Articles

- BLOG / Articles / View

- Articles

Market Sentiment Tracker: A Look at the Emerging Gap Between Growth and Hiring

By Osama on November 26, 2025 in Market Sentiment

The softening in US job creation has become one of the more persistent inconsistencies in an otherwise resilient expansion, and it is increasingly shaping how the Federal Reserve interprets the economy’s trajectory. Payroll growth has decelerated sharply over the course of the year, averaging roughly 60,000 per month in late summer and even slipping into negative territory in June and August. These weak readings stand in contrast to GDP growth, which has remained robust, with second- and third-quarter output supported by firm consumer spending and a surge of investment in information processing equipment and software. The combination signals an economy capable of generating strong output without proportionate labor demand, and it challenges the Fed’s usual assumptions about how tight financial conditions translate into real activity.

The slowdown in hiring reflects a shift in business strategy that began before the Fed’s rate-cut cycle and accelerated as political and regulatory uncertainty rose. Firms have continued to invest in capacity and technology—evidenced by the 4.4 percent share of GDP devoted to information-processing equipment earlier in the year—but these investments increasingly substitute for labor rather than complement it. Productivity growth has been stronger than expected, giving companies room to meet demand without expanding payrolls. This pattern is visible in sectoral data: output per hour in nonfarm business rose noticeably during the past two quarters, even as job openings trended lower from their 2022 peaks. The implication is that companies are optimizing rather than expanding, a rational response when cost structures remain in flux and policy signals are harder to interpret.

.jpeg)

The policy environment itself has contributed to the hiring hesitation. Major shifts in trade and immigration policy have altered both the composition of labor supply and the cost of securing inputs from abroad. Firms faced with uncertainty around tariff exposure or labor-force availability often delay hiring decisions, even when demand fundamentals appear solid. This has been reinforced by the uneven effects of earlier policy tightening: smaller firms remain more exposed to higher financing costs than large corporates, which have benefited from stronger cash positions and easier access to capital markets. The divergence means that the largest and most productive firms continue to invest, while smaller employers which account for a disproportionate share of net job creation, remain cautious.

The question troubling the Fed is not simply whether the labor market is slowing, but why the slowdown is occurring without the typical accompanying signs of stress. Layoffs remain low, unemployment has only drifted up modestly, and claims data show only a gradual rise in continuing claims. The underlying dynamic appears to be a freeze rather than a collapse: firms are not shedding workers, but they are not adding many either. This distinction matters because it implies the economy can maintain growth for a time, but with an increasingly narrow buffer against shocks. If productivity growth moderates or demand cools, the absence of hiring momentum could transform a benign slowdown into something more destabilizing.

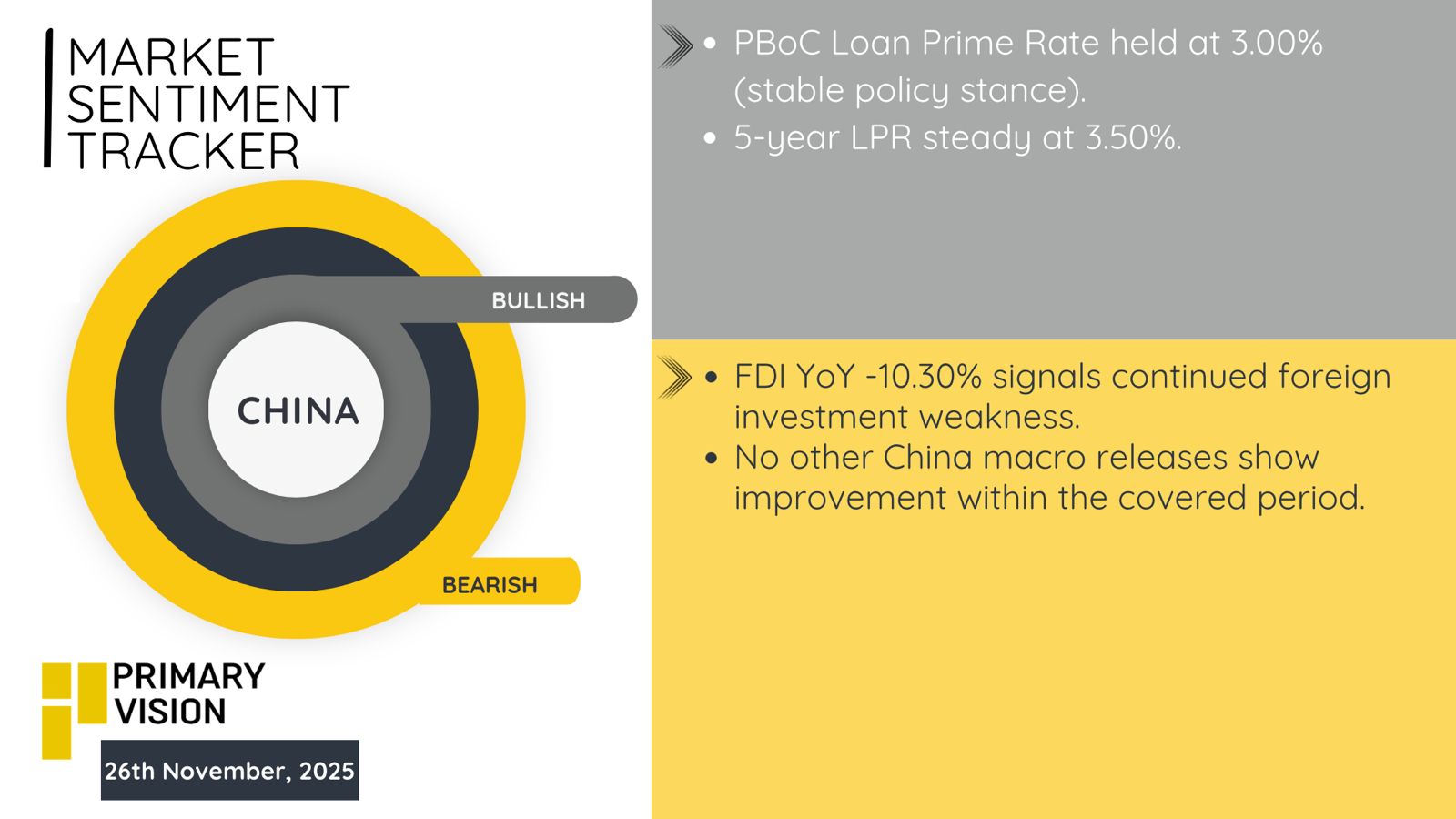

Finally, before we go let's have a look at the recent Market Sentiment from China that we covered in detail last week:

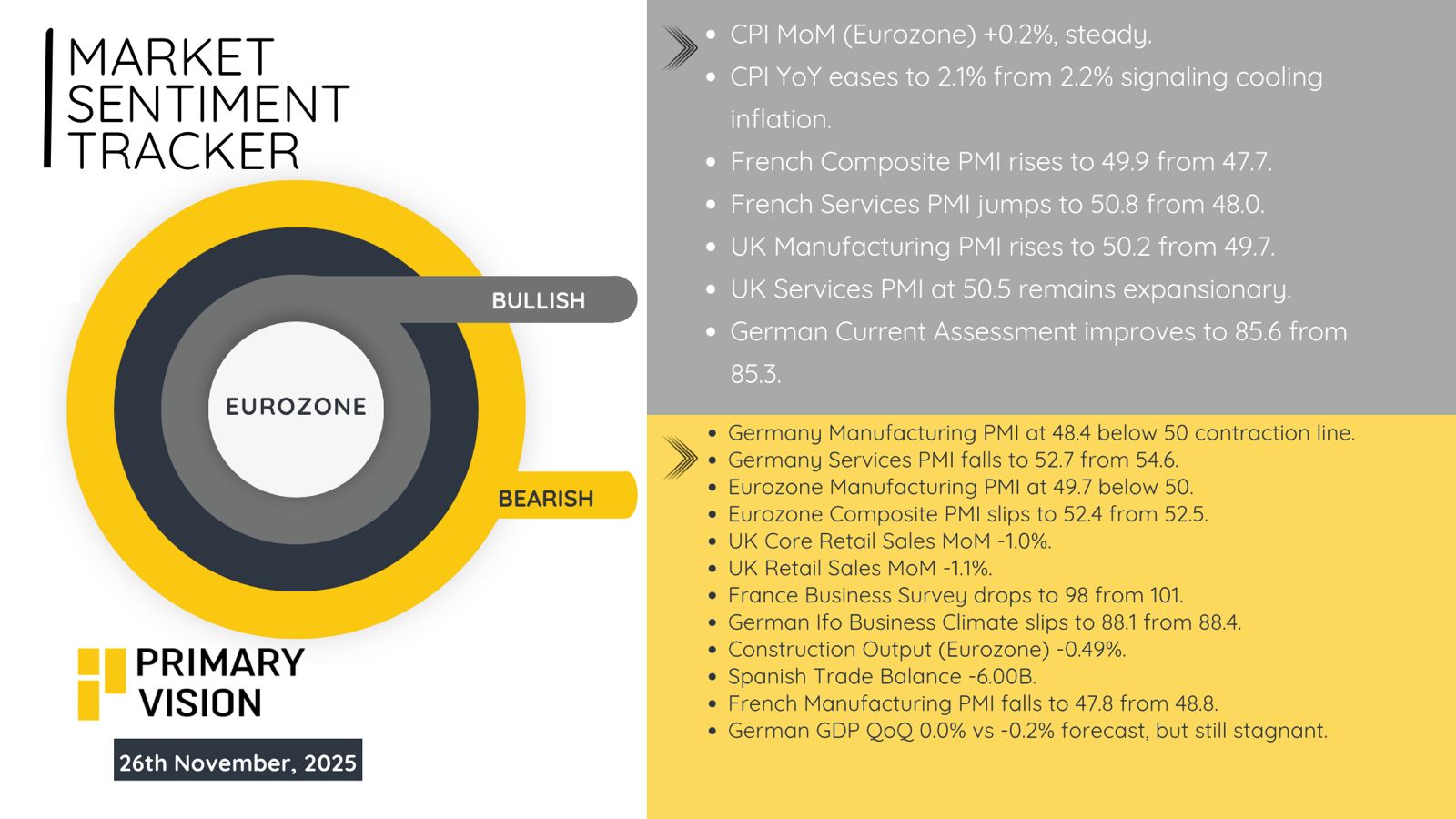

Also important to look at Eurozone that I intend to write about in detail next week! We can see things stabilizing a bit in Europe but issues persist.

Coming back to Fed the central risk stems from the possibility that the economy is undergoing a structural shift rather than a cyclical one. If firms are adjusting to a higher baseline of uncertainty and adopting technologies that permanently reduce marginal labor demand, then traditional models linking hiring, output, and wages may understate the degree of slack building beneath the surface. Strength in GDP cannot be taken as evidence of sustainable labor-market health if it rests on productivity gains that may or may not persist. Moreover, the decoupling of output and employment weakens one of the Fed’s most reliable indicators of underlying demand, forcing policymakers to rely more heavily on a patchwork of sentiment data, credit conditions, and high-frequency spending metrics.

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform