Articles

- BLOG / Articles / View

- Articles

Monday Macro View: Will we see a frac'ing boom in Mexico?

By Osama on August 7, 2025 in Market Sentiment

Mexico sits on one of the largest shale gas endowments on Earth, with an estimated 545 trillion cubic feet (Tcf) of technically recoverable natural gas and roughly 13 billion barrels of tight oil and condensates, according to the U.S. Energy Information Administration (Vinson & Elkins). Within that, the Burgos Basin alone may hold around 343 Tcf of shale gas and over 6 billion barrels of oil-equivalent in the Boquillas Formation—essentially Mexico’s version of Eagle Ford.

Pemex did its first shale experiment in late 2010–11, drilling a handful of horizontal wells—Emergente‑1, Habano‑1, Montañés‑1 and others—that tested at initial rates of around 2.2 to 3.2 million cubic feet per day. But those wells never became economic, especially considering the water-intense fracking and low gas prices at the time. By early 2013, Pemex had only six productive shale or tight oil wells in Mexico. That’s it. Contrast that with the U.S., where Eagle Ford operators drill thousands of wells yearly—hundreds of rigs add around 1,800 new wells per year in major plays, same approach Mexico has barely used.

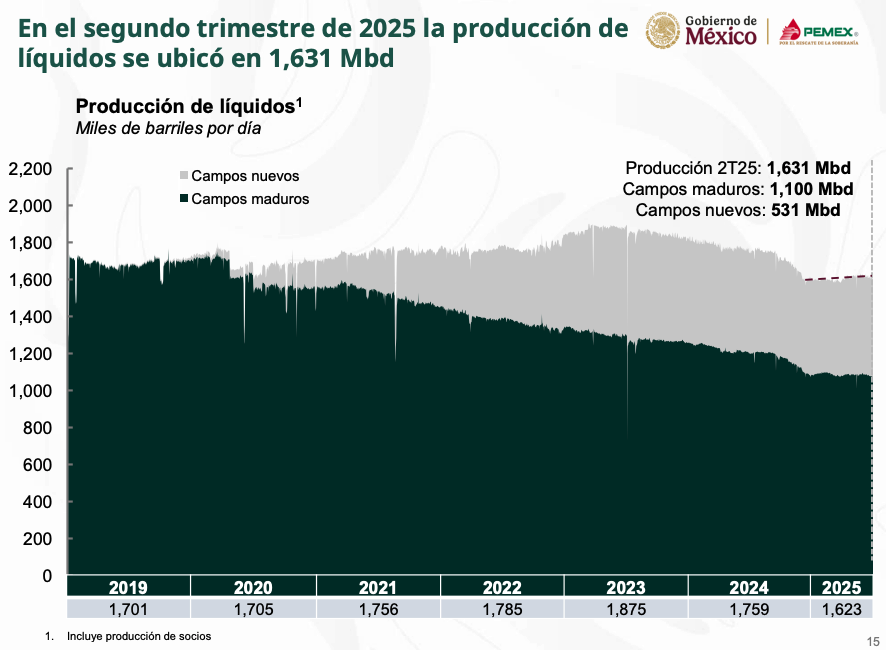

So Mexico has the geology, but the first issue that emerges as a challenge for their frac'ing is money. Developing Mexico's unconventional reserves would require Pemex to partner with companies that have the necessary technology. But under the new legal framework, Pemex must hold a majority stake in every venture. Also, Pemex itself has debt problems. As of December 2024, its financial debt stood at roughly $97.6 billion, down slightly from 2023. But by end of Q2 2025 its liabilities climbed to nearly $98.8 billion, with supplier debt at $22.8 billion—up from $7.6 billion in 2018 (El País). To service that burden and stay afloat, the Mexican government has injected approximately $45 billion between 2019 and 2023, and in mid‑2025 raised $12 billion via pre‑capitalized notes to finance payments due in 2025–26 (Reuters). Q2 2025 brought Pemex its first net profit in over a year: 59.5 billion pesos (about US $3.17 billion), aided by peso strength and lower cost of sales. But revenue fell 4.4% year–on–year to 391.6 billion pesos, while output remains stuck: crude at 1.64 million barrels per day, gas at 3.59 billion cubic feet per day.

Source: Energy Analytics Institute

Pemex’s operating budget for 2025 is MX$464.3 billion (~US$22‑23 billion), down around 3.6%, and capex through May fell 22%, with revenue plunging 34% over the same span. Fracking-related spending surged by 200% in 2022 but then halved in 2023—and still accounts for only about 10% of total production.

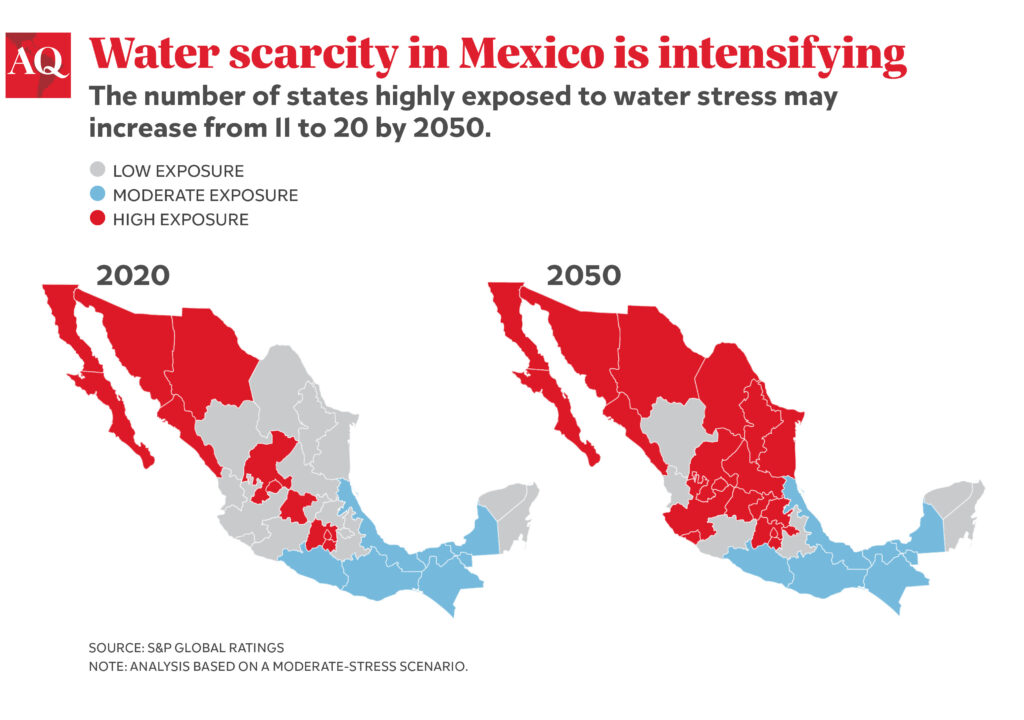

Another important challenge is that of water. Water scarcity can spark concerns regarding frac’ing that typically requires 2 million–10 million gallons of water per well. Burgos and Veracruz lie in semi‑arid northern Mexico, where water shortages create severe logistical constraints. Experts warn that scaling any shale activity requires solving the water puzzle—not just from an environmental perspective but simply to have enough fluid for millions of gallons per well.

Furthermore, the political and legal framework remains tight. Mixed contracts with private partners now require Pemex to hold at least a 40% share. That deters most international operators. Though President Sheinbaum once opposed fracking, she’s now signaling openness to shale gas development and targeting domestic gas output to rise from about 3.8 bcf/day today toward 5 bcf/day by 2030. Mexico hs realized that frac'ing can compensate for the loss of oil output and other energy related opportunities. It is instructive to note here that Mexico relies on U.S. for 70% of its gas meaning any disagreement with Trump can put them in a very disadvantegous position.

So what does this mean? Mexico’s shale story is still about potential. It ranks among the top four or five countries globally in recoverable shale gas, yet produced practically zero output from that resource. Pemex’s debt, diminishing budget and energy policy limitations have sapped momentum. Water access, permitting delays and structural fiscal constraints remain formidable barriers.

Where the signal lies is in three tangible metrics: drilling permit grants, frac job frequency (the actual frac crew days), and joint-venture capital deployment post‑2025. If those start rising meaningfully, then Mexico’s shale ambition may finally shift from talk to wells, and from reserves to actual flow. Until then, it remains a giant under leverage—not unlike the Burgos Basin itself, rich yet trapped under pressure.

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform