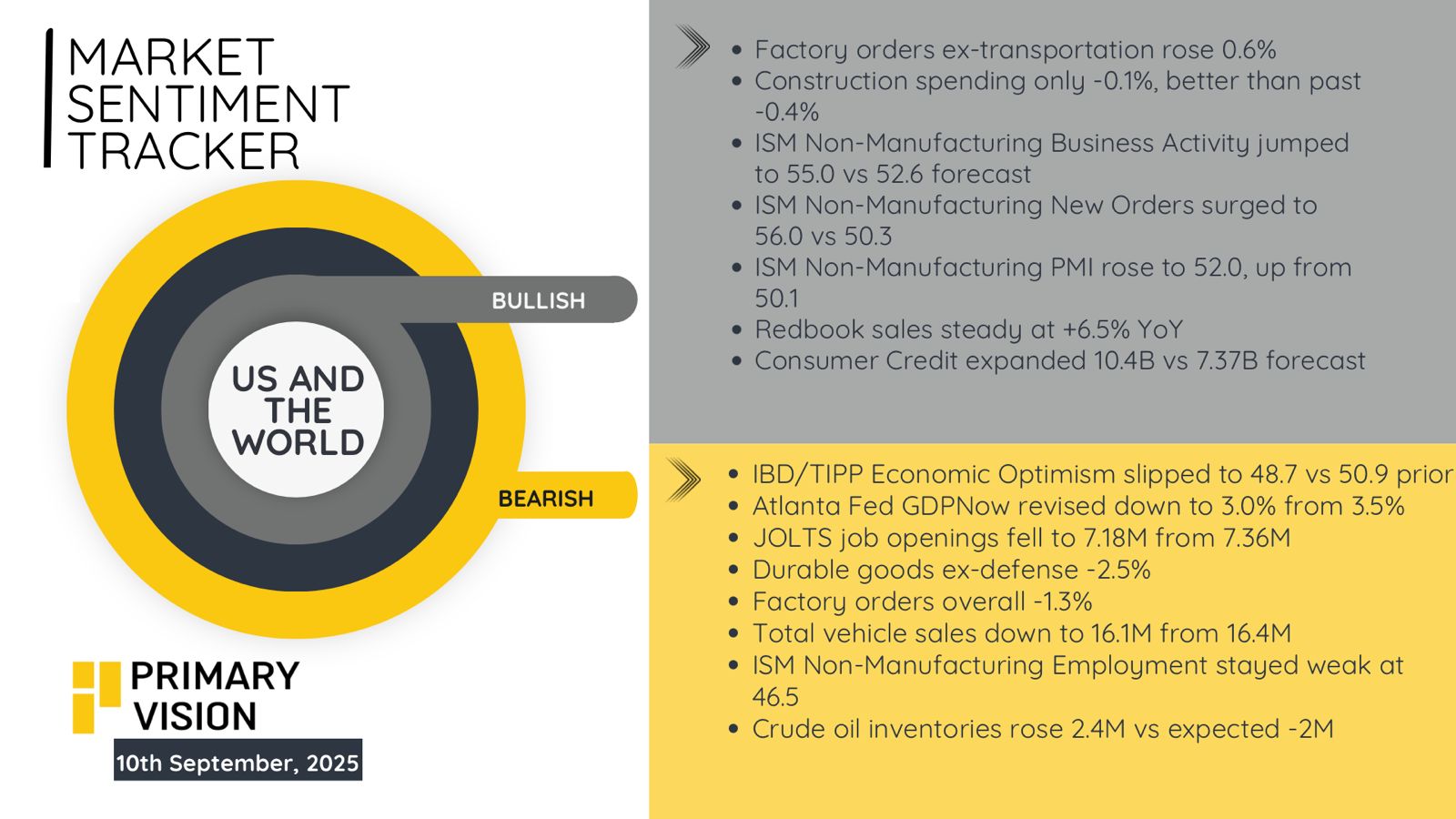

Oil markets rarely move in straight lines, and right now the signals are conflicted. Operators are cutting jobs and reining in spending yet the production looks strong. Pipeline flows from the Bakken are easing as well, pointing to a softer near-term supply profile. Yet shale has faced these kinds of setbacks before — whether in 2015 after the OPEC price war or in 2019 ahead of the pandemic — and in both cases it adapted and pushed U.S. production to new records. There are some bullish forces gathering in the markets as well ie geopolitical conflicts but the specter of tariffs is keeping any upward movement in check.

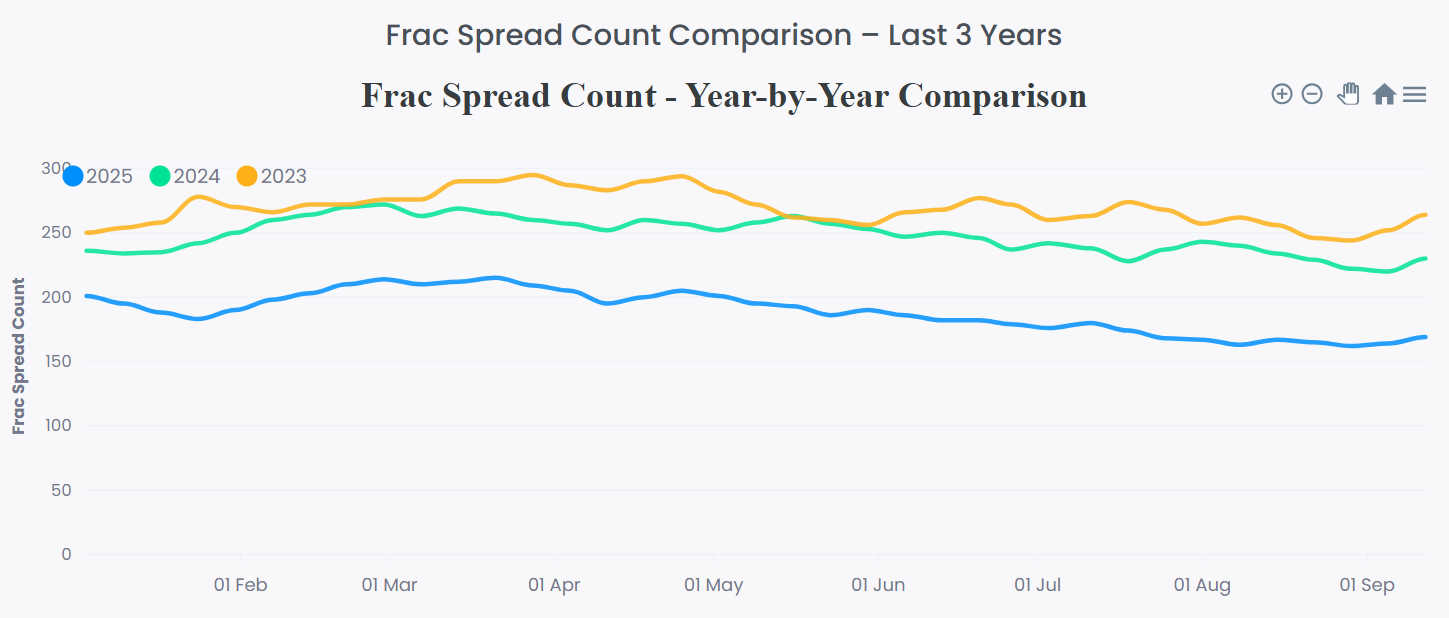

First things first. Primary Vision's Frac Spread Count jumped by 5 last week along with the Frac Job Count that registered a similar uptick now standing at 198. Rig count also followed with a WoW increase of 2. The main surge in activity was registered in Eagle Ford.

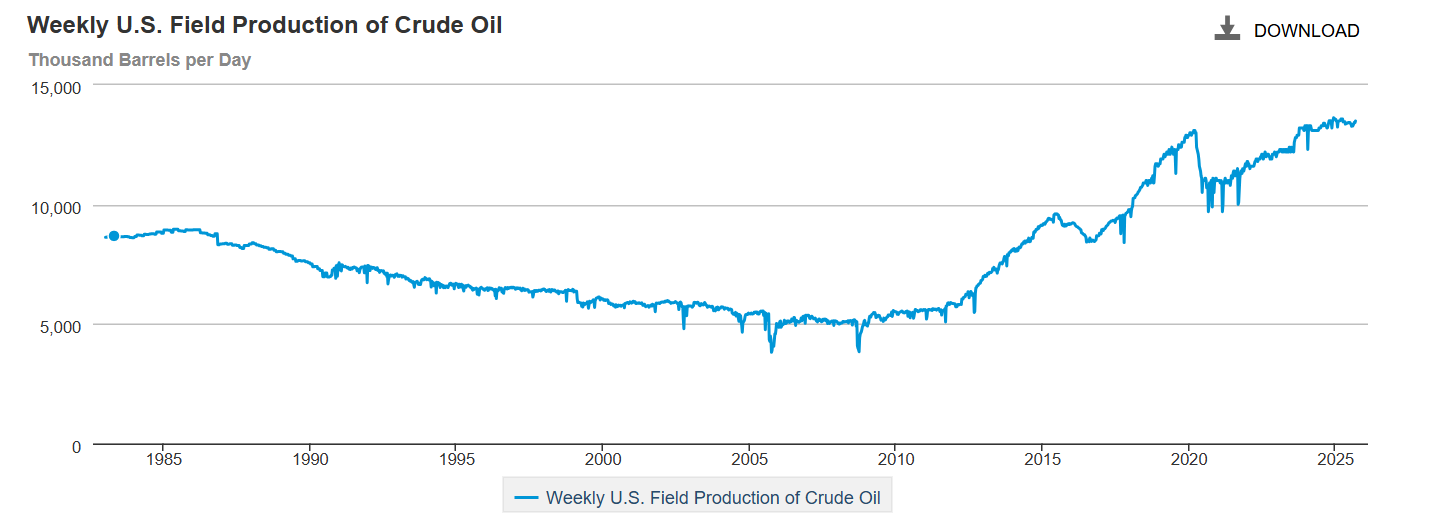

When we turn towards the oil majors there seems to be a mass layoff trend. Chevron, BP and ConocoPhillips have all announced workforce reductions and broader cost programs; Wood Mackenzie now expects global upstream capex to fall 4.3% in 2025 to about $342bn, and the U.S. EIA has warned that U.S. crude output could contract for the first time since 2021 if investment doesn’t recover. But here is the point: U.S. production, week ending September 5, increased from 13.423 to 13.495. The figure is 68,000 bpd down from the start of the year but that is something that we could see recovering next week. The reason for the job lay offs is cost rationalization and that is the reason I believe U.S. shale producers are preparing for what is to come next.

This is the same topic that I discussed with Midland Reporter Telegram last week. Here is the link if you want to read.

Moving towards the shale patch we see that the Bakken is where some of the bearish concerns meet the barrels. Bloomberg reported last week that flows on the Dakota Access Pipeline averaged ~542 kb/d in August, down from 566 kb/d in July and a 2025 high of 588 kb/d in January, with preliminary September volumes slipping further. In a world where OPEC+ has pivoted toward protecting market share, Western producers are prioritizing balance sheets over growth.

On the geopolitical front we have the worrying development where Israel attack Qatar and that issue seems to have settled at the moment but we are living in an era where nothing is impossible. The Strait of Hormuz has already reminded the market how much oil moves through one narrow lane, and the latest shock from Doha has raised the perceived risk premium across the region and triggered shuttle diplomacy among Gulf leaders. Even if the direct oil impact from Qatar is limited (its export muscle is LNG), any sustained threat to Gulf political stability, LNG shipping insurance, or U.S. posture in the region is a bullish overlay for liquid fuels via cross-commodity substitution and a higher general risk premium.

Where we go from here will depend upon the price of oil and that will be based on the macroeconomic indicators. U.S. economy has now started to give clear stagflationary signals and if we take into account the recent data it presents with a worrying picture ahead. I covered this in detail in our last week's Market Sentiment Tracker.

So the recent jumps in FSC and FJC shows us that there is more to the story of US shale then just falling rig counts. In the coming weeks, I will be closely following the company announcements especially that of the OFS industry (you can actually read our Key Takeaways for that purpose as well). Attention to OPEC+ and specifically the crude export numbers is also a must.

Until next Monday!

Tags:

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform