Articles

- BLOG / Articles / View

- Articles

Monday Macro View: U.S. production hits record high; OPEC+ to provide some floor to oil prices

By Osama on October 6, 2025 in Market Sentiment

I’ve been highlighting for a while now how resilient U.S. shale has proven to be, even when many expected output to plateau. The latest figures once again back that up. U.S. oil and gas producers pushed production to record highs in July, despite prices sitting well below their long-term inflation-adjusted averages. The sector continues to show its ability to adapt — cutting costs, improving efficiency, and getting more barrels out of the ground with less. It’s a reminder that the U.S. remains the most flexible source of incremental supply globally, and that flexibility is shaping market dynamics in real time.

Source: Energy Information Administration, Weekly U.S. field production of oil

But the price of oil remains a big question even now. Some in the market are speculating whether a sustained move below the $60s could alter shale’s response and slow the pace of growth. To understand how that scenario might unfold, it’s worth looking at what’s happening elsewhere — and this is where OPEC+ comes in. The group announced in April that it would gradually unwind some of its production cuts and increase output, and a second wave of 137Kb/d hike in October. But the reality on the ground is telling a different story. Since April, OPEC+ has delivered only about 75% of the promised increase, falling roughly 500,000 barrels per day short of targets. Structural limits — from capacity constraints to required “compensation cuts” by countries that previously overproduced — mean that future increases may cover only half of what’s planned. Most members are already pumping near their limits, with Saudi Arabia and the UAE accounting for almost all of the spare capacity.

This shortfall is not trivial. It has helped hold Brent near a seven-week high around $69 per barrel and pushed prompt prices to a premium over futures, a clear sign that immediate supply remains tight despite talk of a looming glut. OPEC+ is still expected to raise targets by 137,000 bpd this month, but real-world output could fall short by as much as 50%. The result is a supply landscape that is far less flexible than headlines suggest, and that lack of cushion continues to shape price expectations heading into 2026.

Source: John Kemp, Chartbook

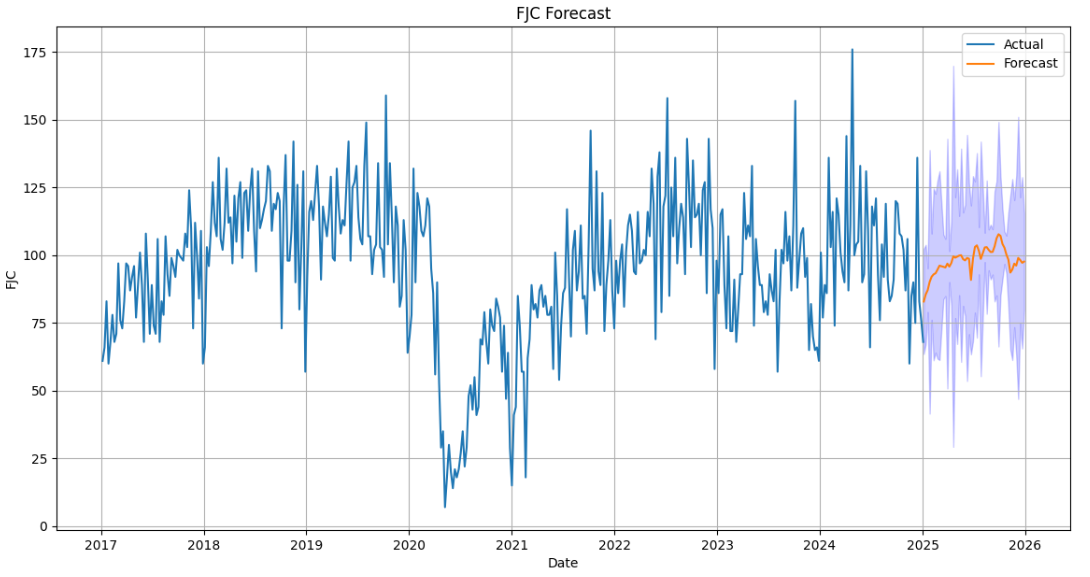

For U.S. shale, that backdrop matters. A tighter market, supported by OPEC+’s underperformance, improves the economics for unconventional producers even in a lower-price environment. It also provides context for why activity levels across the U.S. have stabilized. Our EFrac Forecasts — focused specifically on the Permian Basin, the most important oil-producing region in the U.S. and widely used as a proxy for the broader shale patch — point to a period of stability ahead. Over the next 52 weeks, the Frac Spread Count is forecast to hold around 77, indicating that completion capacity is expected to remain broadly unchanged rather than seeing any major expansion or contraction - the current level stands at 80 as per our recent weekly report. On the jobs side, the Frac Job Count is forecast at about 107 over the same 52-week horizon. This outlook signals that operators are planning around steady, efficient activity levels rather than gearing up for rapid growth, and it reinforces the view that Permian completions — and by extension, U.S. shale — are entering a more stable and consolidated phase as we move into 2026.

Source: Frac Job Count 52 week forecast - Primary Vision's Efracs Platform

The takeaway is that while production strength in the U.S. has been the dominant narrative this year, it is now being reinforced by dynamics elsewhere. OPEC+’s inability to meet its own targets is supporting prices and tightening the supply outlook, which in turn sustains U.S. shale’s momentum even without a major surge in completions or spreads. However, we need to continue to follow the latest rise in seaborne crude exports and whether they translate into something more significant.

For the time being the interplay between these forces — U.S. output resilience on one side and constrained OPEC+ capacity on the other — is likely to define oil market behavior into next year, setting the stage for a more balanced but still supply-sensitive environment. Geopolitical flashpoints will continue to provide temporary swings on the upside while China's buying pattern will determine how much of the extra barrels (if they actually come out) will be absorbed hence impacting the prices.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform