Articles

- BLOG / Articles / View

- Articles

Market Sentiment Tracker: Credit Creation Without Credit Use

By Osama on November 12, 2025 in Market Sentiment

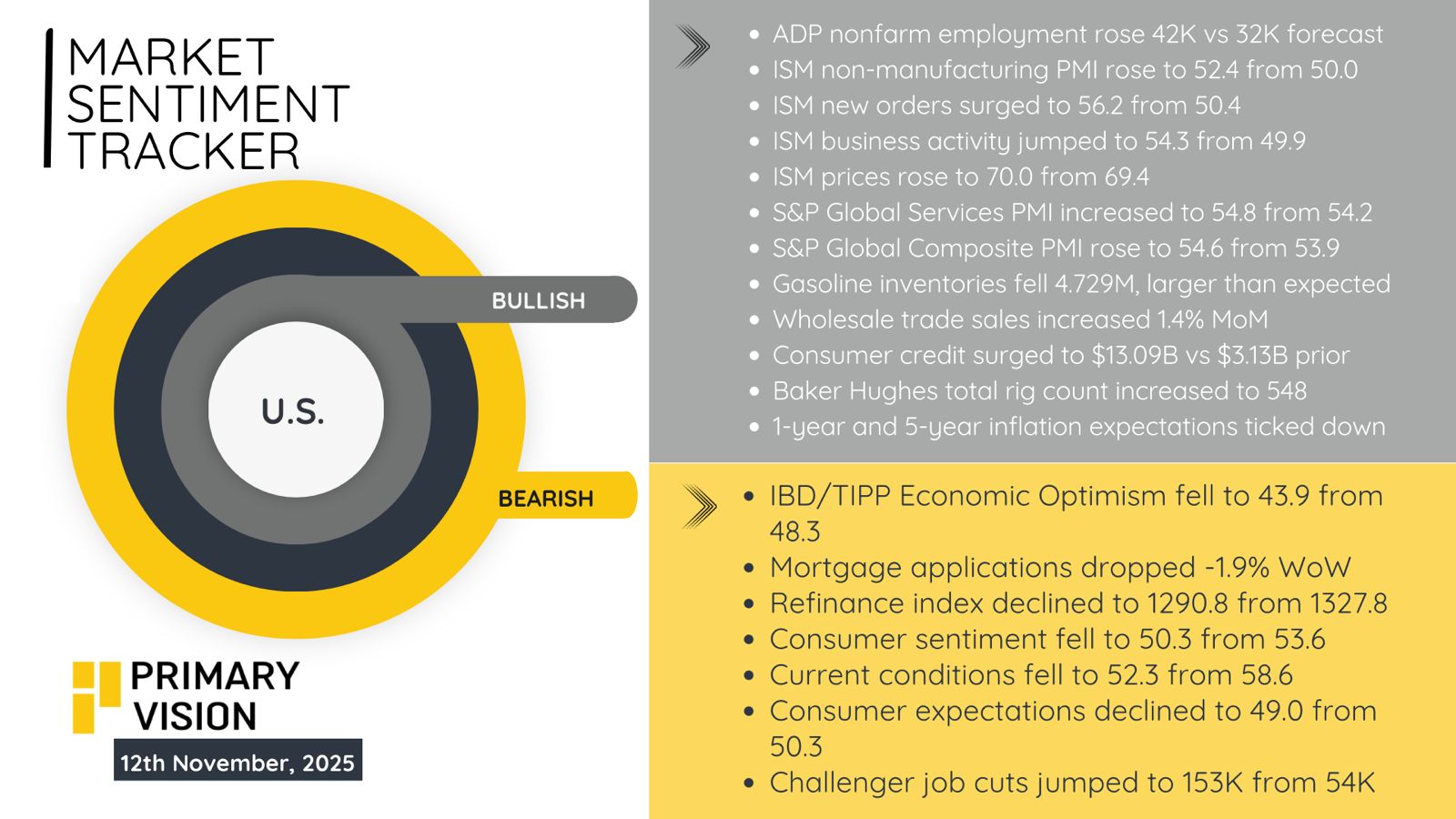

Market sentiment this week turned brittle beneath the surface. U.S. macro prints improved and appeared conducive to a soft landing narrative holding firm, but the issues persist. Services activity accelerated, price pressures crept up, and job cut announcements surged. Investors are trading optimism on momentum, not conviction.

The ISM services index moved to 52.4 in October, driven by a jump in business activity and new orders. Prices paid rose to 70.0, the highest since spring. This didn’t come from a demand shock. It came from energy. Gasoline inventories dropped 4.7 million barrels and refinery utilization slipped again. Job market signals were mixed, but the divergence is widening. ADP payrolls came in at 42,000, better than forecast. But Challenger job cuts more than doubled to 153,000. This wasn’t isolated to tech or financials. Retail and healthcare layoffs picked up. It’s the clearest indication yet that corporate margin defense is back on the table ahead of year-end. With real rates elevated and profit growth plateauing, the corporate response is rational.

A recession in the U.S. is no longer an imminent threat, but neither is it off the table. The data has moved from contraction risk to stagnation risk. but the short term outlook at least for the 1H 2026 seems better. The yield curve has been inverted for over 14 months and Real GDP is barely growing. We need to pay special attention to credit conditions that are tight.

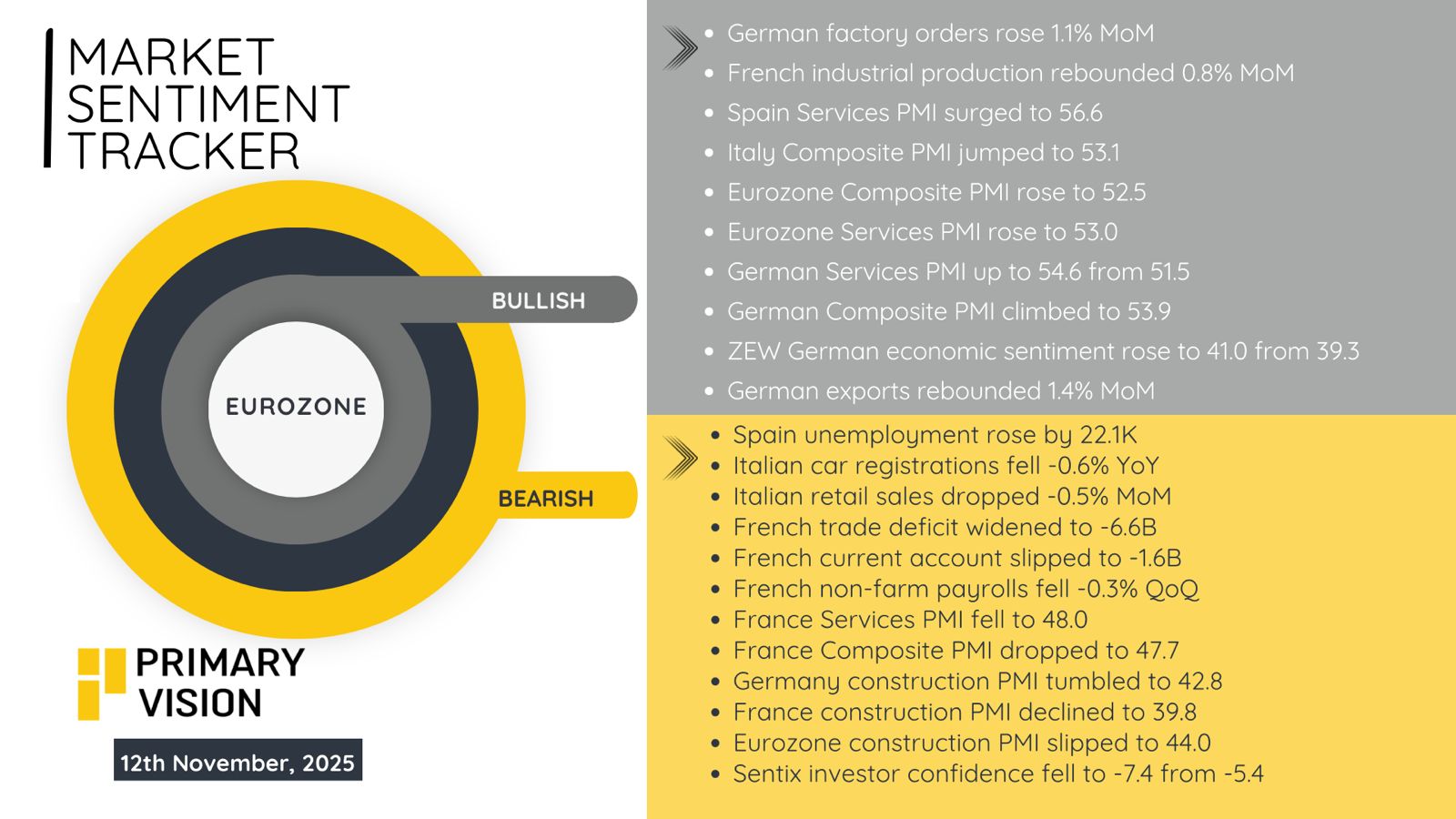

Europe is cycling through a technical recovery. Germany’s factory orders rose 1.1 percent. Industrial production improved in France and Italy. Composite PMIs for the euro area returned to expansion. Even ZEW sentiment in Germany improved. But construction collapsed. France’s PMI fell to 39.8. Germany printed 42.8. These are not isolated misses. They reflect a policy failure to reaccelerate fixed investment. Real rates remain deeply positive across the eurozone. Credit demand is weak, particularly among SMEs. The ECB has tightened into a stagnation trap, and energy resilience this winter won’t fix structural underinvestment.

Trade figures confirm the drift. France's deficit widened to 6.6 billion euros, the worst in four months. German exports rose, but the surplus narrowed. Retail sales across the bloc fell again. Sentix investor confidence dropped for the third straight month. Eurozone consumer momentum is still absent. Household net saving rates are falling, not because of strength in spending, but because inflation-adjusted wages remain compressed.

The recession Europe faced in the first half of the year never resolved it simply dispersed. Germany is in stagnation. France is rebalancing through fiscal expansion, not private demand. Italy is holding up only because of prior stimulus carryover. The ECB is boxed in.

China’s prints were the weakest in months. Export growth turned negative again, falling 1.1 percent. Imports missed by a wide margin. The trade surplus contracted in yuan and dollar terms. New loan issuance collapsed to 465 billion yuan, a fraction of the expected 1.3 trillion. Social financing fell by two-thirds. This isn't a liquidity issue. It’s a signal that firms and households see no viable return on borrowing. The private sector is in repair mode, not expansion.

The PPI print stayed deeply negative, and although CPI turned marginally positive, it’s no signal of demand revival. Retail sector inventories remain bloated. Housing transactions continue to decline. Developers are still unable to access clean credit channels despite multiple rounds of policy support. Property as a growth lever is spent.

What’s left is credit-based industrial support, and even there, the transmission mechanism is weakening. M2 growth slowed to 8.1 percent. That implies one of two things: either the PBoC has lost control of credit multipliers, or lending conditions are tightening informally. Neither supports a recovery narrative.

.jpeg)

Global trade tensions and energy politics will shape what happens next. The new tariffs on Chinese goods, rising costs of industrial metals, and OPEC+ efforts to manage production are creating a more uncertain environment for growth. Supply chains are shifting, energy flows are being redirected, and costs across manufacturing and transport are likely to stay high. If these pressures persist into 2026, the global economy could face another year of fragile stability, where policy choices, rather than demand, determine how long the balance between inflation and growth can hold.

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform