Articles

- BLOG / Articles / View

- Articles

Monday Macro View: Can Record U.S. Output Survive Tariffs, Tungsten, and Tight Margins?

By Osama on October 13, 2025 in Market Sentiment

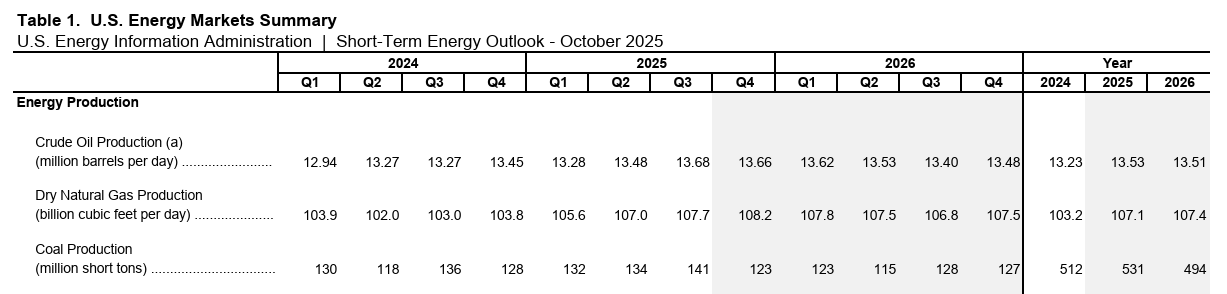

The U.S. Energy Information Administration’s October Short-Term Energy Outlook confirmed what recent field data had already been signaling — an upward revision in U.S. crude oil production. This adjustment validates the trend we have been tracking over the past three weeks, with both the Frac Spread Count and Frac Job Count continuing to support the production strength now reflected in the EIA’s updated numbers. At the same time, tungsten prices have surged sharply, introducing another layer of cost pressure for U.S. drillers at a time when margins are already under strain.

EIA’s latest data shows that U.S. crude oil production reached a record high of 13.6 million barrels per day in July, surpassing its previous estimates and effectively resetting the base for future forecasts. The agency now expects average production of 13.5 million barrels per day in both 2025 and 2026, up slightly from its September outlook. The quarterly projections indicate that production remains robust through the back half of 2025 before easing marginally into 2026. This revision underscores the resilience of U.S. producers despite weaker prices and softer drilling activity, underpinned by efficiency gains and productivity improvements across major shale basins.

Source: EIA, October 2025, STEO

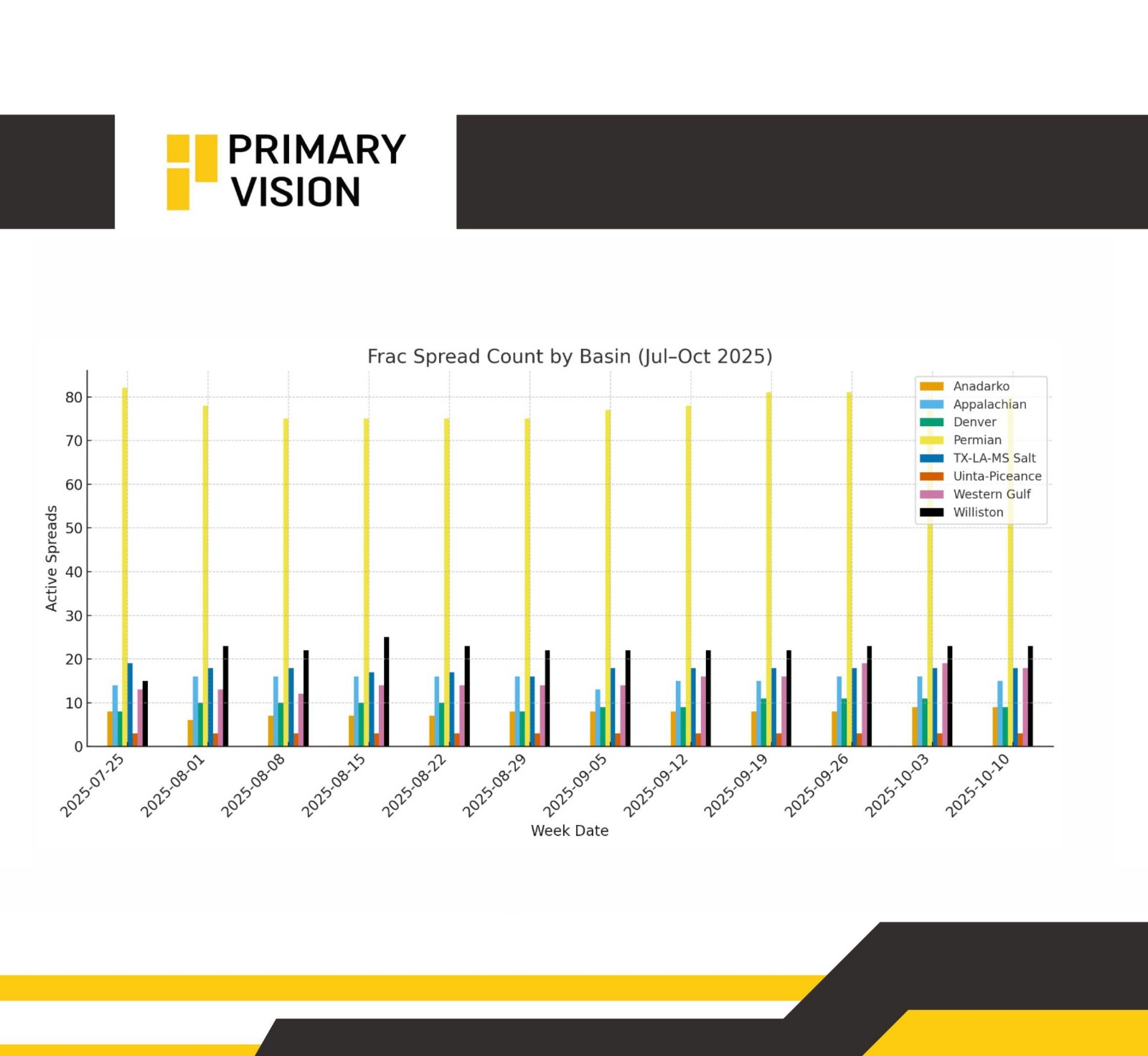

Recent field data further reinforces this picture, even as completion activity has softened modestly over the past week. The Frac Spread Count declined by 4 week-over-week to 175, marking a 66-unit decrease year-to-date, while the Frac Job Count slipped 4 to 204, down 28 year-to-date. Though the pullback points to short-term operational pauses, the broader completion trend remains aligned with sustained production momentum across key shale regions. The moderation largely reflects typical seasonal and logistical adjustments rather than a structural downturn, as operators continue to balance efficiency-driven output with capital discipline and service cost inflation. Recent field data further reinforces this picture, even as completion activity has softened modestly over the past week.

Our weekly reports further show a strong trend in basin-level dynamics, with the Permian Basin remaining the dominant driver of national activity at 80 active spreads, only slightly below recent highs. The TX-LA-MS Salt region has also held steady near 18 spreads, while the Denver-Julesburg (DJ) Basin and Appalachian regions continue to show modest fluctuations tied to local gas economics. The Anadarko and Williston basins have demonstrated steady performance, underscoring the broad base of operational consistency that continues to underpin U.S. production. This regional stability, even amid a mild national slowdown, reflects the sector’s disciplined approach to sustaining output through efficiency rather than expansion.

Meanwhile, tungsten prices have climbed above $600 per metric ton unit, almost doubling since February, following China’s export controls on critical metals. The situation has now intensified after former President Trump imposed 100% tariffs on a range of Chinese imports, further constraining supply chains and escalating costs for U.S. oilfield service providers. With China supplying over 80% of global tungsten, the combination of export curbs and tariffs has sharply raised costs for shale operators. Tungsten, which makes up as much as 75% of the material in polycrystalline diamond compact (PDC) drill bits, is now adding anywhere from $3,000 to $25,000 to the cost of each bit. For service companies already contending with weaker utilization rates and thinner margins, these additional costs are amplifying financial pressures. Although some operators may attempt to absorb the increases, the combination of lower activity and tighter pricing power makes full cost pass-through increasingly untenable.

Source: Global Market Insights

Taken together, these developments capture a U.S. upstream sector that remains both resilient and constrained. Record production levels and ongoing efficiency gains highlight the industry’s adaptability, yet the operating environment is becoming more complex — defined by rising input costs, geopolitical trade frictions, and tighter capital discipline. The EIA’s revised outlook captures this duality: output remains historically strong, but future growth will hinge more on technological gains and operational efficiency than on drilling expansion. As the sector moves toward 2026, it faces an environment shaped as much by policy and trade decisions as by geology and price signals — a phase where strategic resilience, rather than sheer scale, will define success.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform