Articles

- BLOG / Articles / View

- Articles

How Pressure Pumpers Are Rewriting the Shale Playbook

By Avik on January 3, 2026 in Articles

Pressure Pumpers at a Crossroads: Basin Intensity vs. Diversification

Updates from U.S. pressure pumpers point to a sector adapting to two realities. Shale activity is becoming narrower and more competitive. At the same time, power and energy infrastructure are emerging as the next growth platform. Primary Vision’s frac job count data through November 2025 already shows a cycle that has rolled over – meaning the recent run-rate is below the earlier average. HAL and Liberty both show declines at the same time. When multiple large players roll over together, it’s not execution. It’s the market.

Permian Still Sets the Tone, but Growth Is Elusive

The Permian Basin remains the earnings backbone for pressure pumping. But it is no longer driving expansion. Operators are holding activity flat, prioritizing discipline over share, and reallocating capital away from new frac capacity.

Liberty Energy leverages scale across the core U.S. shale basins, but its differentiation is shifting. Through Liberty Power Innovations, management is positioning power as a second platform tied directly to data centers and industrial demand, offering a full “molecule to megawatt” solution. Ir means LBRT can handle the full chain from natural gas supply (“molecule”) to power generation and delivery (“megawatt”). It is framed as the next growth leg. Shale scale funds the option. Power defines the upside.

Halliburton is taking the same logic global. Its 400 MW commitment with VoltaGrid to supply modular natural gas power for hyperscale data centers in the Eastern Hemisphere moves power squarely into core infrastructure. For HAL, this is less about smoothing cycles and more about exporting its execution model into a structurally growing end-market. It is a clear signal that pure shale services no longer offer enough runway.

From Cash Engine to Platform Build

ProPetro’s PROPWR business shows how far this shift is already going. With 220+ MW contracted, ~550 MW on order, and a stated path to 1+ GW by 2030, PROPWR is being built as a scaled power platform, not a pilot project. Management is explicit that free cash flow is the funding source. That frames Permian frac as the engine financing a structurally different business with longer-duration returns.

Gas Basins Are the Swing Factor

KLX Energy highlights where incremental work is coming from. Management attributes recent weakness to rig decline and frac spread drop in the Permian, while stronger gas-focused activity in the Northeast/Mid-Con more than offset that softness. Gas is no longer just a hedge. It is becoming the marginal driver of utilization.

With revenue split roughly evenly across Rockies, Southwest, and Northeast/Mid-Con, KLX’s basin diversity is translating into resilience as oil-heavy basins cool. In this cycle, exposure to Haynesville and Marcellus-linked work is proving more valuable than pure Permian leverage.

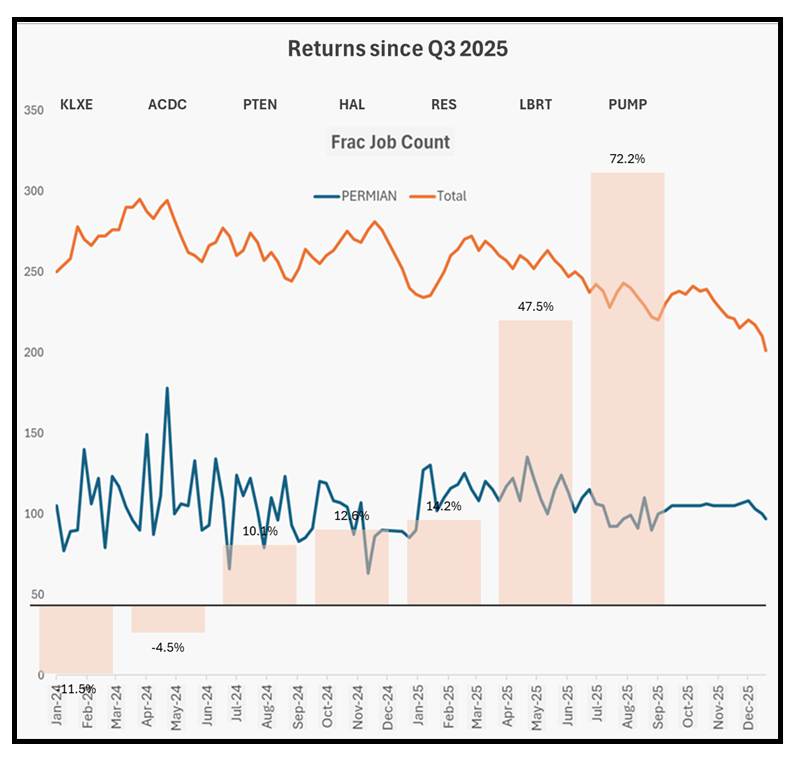

Frac Job Counts Through Nov’25: The Turn Is Visible

Primary Vision’s frac job count data through November 2025 confirms what management teams are signaling. Halliburton’s activity rolls from high-30s jobs per week on average to a low-30s recent run-rate. Liberty shows a sharper drop, from low-20s to the mid-teens. RPC/RES remains small in scale, averaging around six jobs per week, with a modest recent uptick but still low in absolute terms.

The pattern is clear. The cycle had already peaked before December. Activity is easing, not accelerating. This aligns with commentary around excess capacity, falling spreads, and a disciplined stance on fleet utilization.

What This Says About Shale Today

Shale is becoming more selective and basin-concentrated. The Permian still sets the pace, but it no longer lifts the entire sector. Gas basins are quietly regaining relevance as swing contributors. Efficiency is higher, but absolute frac intensity is rolling over.

Against that backdrop, power is where strategic energy is shifting. Liberty’s LPI platform, ProPetro’s rapidly scaling PROPWR business, and Halliburton’s hyperscale push all point to the same conclusion. Pressure pumpers are building platforms that can outlast the next completion downturn.

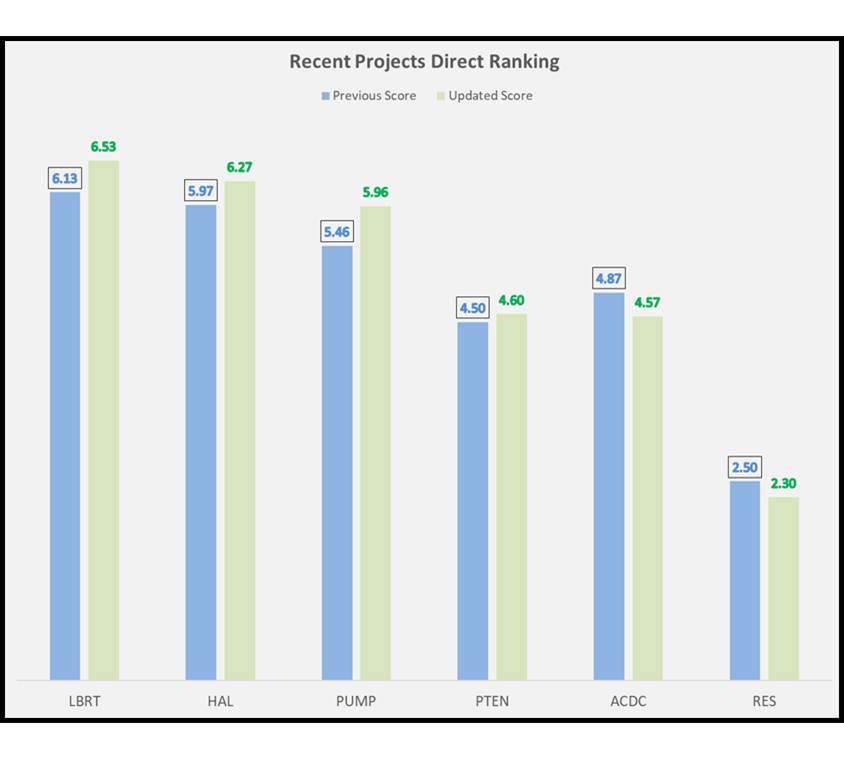

Renewed Ranking and Returns

So, how have all these factors affected their scoring and ranking, which we established in our previous article? LBRT and HAL extend their lead because power platforms and execution scale appear to matter more than raw frac exposure. PUMP holds #3 as PROPWR shifts it from “efficient frac” to “platform builder.” PTEN edges up on integration stability. RPC slides because being frac-pure while ACDC goes south (investors may note that ACDC sold mobile power generation assets in April 2025. It seems the company’s uneven execution contributed to the fall.

Since Q3’25, returns have sharply diverged, with ProPetro (+72%) and Liberty (+48%) far outperforming peers while smaller or more frac-pure names like KLXE and ACDC are negative. This dispersion comes even as total and Permian frac job counts trend lower, showing that equity performance is decoupling from near-term activity. The market is rewarding companies with credible power and platform diversification, not those most exposed to the frac cycle.

Takeaway

The sector is in transition. Basin activity remains the earnings engine, but it is narrower, more competitive, and already decelerating, as shown by frac jobs through November 2025. Power offers longer contracts, structural demand, and a path to redeploy shale cash into more durable returns. The winners will be those that convert today’s Permian and gas-basin cash flows into credible, scaled power franchises — before the next downcycle forces the issue.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform