Articles

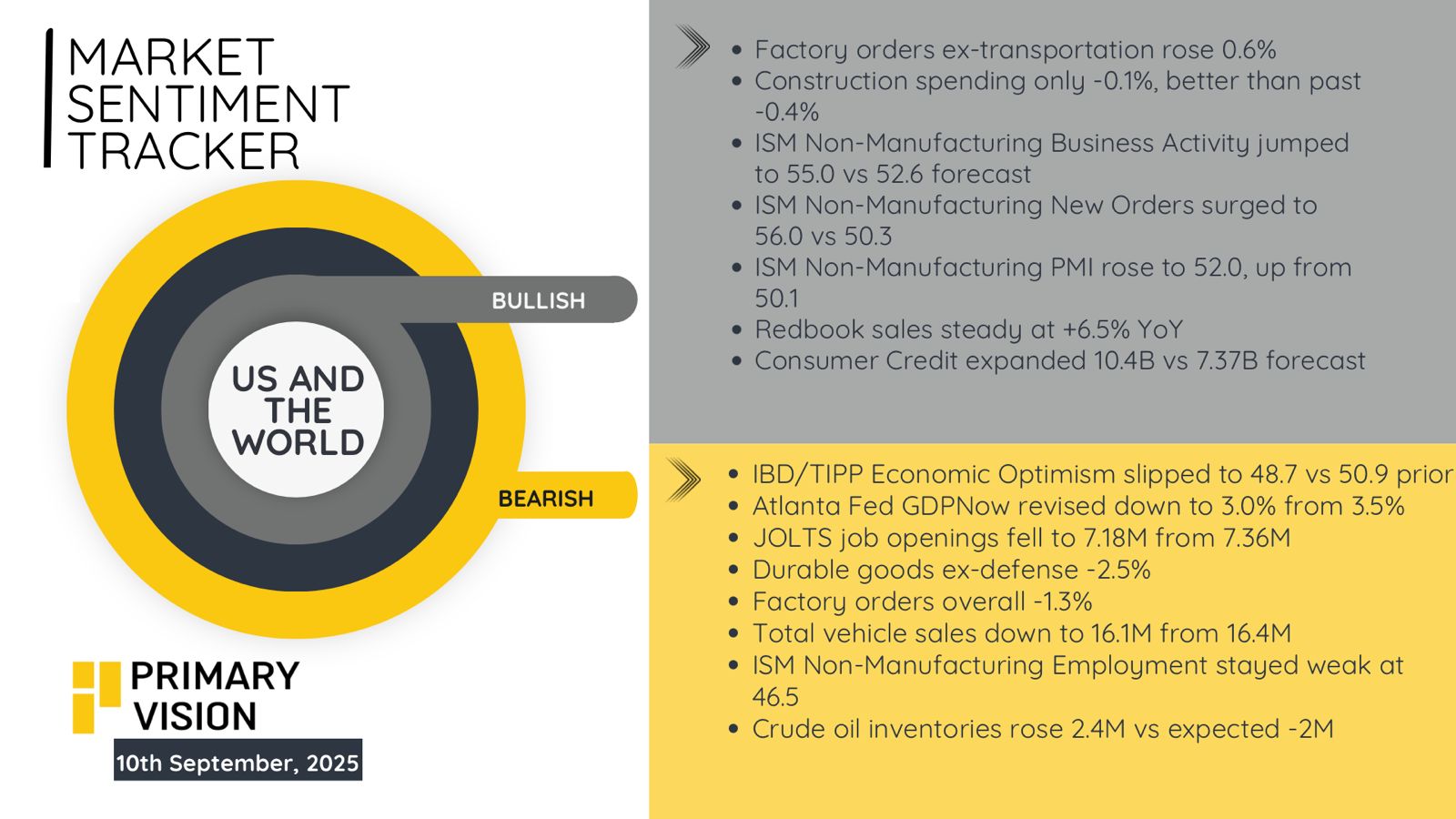

Market Sentiment Tracker: Will U.S.' slowdown be mimicked in Europe and China?

By Osama on September 11, 2025 in Market Sentiment

By Osama on September 11, 2025 in Market Sentiment

What happens next follows from those mechanics. With breadth negative, healthcare doing the heavy lifting, and job seekers exceeding vacancies, another subdued payroll print is more likely than a snapback. Weakness should remain concentrated in goods-producing industries and interest-sensitive services, which Moody’s flags as experiencing recession-like conditions, amplified by tariff-related pressure on traded goods. Claims and Challenger layoff announcements aren’t surging, but they’re no longer improving; that’s classic late-cycle behaviour where hiring freezes and attrition lead the turn. Expect unemployment to drift higher from 4.3%, wage growth to edge down, and revisions risk to bias the next couple of reports lower rather than higher as the breadth squeeze washes through. In short, we were braced for a lower number — just not this low — and the reasons it undershot (narrow sector support, sub-50 diffusion, sub-50 employment indices, softer hours and wages, and a flipped openings-to-unemployed ratio) argue for further cooling rather than a quick reversal.

Europe’s latest data highlight the same deceleration but through a different lens. Industrial output briefly surprised on the upside, only to reveal year-on-year contraction once base effects are stripped away. That mix reflects firms working off inventories rather than building new capacity. German exports disappointed because demand from Asia has softened, while imports contracted in line with falling domestic spending. Consumer confidence remains weak, capping household demand and curbing retail volumes. In short, the apparent resilience in headline GDP masks a real economy where growth is eked out by temporary factors, and the structural drag from tight credit and weaker demand remains intact.

.jpeg)

China’s prints reveal the same tension between surface stability and underlying weakness. The services PMI at 53 suggests activity is improving, yet the trade data were starkly softer: exports slowed and imports undershot expectations. That divergence points to a recovery driven more by domestic policy support than organic demand at home or abroad. Rising FX reserves and a wider trade balance signal the state’s hand in stabilising financial conditions, not a surge in private-sector momentum. Without a property rebound or firmer global demand, the uptick in services will remain narrow, with the broader economy constrained by cautious spending and subdued external orders.

The common thread is that momentum is fading, even if outright recession has not yet arrived. The U.S. is moving from a cooling labour market to one that is beginning to shed its protective role, Europe is sliding into stagnation as external demand dries up, and China is leaning ever more heavily on policy rather than private dynamism. That alignment matters for markets: the risk is not a dramatic break but a steady erosion of hiring, output, and trade that chips away at growth expectations quarter by quarter. Unless policy surprises on scale or timing, investors should expect data to keep undershooting, and sentiment to adjust downward in step.

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform