Articles

- BLOG / Articles / View

- Articles

Monday Macro View: What’s Keeping Oil Prices From Dropping?

By Osama on September 1, 2025 in Market Sentiment

Crude oil markets entered the summer with the expectation that OPEC+ supply increases would loosen balances and drag prices lower. Instead, Brent has staged a steady rebound, rising about 15% from May lows to trade around $68 per barrel. The resilience has surprised many market watchers. There are multiple reasons for this. Firstly, the promised barrels by OPEC+ has still not made it to the markets yet. But our expectation is that it will in the next quarter. Also, diesel has provided some unexpected support to oil prices (and OPEC+) but the reason for a strong demand isn't strong economic activity but something else. What are those reasons? And how will Frac Spread behave moving forward? We will try to address these questions in today's Monday Macro View.

Diesel has become the unexpected bright spot in an otherwise muted oil demand landscape. Worldwide stockpiles are running thin: U.S. distillate inventories stood at 113 million barrels at the start of August, roughly 12% below the five-year seasonal average, while independent diesel stocks in the Amsterdam–Rotterdam–Antwerp hub slipped under 13 million barrels for the first time since December 2023. Refining capacity additions, such as Nigeria’s 650,000 bpd Dangote refinery and Mexico’s Dos Bocas project, had been expected to ease constraints, but both have underperformed expectations, leaving the global system short.

At the same time, consumption has proven stickier than analysts forecasted. Industrial activity, while on the downside, has managed to resist a steep fall, and heatwaves across Asia, Europe, and North America lifted power generation demand in recent months. In the U.S. Midwest and South America, seasonal harvests are beginning to pull more diesel, and in Europe, the marine sector is increasingly leaning on diesel and gasoil as an alternative to higher-cost bunker fuel in emission control areas.

The tightness is reflected in refining margins. U.S. ultra-low sulfur diesel futures briefly commanded a $40 per barrel premium over domestic crude in mid-July, the widest spread since February 2024, before settling closer to $31 — still above the five-year average of $30. In Europe, diesel cracks reached nearly $26 per barrel above Brent in late June, holding firm near $21 in early August. Asia has softened more quickly, with margins slipping to $17 per barrel, but that remains in line with longer-term seasonal averages. This contrast with gasoline is striking: seaborne imports of gasoline and blending components between January and August are running about 0.5% below 2023 and 3% below 2024, despite lower retail prices in the U.S. and ample Atlantic Basin supply.

.png)

Looking forward, the diesel story is unlikely to fade quickly. Maintenance season looms: Saudi Arabia’s 460,000 bpd Satorp refinery will undergo a 60-day turnaround in November–December, while Kuwait’s 490,000 bpd Mina Abdullah plant will conduct a 30-day outage in October. These outages coincide with Europe’s growing dependence on Middle East supply after Russian barrels were largely shut out by sanctions. The next sanctions wave in January 2026 will add another layer of risk, as EU rules will bar diesel from Turkey and India unless refiners can certify the crude’s origin. That policy could disqualify up to 400,000 bpd of imports into the EU and UK, a major potential shock to balances. Meanwhile, U.S. sanctions on Russia and Venezuela have already constrained availability of the heavier crude grades that yield more diesel, and Washington’s pressure on China and India to reduce purchases from Moscow further complicates the supply map.

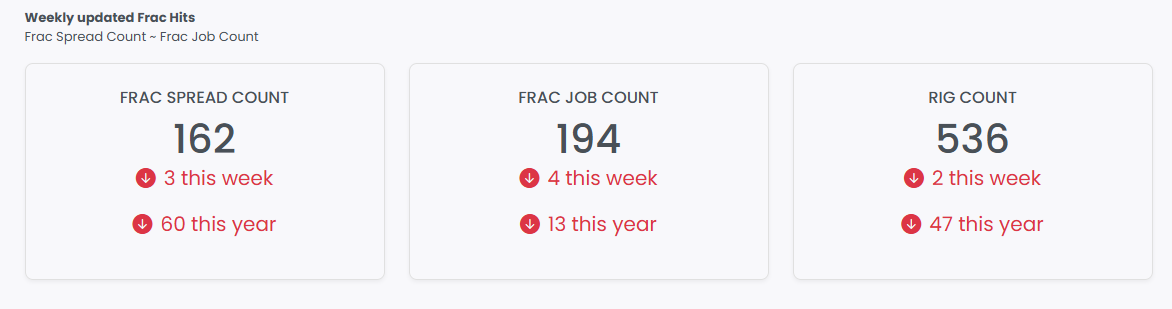

Against this backdrop, crude prices have found a durable floor in the mid-$60s. Analysts at J.P. Morgan note that tight diesel inventories are preventing oil from sliding back into the low $60s despite OPEC+ restoring its largest tranche of curtailed supply months ahead of schedule. For refiners, this has meant stronger-than-expected profitability, as cracks for middle distillates offset weaker gasoline and naphtha margins. For traders, diesel remains the most attractive long bet among refined products. But it is concerning for U.S. shale producers that seem to be battling with longer for lower oil prices. The FSC is down 60 on YoY basis but the Frac Job count seems to be holding strong so far.

The message for H2 2025 is that diesel, more than gasoline or crude itself, will dictate the direction of the energy complex. The combination of low stocks, structural refinery constraints, seasonal pull, and looming policy shocks creates an environment where distillate margins remain firm. That, in turn, cushions crude from the downside and ensures that both freight and aviation will face persistently elevated fuel costs. For shippers, that means stubbornly high FSCs. For airlines, it means little relief on FJC despite weaker ticket revenues.

In short, the global oil market has entered an unusual phase: even as OPEC+ supplies more crude and gasoline underperforms, diesel has emerged as the anchor holding up prices and reshaping cost structures across the transport economy. As long as that dynamic holds, investors should expect oil’s floor to remain firm and energy-linked surcharges to stay sticky.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform