Articles

Monday Macro View: The $50 Oil Shock That Shale Shrugged Off

By Osama on October 20, 2025 in Market Sentiment

Tags:

By Osama on October 20, 2025 in Market Sentiment

Whether we like it or not, oil prices have slipped into the mid-$50s, testing the resilience of the U.S. shale sector once again. While past downcycles often triggered abrupt pullbacks in activity, the real test now lies in how modern shale operators respond under capital discipline and efficiency driven strategies. This week’s Monday Macro View looks at historical and current completions data to assess whether the U.S. market is better equipped to weather price softness than in earlier cycles.

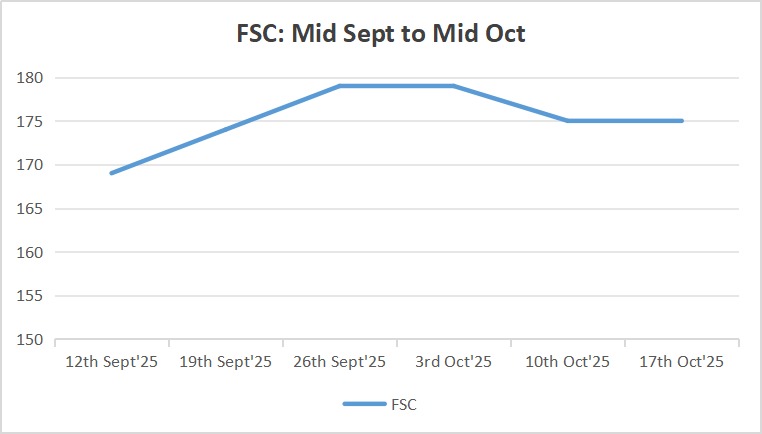

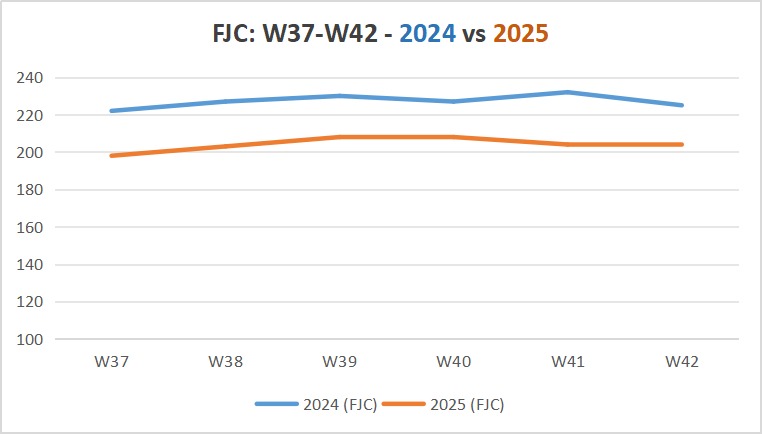

Let's start with the recent data from Primary Vision. Our weekly report, released every Friday, show that both the Frac Spread Count (FSC) and Frac Job Count (FJC) held steady week-over-week, underscoring stable field operations despite weaker crude benchmarks. As of October 17, 2025, the FSC stood at 175, unchanged from the prior week and only slightly below the late-September peak of 179. Similarly, the FJC measured 204, matching last week’s level and holding close to recent highs.

Interestingly, over the past six weeks, activity has risen modestly and then steadied, with FSC climbing from 169 in mid-September to 175 by mid-October, while FJC advanced from 198 to just above 200 during the same period. This pattern points to a short-term equilibrium in completions activity: crews are fully utilized, but new spread additions have paused. The steadiness of both indicators highlights the sector’s operational resilience and productivity consistency, even as oil prices move lower.

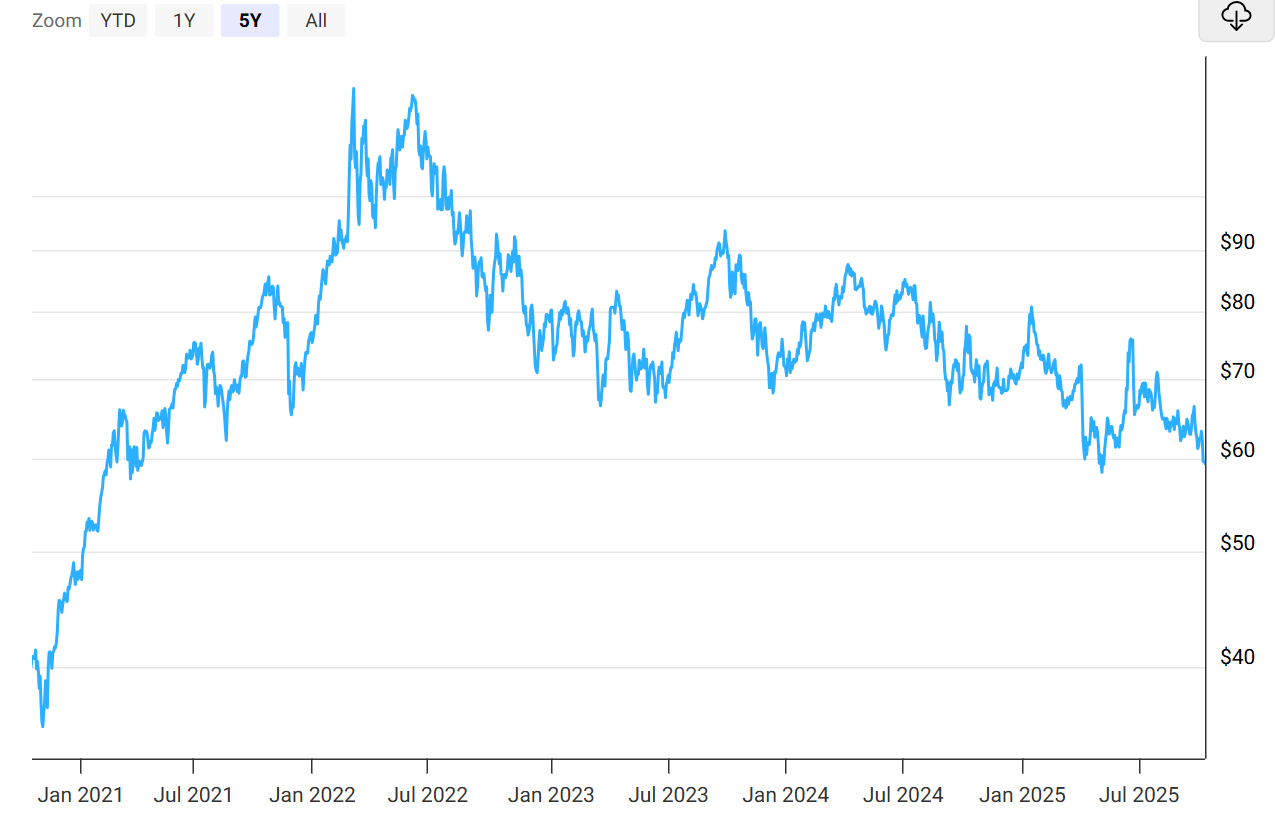

Looking at the broader trend, 2024 and 2025 together show a decisive structural shift toward efficiency rather than expansion. In 2024, the Frac Spread Count (FSC) declined from 234 to 201, a drop of roughly 14 percent, even though oil prices slipped only 4 percent between January 5 ($73.81 WTI) and December 27 ($70.60 WTI). That disconnect highlights how operators were already tightening budgets and consolidating activity despite relatively stable prices. By contrast, in 2025, the macro environment reversed: WTI fell sharply by about 20 percent between January 3 ($73.96) and October 16 ($58.84), yet the FSC decreased just 13 percent (from 201 to 175) and the Frac Job Count (FJC) actually rose 9 percent (from 185 to 204).

In other words, while oil prices dropped five times faster in 2025 than in 2024, the contraction in active fleets was smaller and output per fleet actually increased. This underscores how the completions market has become far more efficient and less price sensitive, as operators consistently achieve more work with fewer crews through simul-frac deployment, pad concentration, and disciplined capital allocation.

There are also signs of innovation extending this efficiency theme. In the Permian Basin, ExxonMobil’s “bespoke” proppant initiative uses lightweight, petroleum coke derived particles to enhance fracture reach and well recovery. Early results show 7–18 percent higher first-year production and around 15 percent uplift across its Permian portfolio compared with standard sand completions. The approach costs more upfront but boosts ultimate recovery, a clear example of how integration and design innovation continue to drive incremental gains even in a lower-price environment.

The combined picture is of a U.S. energy sector that is leaner, more efficient, and increasingly insulated from short-term price volatility. Despite oil sliding into the mid-$50s, completion activity has held firm, technology continues to raise productivity, and operational discipline remains the defining characteristic of this phase of shale evolution.

Tags:

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform