Outlook for 2H 2025 and 2026: Liberty sees near-term weakness in frac activity as oil producers scale back completions amid market uncertainty. This has created pricing pressure and underutilized fleets, though the company expects recovery by late 2026 as oversupply eases. Demand for next-generation digiTechnologies fleets remains strong, helping Liberty outperform peers through efficiency gains.

Its growing power business, driven by AI, electrification, and grid reliability issues, offers a key long-term growth opportunity. The company expects total power generation capacity to exceed one gigawatt to be delivered through 2027. Despite the near-term challenges, LBRT expects “Moderation in activity anticipated in the near term is transitory in nature.”

Frac Market Developments: Weak industry activity and underused fleets are creating pricing pressure, especially for conventional frac equipment. However, this is accelerating fleet attrition, which should tighten supply and support stronger pricing once activity rebounds. Demand for Liberty’s next-generation digiTechnologies fleets remains robust, driven by superior efficiency, fuel savings, and emissions performance. You can also read more about LBRT's fracking activities here.

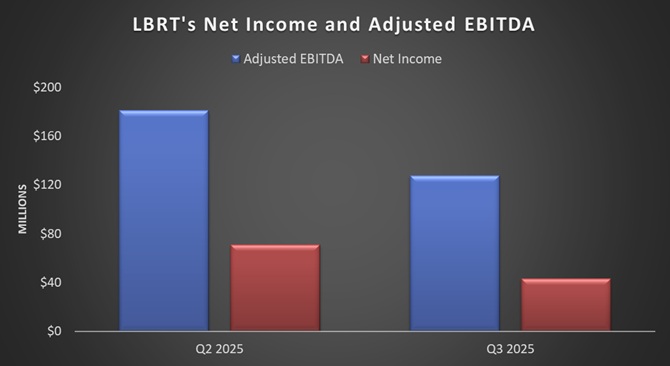

Topline and Bottomline Declined In Q3

LBRT's revenues decreased by 9.1% quarter-over-quarter in Q3, while its adjusted EBITDA dipped by 29%. Its net income fell even more sharply, by 39%, in Q3 after surging remarkably in Q1. The deterioration in financial results in Q3 was due to lower completions activity and weaker pricing, causing margin erosion and underutilized fleets.

The company's debt-to-equity ratio deteriorated to 0.12x as of September 30, compared to 0.08x in the previous quarter. In Q3, its debt increased, reflecting higher borrowing to sustain capex and liquidity. Despite the strain in the environment, it has recently increased its quarterly cash dividend by 13%.

Thanks for reading the LBRT Take Three, designed to give you three critical takeaways from LBRT's earnings report. Soon, we will present a second update on LBRT's earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.