Articles

- BLOG / Articles / View

- Articles

Monday Macro View: Many Opinions on U.S. Oil. One Set of Numbers Tells the Real Story

By Osama on November 24, 2025 in Market Sentiment

This week’s numbers are out and it is once again showing how the Frac Spread Count (FSC) and Frac Job Count (FJC) both predict and explain the rise in efficiency that many are highlighting and discussion but, respectfully, not providing any categorical metric or information as to where can this be attributed to. FSC came in at 179 units (up 4 units from last week), while the Frac Job Count jumped by 5 and is now at 212. Compared to last year the FSC is down only 42 (down 19%) but the FJC is actually up by 2 on YoY basis! The rig count is 554, also higher this week by 5 units. What I continue to highlight is the fact that t the benchmark WTI crude-oil price has fallen by approximately 15 % from about US $68 per barrel at the end of November 2024 to around US $58 per barrel today. The fact that completion activity is increasing even as oil-prices are materially lower underlines that the rise in completions appears to represent an increase in efficiency and frac utilization rather than simply a baseline maintenance of capacity.

Source: Primary Vision, Frac Hits

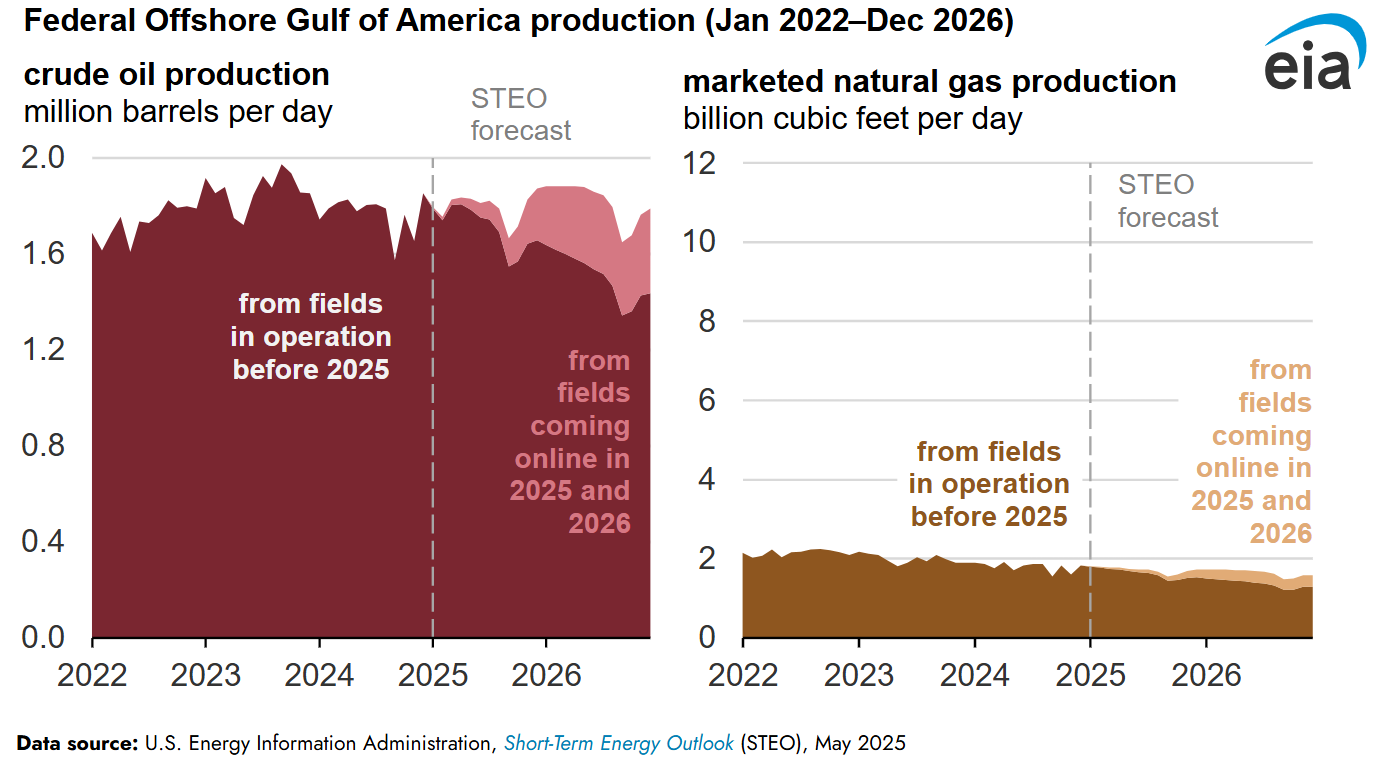

As we head into next year, the overall trend in oil and gas is encouraging in terms of the industry's position vis a vis production. The Gulf of Mexico is entering a period of renewed investment as multiple deepwater projects gain traction. New high-pressure drilling capabilities have improved the feasibility of reservoirs that remained undeveloped for years. Projects such as Anchor are the initial examples, followed by several fields under development at Shell and BP that are set to come online in the next few years. According to the EIA, Gulf output could increase from about 1.8 million barrels per day today to roughly 2.4 million barrels per day by 2027.

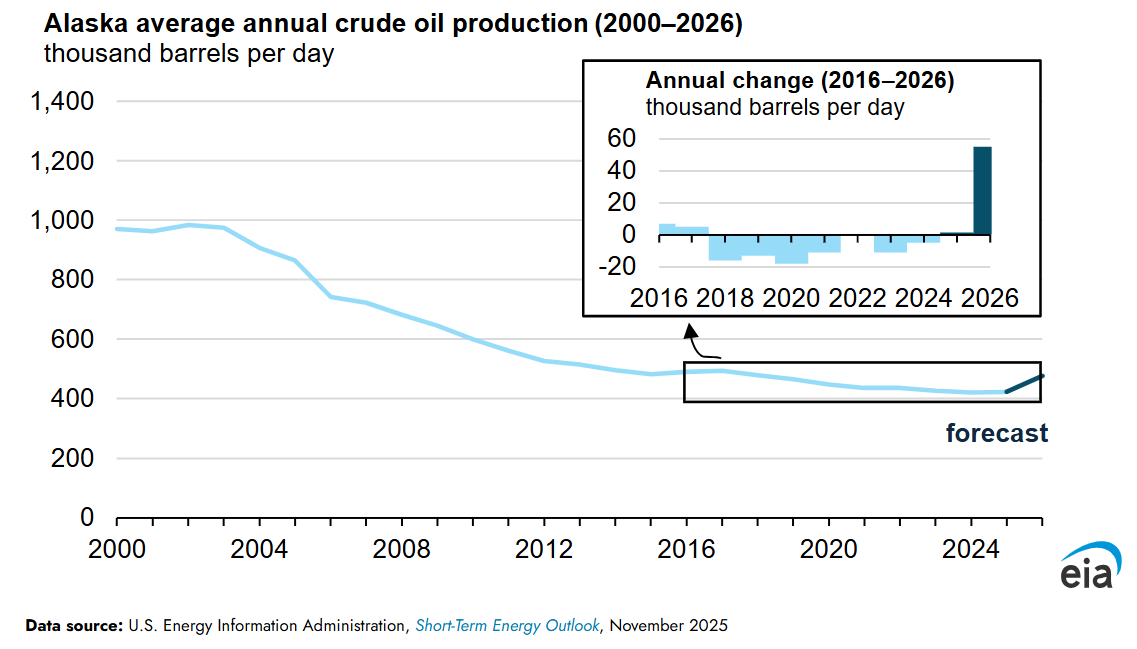

Alaska presents a comparable shift, although its trajectory is more immediate. The combination of the Nuna development and the Pikka Phase 1 project is expected to move the state into its strongest annual production growth since the 1980s. Pikka alone is projected to reach about 80,000 barrels per day by mid-2026, while Nuna continues to ramp after entering production in late 2024. The EIA estimates Alaskan production at 477,000 barrels per day in 2026, which would represent a 13 percent increase over this year and the highest level since 2018. For a region that has experienced long -term decline, these additions hold significance. While neither Alaska nor the Gulf alters completion activity in the Lower 48 directly, both influence how capital allocation decisions are being made across the broader upstream sector.

Even when we look at the international oil markets we see more supply coming in. Look at what is happening in Iran where crude exports have remained in the range of 1.5 to 1.7 million barrels per day throughout 2025. Oil on the water has risen toward 200 million barrels, and fleet utilization has reached about 58 percent, which is the highest level in several years. These figures indicate that nearly all available tankers capable of moving Iranian crude are already being used. This also, indirectly, indicates that even though on paper we might be seeing impact of Russian sanctions, they are doing something similar to Iran. Tankers continue to carry sanctioned oil.

Recent analysis show a growing share of shipments is being handled by sanctioned or shadow vessels, which complicates financing and logistics. In October, 44 percent of Russian crude exports moved on sanctioned tankers. China and India remain the main destinations, though their refiners appear to be adjusting volumes as sanctions evolve. The barrels still move, but the system is becoming less efficient, and the additional friction reduces the flexibility that exporters once had.

Although I will be doing an end of year report that will have our outlook for U.S. shale in 2026, the current indicators showcase that we are entering the next year on a strong footing. It is also showing that even globally the theme of oversupply will continue to to be a key issue and shape the trajectory of prices. We need to closely watch China and what is happening in their economy. I recommend that you follow our Market Sentiment Tracker for that purpose.

I will see you all next week! Happy reading!

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform