Articles

- BLOG / Articles / View

- Articles

Monday Macro View: Why Horsepower Matters

By Osama on December 14, 2025 in Market Sentiment

This week’s Monday Macro View follows a well-received Primary Vision webinar that focused on the evolving relationship between frac activity, oil production, and the structural changes underway in U.S. pressure pumping capacity. The discussion drew strong engagement from both operators and investors, reflecting a market that is trying to reconcile modest near-term activity with the clear long-term efficiencies emerging across the frac supply chain. Several themes from that session help frame the current read on the market, especially as sustained frac job activity continues to play a larger role in forecasting production outcomes.

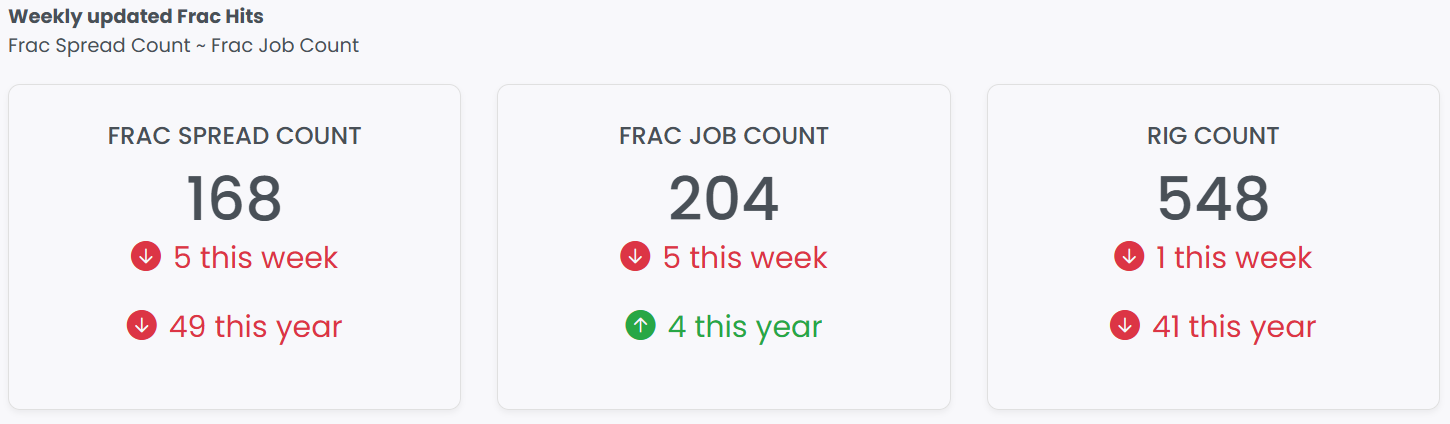

But first, let's discuss the latest numbers. Primary Vision’s Frac Spread Count came out at 168, compared with 173 last week, a change of -5 spreads. The Frac Job Count printed 204, versus 209 last week, also down 5 jobs.

But before we start worrying about this downward revision, we turn towards the insights discussed in the webinar. It increasingly focused on determining the predictive link between sustained frac job activity and U.S. oil production. Our analysis show thatsteady frac job activity over time is a reliable driver of U.S. oil production, with production responding after a clear lag rather than immediately. When completions are maintained consistently over a one- to two-year period, oil output tends to rise in a predictable way, and the statistical relationship between the two is strong, with correlations in the high 0.6 to low-0.7 range. The data indicates that sustained completion programs support gradual, durable production growth, while slowdowns in frac activity eventually translate into softer output. The key takeaway for industry readers is that cumulative frac jobs provide a more meaningful forward signal for production than short-term changes in spreads or weekly activity, reinforcing the value of looking at completion cadence rather than only headline counts. Several participants noted that this gives cumulative frac job activity more value as a forward signal than weekly spread counts alone. Importantly, this historical relationship is not immutable; constraints around crew availability, experience, and fatigue could introduce drift and reduce the predictive power of past correlation.

Source: Frac Job Count - EFRACS, Primary Vision

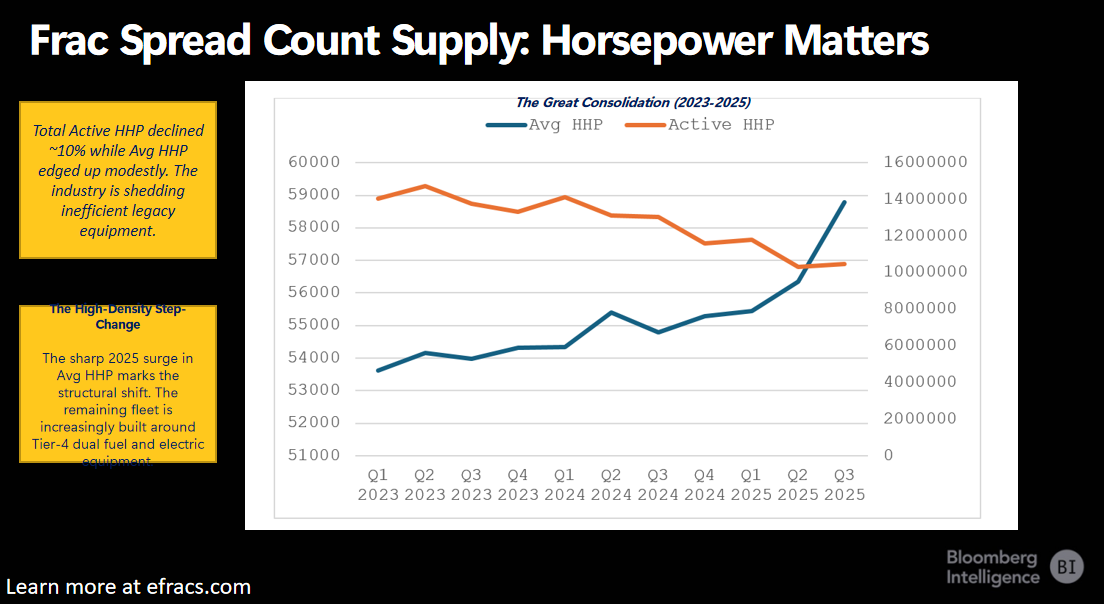

Another major theme centers on the structure of frac spread supply and, specifically, the quality of the horsepower behind those spreads. The industry’s transition away from legacy diesel fleets toward Tier-4, dual-fuel, and fully electric systems reflects a broader shift in how power is generated and utilized on location.

Older Tier-2 fleets rely on conventional diesel engines that were designed for flexibility rather than efficiency. These systems typically require higher fuel consumption, experience greater mechanical wear under continuous high-load conditions, and are more susceptible to derating as ambient conditions change. Their operating profiles often limit sustained horsepower delivery during longer, higher-intensity frac programs. Tier-4 dual-fuel fleets represent a meaningful evolution. These systems integrate advanced engine controls and emissions technology while enabling significant diesel displacement through natural gas substitution. Beyond emissions compliance, dual-fuel units improve thermal efficiency, stabilize power output, and reduce fuel cost volatility. Importantly, they allow operators to maintain consistent pressure and pump rates over extended pumping windows, improving stage execution efficiency.

The 2025 step-change visible in the horsepower data reflects this transition. Average HHP per spread rises sharply even as total active HHP declines. The implication is that the fleet is becoming both smaller and more capable. This is why the frac spread count has lost some of its explanatory power when used in isolation. A spread today can complete more stages per day, consume less fuel per barrel of sand pumped, and maintain higher reliability than spreads deployed just a few years ago. The webinar audience responded strongly to this point, recognizing that the market is shifting from a spread-count-driven view of capacity to a horsepower-quality-driven view.

Oil prices remain in a narrow band, with WTI trading in $55 - $60 range. OPEC+ pause on production hikes and steady demand offset geopolitical noise. Chinese buying continue to provide a floor to the prices. These price levels support maintenance-level completion activity but do not incentivize a broad acceleration. Gas markets remain oversupplied heading into the shoulder season, although long-term LNG buildout continues to support the Appalachian outlook beyond 2026. For now, the macro backdrop encourages steady operations.

The coming weeks will clarify whether operators intend to front-load completions or maintain even pacing throughout the year. The leading indicators still point to a restrained but stable environment, with horsepower capability—not spread count—emerging as the more meaningful determinant of service-sector tightness. As Primary Vision integrates these structural shifts into its frac job and activity models, visibility into 2026 production trajectories will continue to improve. The forward signal remains one of moderate, predictable growth supported by sustained operational continuity.

Tags:

Permission denied

Upgrade to Pro Today and get…

• This article — plus dozens more each month, all within our full Research Module

• Frac Hits — our National-Level Frac Spread Count and Frac Job Count, updated weekly

• Frac Operator Monitor — detailed FSC & FJC by operator

• And so much more, designed to help you track, forecast, and outperform