Articles

- BLOG / Articles / View

- Articles

Market Sentiment Tracker: Why Is Europe So Hard to Fix?

By Osama on December 16, 2025 in Market Sentiment

European growth has been positive but anaemic. Many analysis talk about a collapse of the Eurozone economy but the distinction matters. Eurostat’s detailed releases show quarter-on-quarter GDP in the euro area expanded 0.3 per cent in Q3 2025, revised up from earlier estimates and outpacing the prior quarter’s 0.1 per cent gain. Industrial production climbed 0.8 per cent in October, even as services output was flat. Unemployment is steady at 6.4 per cent, slightly above a year earlier, and job vacancies are declining — a warning sign of cooling demand.

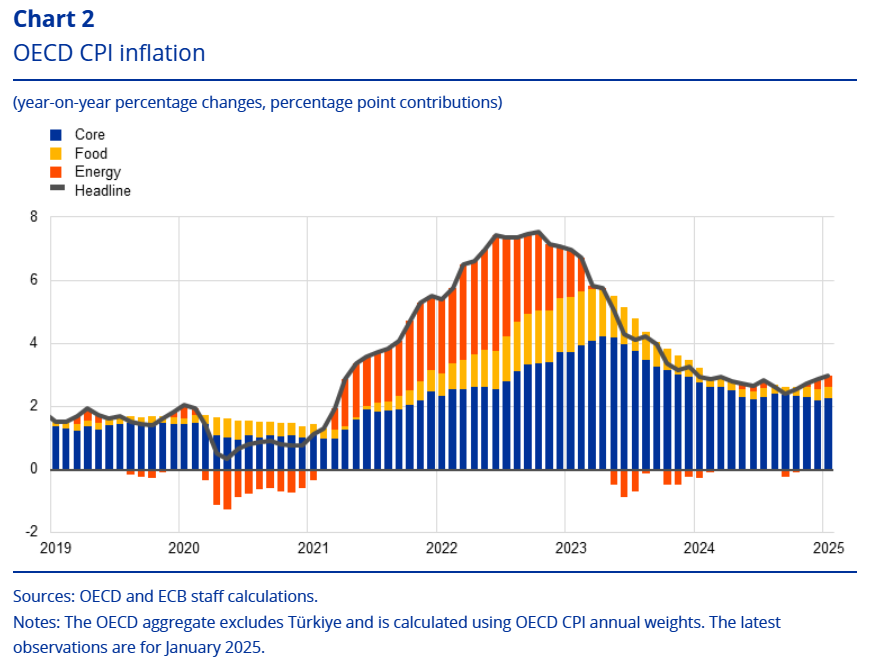

This picture complicates the prevailing doom narrative. Europe’s output baseline is holding above contraction thresholds — but momentum has eroded. The HCOB flash Composite PMI plunged within 2025 to a three-month low, chiefly on German manufacturing weakness, even while services here continued modest expansion. Firms are hiring, yet sentiment has waned, and price pressures linger near the European Central Bank’s 2 per cent anchor.

Labour dynamics underscore this nuance. The EU’s official forecasts project unemployment edging down through 2027 as productivity accelerates relative to wage growth, but wage moderation is a double-edged sword: it relieves unit cost pressures even as it risks suppressing aggregate demand. Inflating labor costs and demographic shifts imply migration will remain a key plug in labour markets, not a fringe factor. Fiscal metrics underscore structural headwinds. The European Commission’s Autumn Forecast projects the EU general government deficit widening from 3.1 per cent of GDP in 2024 to about 3.4 per cent by 2027, with the debt-to-GDP ratio climbing towards 85 per cent in the aggregate euro area. These trajectories aren’t crisis-level today, but they constrain macro-stabilisation space.

Growth forecasts are legitimately subdued. The ECB’s own projections anticipate sub-potential expansion around 0.9 per cent in 2025, strengthening modestly to about 1.2 per cent in 2026 and roughly 1.3 per cent in 2027, a downgrade from prior cycles. Cumulative growth through mid-2025 undershot earlier expectations by roughly an entire year’s worth. These revisions stem in part from weaker exports and investment — an indictment of Europe’s competitiveness challenges more than cyclical softness alone.

The British economy reflects spillovers instead of being immune. UK unemployment has climbed to a four-year high near 5.1 per cent, wage growth is decelerating sharply, and consumer confidence is fragile amid soft payrolls and potential imminent rate cuts by the Bank of England. These trends, just across the Channel, accentuate the interconnected nature of European demand and financial conditions. At a granular level, divergences across member states complicate the aggregate story. Peripheral labour markets differ sharply from core ones; Spain and Ireland retain relatively tighter employment conditions compared with Germany and France, where labour market slack is emerging even as headline unemployment holds. And regional production indices reveal pockets of dynamism, durable goods and capital equipment, even as headline PMIs drift lower.

If Europe’s challenge were simply cyclic, policy responses could be calibrated and temporary. But the deeper constraint is structural: investment rates, particularly private R&D outlays, remain low relative to US and emerging Asian peers; chunky regulatory frameworks inflate compliance costs and slow adoption of frontier technologies. The Draghi Report and subsequent Commission initiatives acknowledge this, but implementation lags and political cycles are misaligned with the urgency of productivity gaps.

The only plausible counterweight to this inertia is decisive reform: streamlining regulation, deepening capital markets, incentivising business formation at scale, and accelerating productivity-enhancing investment. Failure to unlock these structural levers consigns Europe to a steady state of subpar expansion — not disaster, but disappointment with global ramifications and spillovers that extend well beyond the Continent.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform