Articles

- BLOG / Articles / View

- Articles

Monday Macro View: Why NGLs Hold the Keys to Shale Economics

By Osama on August 25, 2025 in Market Sentiment

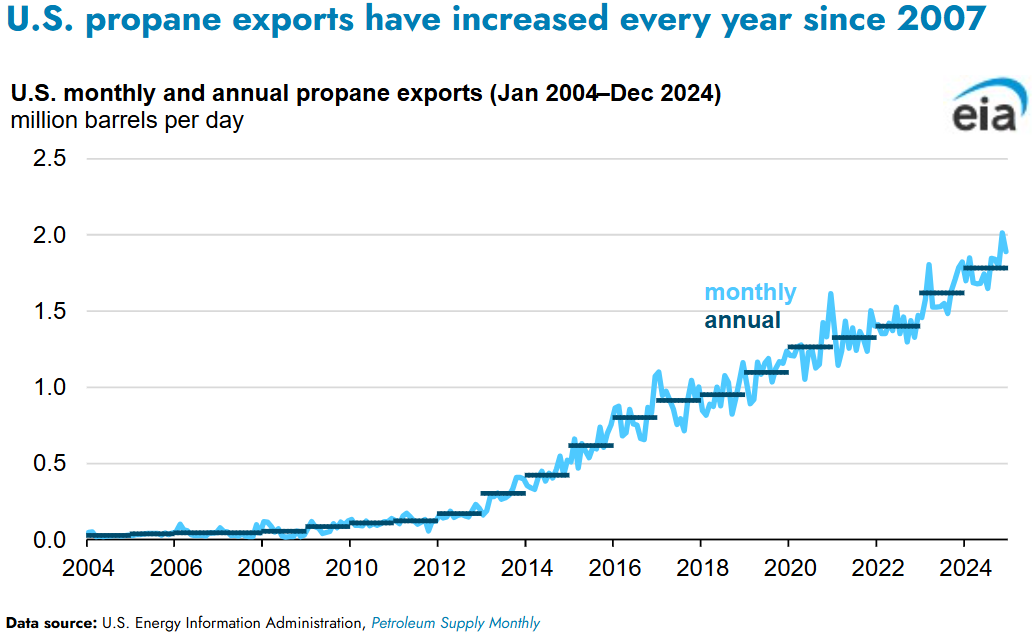

Natural gas liquids (NGLs) rarely command the same attention as crude oil or LNG, but they are central to the U.S. shale economy. Every shale well delivers a mix of crude, gas, and liquids, and in many basins it is the NGL uplift that makes the economics work. On average, U.S. shale output now generates more than 6 million barrels per day of NGL-equivalent production, a stream large enough to rival the output of OPEC+ producers in liquids terms. Propane alone has become the single largest U.S. export of any petroleum product, surpassing gasoline and diesel in volume in 2024.

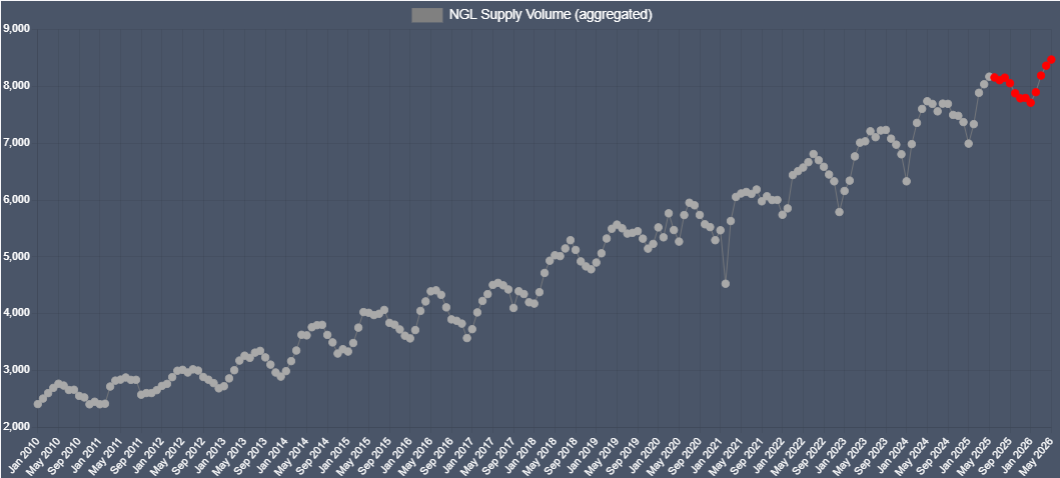

Our Efracs platform host, inter alia, NGL tracker as well. Right now it is signalling that the U.S. NGL market is heading into a temporary squeeze. Aggregate supply is slipping from summer highs above 8,100 MBbl/d to under 7,800 MBbl/d by year-end, led by sharp seasonal declines in natural gasoline and butane. At the same time, demand is still climbing into the winter on the back of heating needs, petrochemical pull, and steady export flows. That mix points to short-term tightness, supporting prices and margins through late 2025. But the relief valve is already in sight: by spring 2026, natural gasoline and butane rebound, ethane edges higher, and aggregate supply pushes past 8,400 MBbl/d just as seasonal demand eases. The result is a quick flip from tight to loose — a whiplash that will reshape balances, pricing, and realizations over the next 12 months.

By May, the recovery in C5+ and butane, combined with modest ethane growth, explains the sharp rebound and the move toward looser balances.

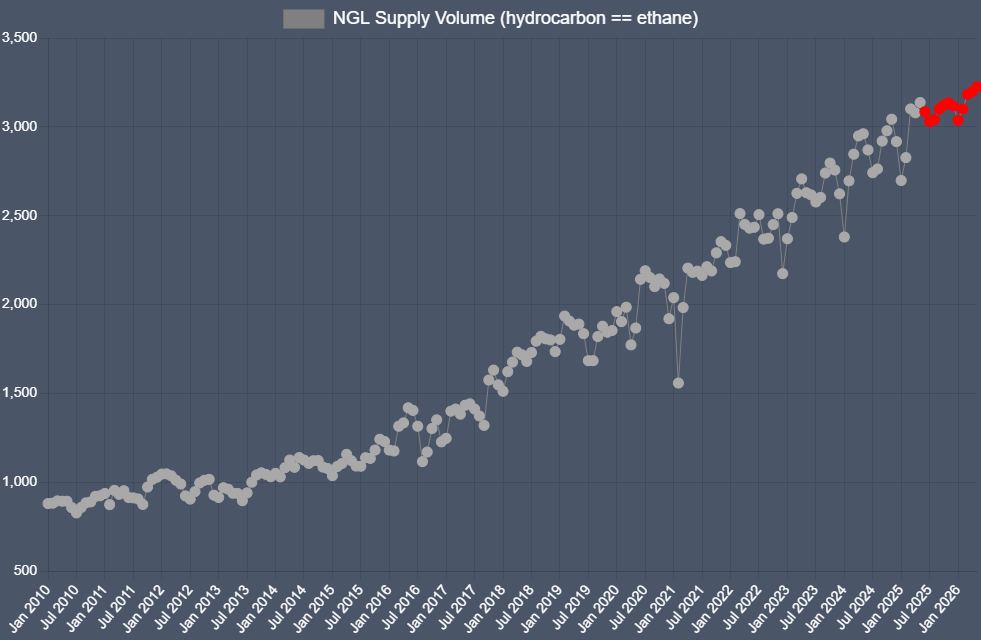

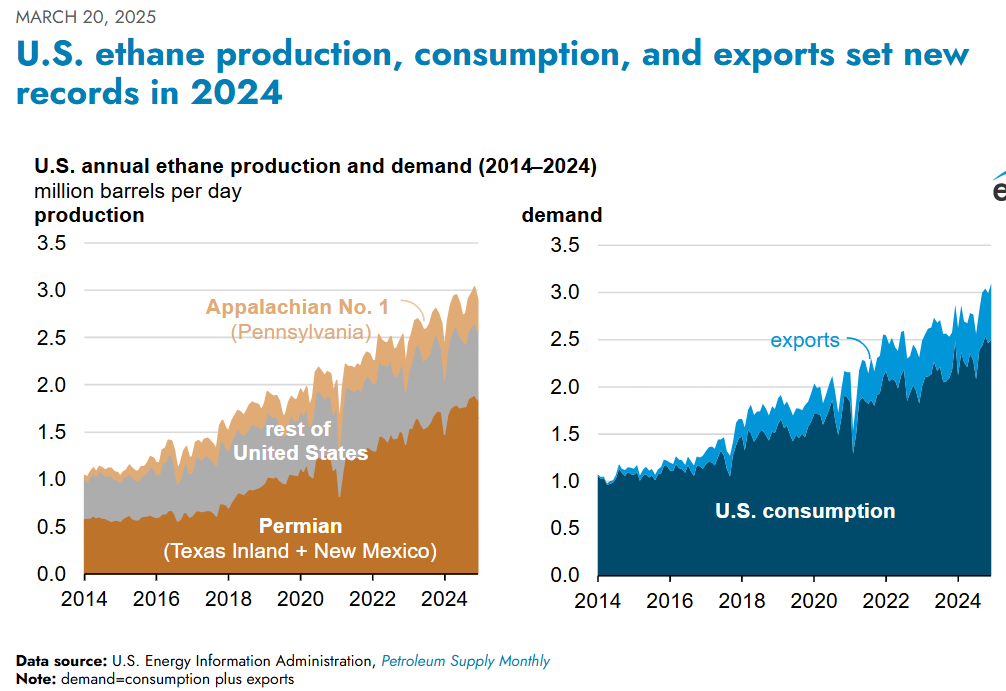

But the aggregated line masks very different stories inside the barrel. Ethane, the largest NGL by volume, is stable through year-end. Our NGL supply portal shows that it will hold near 3,100 MBbl/d from September through December, showing little movement. According to the EIA, U.S. ethane consumption is expected to hold at approximately 2,300 MBbl/d in both 2025 and 2026, with supply rising from ~2,900 MBbl/d in 2025 to ~3,100 MBbl/d in 2026. Exports provide the growth outlet, climbing from ~530 MBbl/d in 2025 to ~630 MBbl/d in 2026.

On the export side, growth is moderate: long‑term contracts, expanding tanker capacity, and ethane’s cost advantage support rising flows, with exports projected to reach 540,000 bpd in 2025 and 640,000 bpd in 2026. However, recent U.S. licensing restrictions on shipments to China have introduced friction—several loaded Very Large Ethane Carriers are stalled at the Gulf Coast, disrupting flows despite strong incremental demand

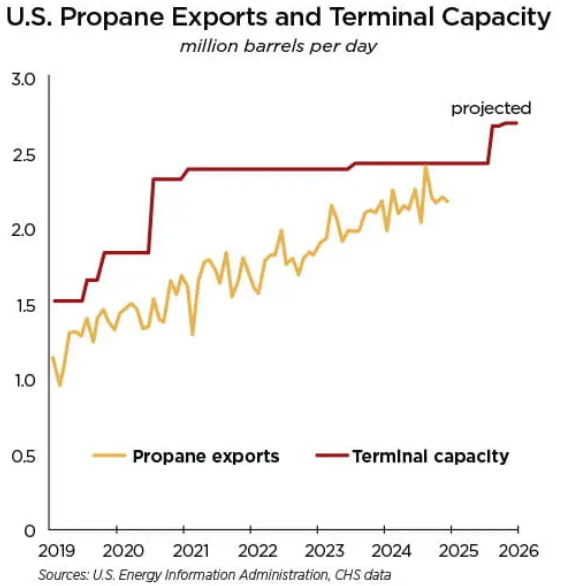

Propane shows the opposite pattern. Supply here grows consistently from ~2,642 MBbl/d in June to almost 2,780 MBbl/d by early 2026. Unlike ethane, propane volumes are not plateauing. Asia alone is expected to account for over half of global LPG demand increases in 2025, ramping up imports by around 230,000 bpd. Northwest Europe is also experiencing record imports of U.S. LPG, with volumes reaching 1.78 million metric tons in Q1 2025—surpassing the Mediterranean.

Natural gasoline (C5+), by contrast, is where the real seasonality shows up. Supply contracts hard into the winter, falling from ~925 MBbl/d in September to just ~828 MBbl/d by January 2026. The drop comes because C5+ is primarily used as a diluent and for gasoline blending, both of which see weaker demand in the colder months. That dip is sharper than anything we see in ethane or propane and weighs heavily on the aggregate supply line through late 2025. But the decline is temporary. By spring, volumes rebound to more than 900 MBbl/d, reflecting the return of blending demand as driving season ramps up, helping fuel the aggregate recovery above 8,400 MBbl/d.

The speed of this swing in NGL balances is what makes them central to the broader energy system. That volatility is not just a U.S. balance-sheet quirk — it cascades into midstream and global markets. U.S. propane exports, already the largest petroleum product export, reached more than 20 million metric tons in 2024, while seaborne LPG exports surged to nearly 70 million tons globally by 2023. In Northwest Europe, U.S. barrels now make up over 60% of LPG imports, anchoring fractionator throughput at Mont Belvieu and the Gulf Coast, where utilization has run at 90%+. When domestic balances tighten, that export pull supports pricing worldwide; when they loosen, it pressures margins across petrochemical systems from Houston to Rotterdam to Ningbo

Through late 2025, tighter NGL balances will be a tailwind for U.S. production. With aggregate supply slipping while demand holds firm, prices and margins for ethane, propane, and C5+ remain supported into the winter. The strength in NGL pricing will help sustain drilling activity, keep rigs working, and encourage completions even as dry gas margins remain under pressure. In gas-rich plays, NGL uplift is material: according to EIA and Wood Mackenzie, liquids revenues contribute 20–40% of total wellhead value, often adding $1–2/Mcf to realized economics. That uplift is what kept rigs active in Appalachia and the Eagle Ford during the 2021–22 propane and ethane rally, even as Henry Hub gas prices softened. With aggregate NGL supply tightening from ~8,100 MBbl/d in summer 2025 to below 7,800 MBbl/d by year-end while winter demand builds, prices are poised to strengthen again. In effect, NGLs will underwrite continued growth in U.S. shale output through the end of the year.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform