Articles

- BLOG / Articles / View

- Articles

Monday Macro View: Thanksgiving-Week Frac Decline and Its Global Oil Context

By Osama on December 1, 2025 in Market Sentiment

Last week the numbers for Frac Spread Count (FSC) and Frac Job Count (FJC) came in earlier. There was a downward revision on a WoW basis. With the FSC registering a decline of 6 and FJC falling by 8 to 204. The rig count also took a dive falling by 10.

The weekly decline in the Frac Spread Count aligns with the timing of the Thanksgiving period, and the historical record shows that holiday weeks may introduce short-lived adjustments in crew scheduling even in otherwise stable operating environments. In 2024, for example, the FSC moved from 221 spreads on November 22 to 215 during Thanksgiving week, before rebounding to 220 the following week, illustrating how a brief holiday-related slowdown can quickly normalize. While earlier years often showed steady activity during Thanksgiving, the 2024 pattern confirms that a temporary dip followed by a prompt recovery is also a normal feature of year-end field activity. With that precedent in mind, this week’s reduction should be viewed as part of the routine cadence of U.S. shale operations rather than a signal of weakening demand, and recent patterns suggest that activity is positioned to firm as crews return to standard schedules in the weeks ahead.

It is also worth noting that the steadier Thanksgiving-week readings in 2021–2023 occurred during a stronger price environment, with WTI averaging roughly $80 over those years—about 19% higher than the 2025 year-to-date average—which provided operators more flexibility to maintain activity through short holiday weeks.

Basin based data shows that Permian (that has seen the most steady activity) is still strong while the downward movement has come from others. Readers are more than welcome to contact me at osama@primaryvision.co and osama@pvmic.com if they or their companies require the detailed.

Now moving towards other important developments in the global oil markets.

Today in an interview on Asharq with Bloomberg, I was asked a very important question that I believe also has direct consequences for U.S. Shale. The question was about the chances of a Russia-Ukraine peace deal and the broader implications for oil. As of late November 2025, we’re in a phase of active but very fragile diplomacy: a U.S.-brokered framework has produced draft peace plans and a new round of talks in Florida, yet core issues like territory, security guarantees, and Ukraine’s political future remain unresolved, with Moscow publicly taking a hard line on any ceasefire that doesn’t lock in its gains.

In my view, that means a deal is no longer a tail-risk scenario and markets are clearly trading the headlines but it is still far from a base case given the political costs for both Kyiv and Moscow and the continued intensity of fighting and strikes on civilian and energy infrastructure. Even if a framework agreement emerges, the odds favor a phased, messy implementation with plenty of opportunities for slippage and renewed brinkmanship, which limits how much risk premium the market is willing to take out in one go.

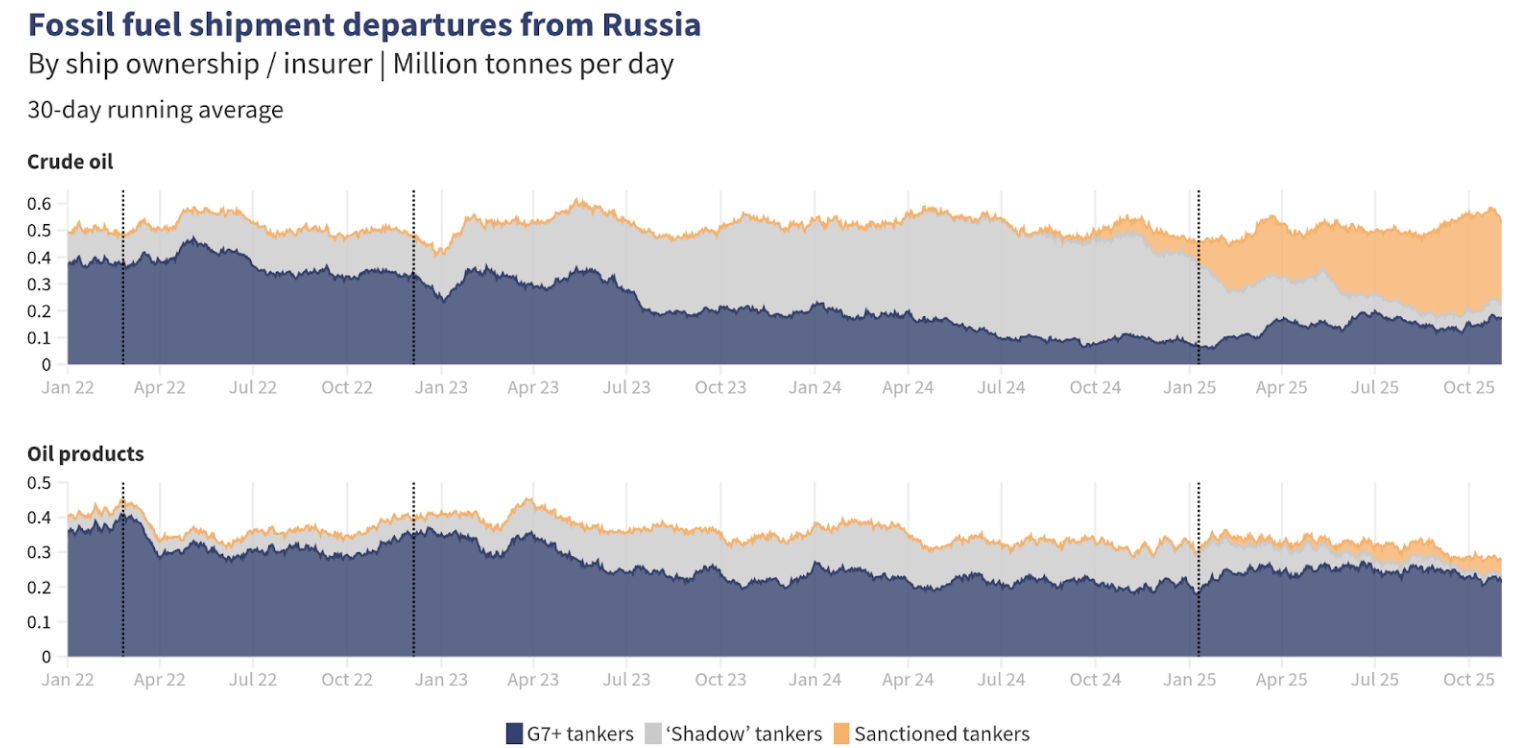

From a physical standpoint, however, the impact on barrels may be more muted than the headlines suggest: Russian crude and products never truly left the market, they were rerouted via discounts, shadow-fleet logistics, and alternative buyers, so a peace deal mainly changes who takes the barrels and at what differential, rather than suddenly adding a wave of “new” supply. In other words, the biggest adjustment is likely to be in trade flows, freight, and spreads (and perhaps a one-off move in prices as the war premium is repriced), not in the underlying availability of oil itself—which is why I’d be cautious about overestimating the structural impact of a peace deal on the global physical market.

Recent movements in activity and geopolitical negotiations point to a market that continues to balance short-term disruptions with longer-term structural considerations. The week-to-week data offers useful context, but it does not alter the underlying dynamics that shape investment decisions, trade flows, and the distribution of supply. The more important question in the weeks ahead is how participants interpret these signals and position themselves, because their responses will determine how durable current trends prove to be.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform