Articles

- BLOG / Articles / View

- Articles

Monday Macro View: Shale is enjoying a stable period - but what comes next?

By Osama on November 3, 2025 in Market Sentiment

Primary Vision’s latest data point to a steady and disciplined U.S. completion market. The Frac Spread Count stands at 175, down three from last week, while the Frac Job Count slipped three to 204, according to Primary Vision’s weekly update. The Rig Count, at 546, eased by four. These minor week-on-week changes follow a steady pattern through October, with the national Frac Spread Count ranging between 175 and 179 over the past month, indicating consistent completion activity rather than any directional shift. The trend underscores a balanced operational environment rather than a contraction. U.S. shale operators are maintaining completion programs even as WTI prices broke the psychological floor of 60s.

If we drill down further, our weekly report shows that the Permian Basin continues to anchor U.S. completion activity with 79 active spreads in the latest week, representing about 45% of the national total of 175.

That stability is particularly notable given the price . There are estimates that WTI may temporarily fall into the mid-$50s per barrel range in the next six months, before recovering during the second half of 2026 as non-OPEC+ supply growth peaks. Even in that scenario, we forecasts that U.S. crude supply will remain near current highs due to efficiency gains and residual completions from the DUC inventory. Projections also suggest that a sustained low price environment, in lower 50s, may be able to dent U.S. production, however, Primary Vision’s data suggest most operators are currently sustaining activity profitably within the existing price band.

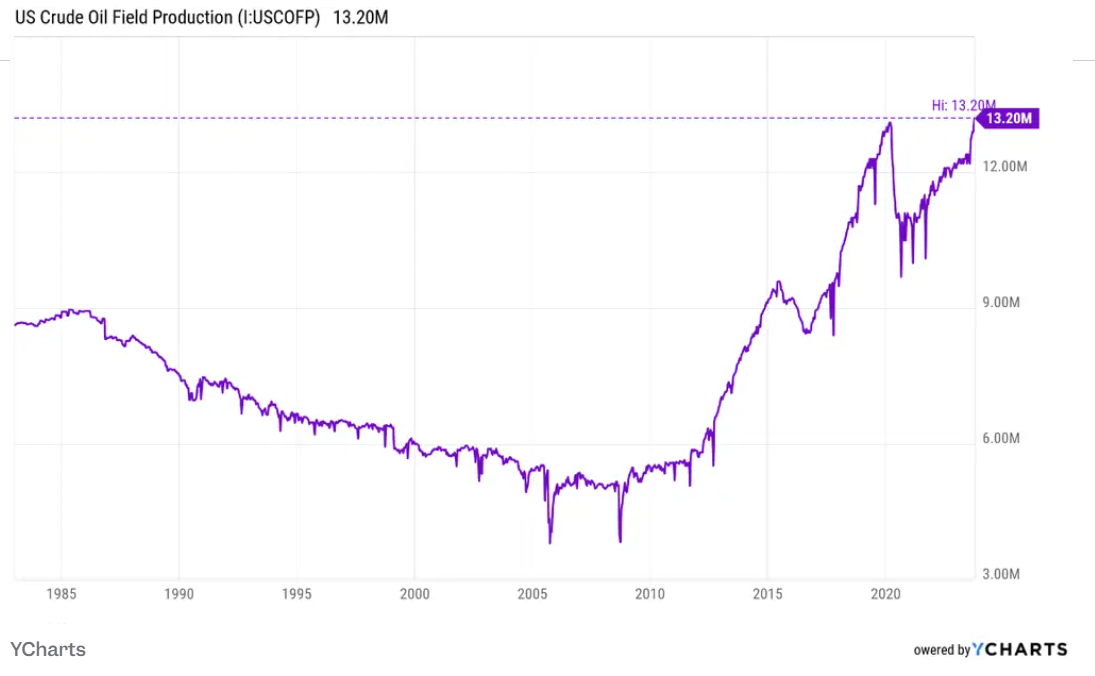

Recent EIA production data confirm that U.S. crude and condensate output remains near record levels, above 13 million barrels per day in recent weeks despite the rig count falling steadily since January. The Permian continues to deliver incremental volume growth. The number of wells drilled per rig has risen across nearly every basin, and efficiency metrics show that new-well oil production per rig has increased by roughly 6–8% since January. These data collectively support the view that technological improvements, more precise well targeting, and stronger logistics continue to offset the effects of lower rig counts.

The oilfield services sector reflects this measured environment. Nabors Industries’ third-quarter results show U.S. revenue down about 2% year-over-year to roughly $250 million, while international revenue grew 10%, according to company filings. CEO Anthony Petrello described the U.S. market as “under pressure” but fundamentally stable, noting that most clients expect flat activity through year-end. Among the 13 companies Nabors surveyed (representing roughly 42% of the U.S. rig market), the majority indicated no material change in planned rig programs through December. Nabors’ Sanad joint venture with Saudi Aramco continues to expand internationally, highlighting the sector’s global diversification even as U.S. completions remain steady.

Global supply dynamics remain fluid but manageable. OPEC+ has maintained modest production discipline, while new U.S. sanctions on Lukoil and Rosneft have constrained Russian crude flows. The measured response in Primary Vision’s U.S. activity indicators suggests producers are positioning for operational endurance, managing programs around efficiency and cash flow rather than reacting to short-term price changes.

As of early November, the U.S. oilfield remains on solid footing. Activity is fluctuating within a narrow range, but service demand is firm, and well productivity continues to climb. Operators are executing disciplined programs, supported by strong balance sheets, hedging coverage, and conservative price assumptions. The linkage between spreads, rigs, and production is evolving, but the data confirm a system functioning efficiently and predictably.

If prices soften further, the pace of completions may moderate, yet the efficiency baseline remains historically high. The latest Primary Vision data reinforce the same conclusion echoed by EIA and others. U.S. shale is stable, productive, and structurally resilient. That equilibrium. neither expansionary nor contractionary, continues to define the most reliable segment of the global oil market.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform