Articles

Market Sentiment Tracker: Global Economic Conditions at the Start of 2026

By Osama on January 6, 2026 in Market Sentiment

Tags:

By Osama on January 6, 2026 in Market Sentiment

The turn of the year is always a useful moment to slow down and take stock, not because calendars matter to economies, but because cycles often reveal themselves only when enough time has passed to see what is durable and what was noise. After several years of shocks, policy responses, and rapid narrative shifts, the global economy enters the year in a more transitional state than markets often like to admit. Expectations are once again running ahead of underlying adjustment. In my experience, these are the periods when disciplined observation matters more than conviction. The aim is not to predict turning points with precision, but to understand the balance of forces already in motion, and which of them are likely to carry weight as the year unfolds.

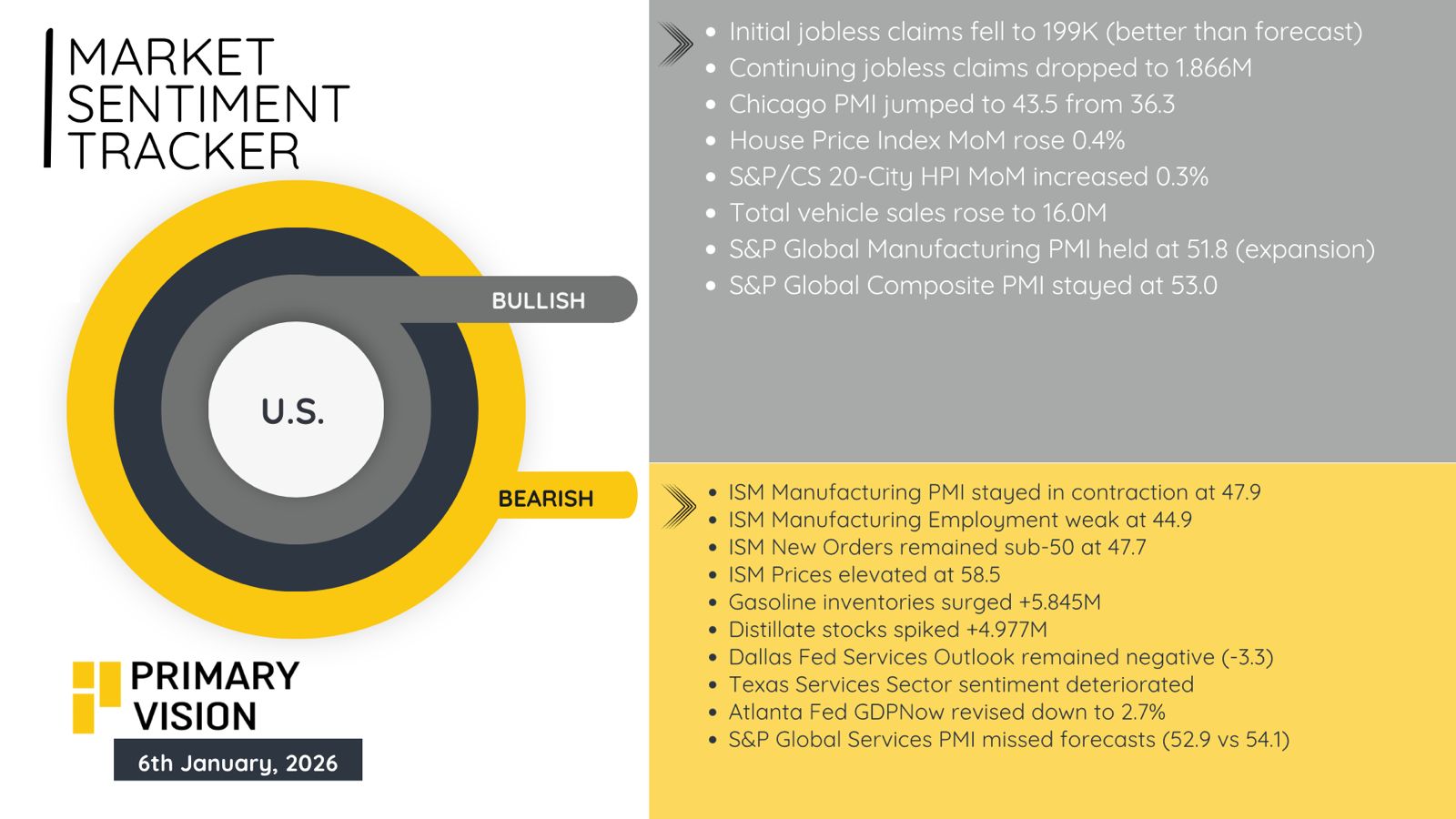

In the United States, I think the base case is a soft landing: growth cools, inflation drifts lower, and unemployment rises only modestly. The chart below and the indicators therein fits that story: jobless claims are still low, while manufacturing is still contracting, with the ISM PMI at 47.9 and prices paid sticky at 58.5. The risk is that goods inflation reappears even as activity slows. Tariffs are already being cited by firms as a cost and demand problem, and that is exactly how soft landings get complicated. Another high-impact swing factor is energy: crude stocks fell, but gasoline and distillates rose sharply in the same week, and those inventory whipsaws can feed price volatility and consumer mood. If the Fed reads sticky prices as the bigger threat, policy can stay restrictive longer than markets want, and the soft landing becomes more fragile.

In the euro area, the central challenge for 2026 is an uneven economy that is serviceable in services and weak in industry. December PMIs are the cleanest snapshot: composite and services remain above 50, but manufacturing is still in contraction at 48.8, with Germany and Italy dragging. That mix usually produces political pressure, because households feel the cost-of-living legacy while manufacturers feel a demand shortfall. Core inflation is still around 2.4%, which limits how quickly the ECB can declare victory. The high-impact issue is confidence in the industrial core: when Germany and its supply chain hesitate, capex gets deferred across the bloc. Another practical constraint is fiscal execution—money exists in theory, but the pipeline from budgets to projects is slow. If Europe gets a global goods upturn it will benefit, but it cannot rely on exports alone. The work for 2026 is to turn decent services momentum into investment and productivity, not just stabilize.

.jpeg)

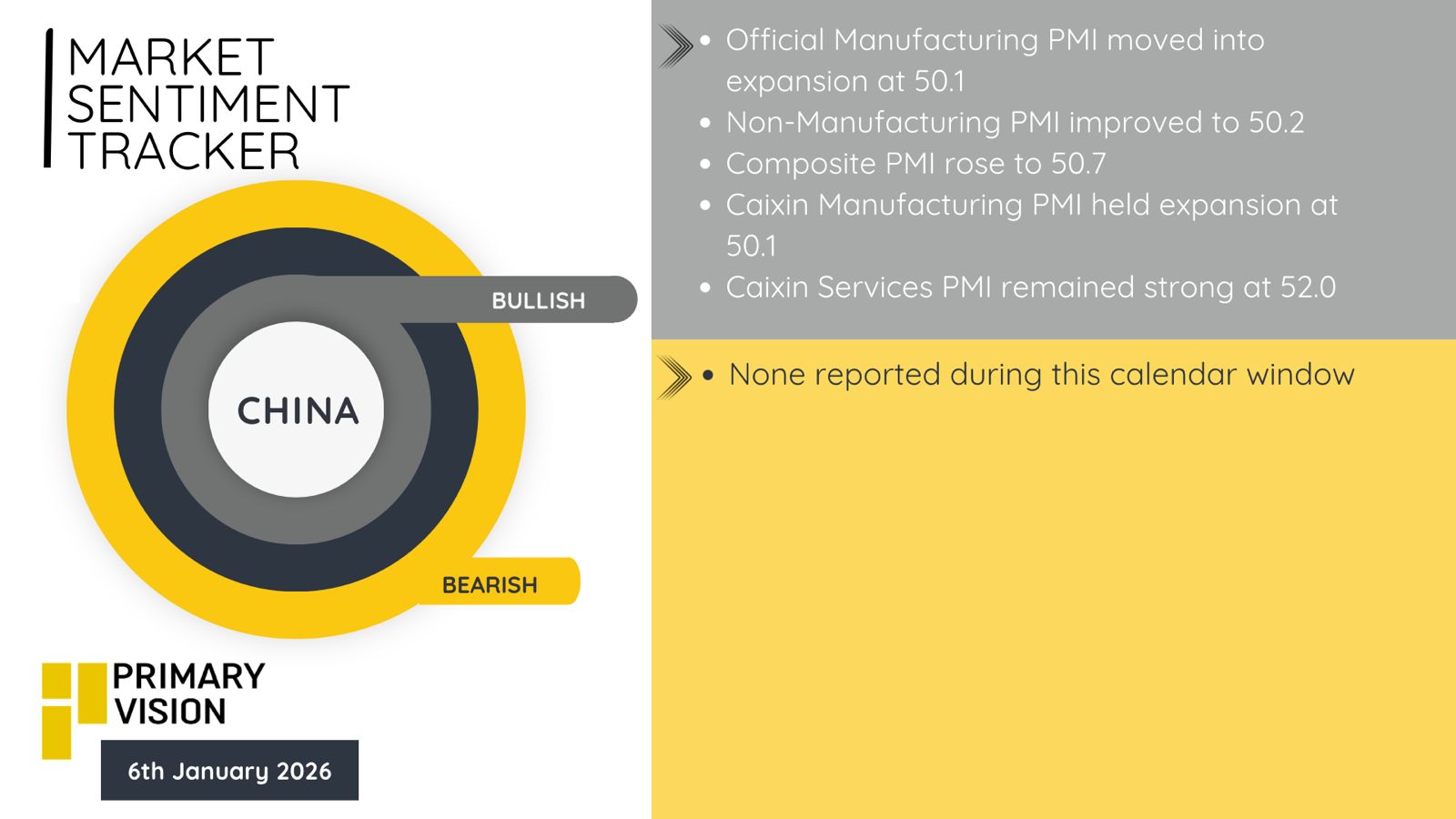

In China, I’m watching whether stabilization turns into something households believe. The official PMIs moved back into expansion in December—manufacturing at 50.1, non-manufacturing at 50.2—and Caixin services held at 52.0. That is progress, but the quality matters: services growth is steady rather than strong, and foreign demand has softened at the margin in the private survey. The biggest macro weight remains property. Beijing is explicitly prioritizing housing stabilization and urban renewal into 2026, but this takes time to transmit into spending. Alongside that, I take seriously the investment push—large approved infrastructure and security-related projects point to a firm fiscal impulse at the start of the new plan cycle. The risk is that stimulus lifts production more than consumption, keeping prices and confidence subdued. The upside is that a steady repair, not a surge, can still change global trade flows meaningfully.

Tags:

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform